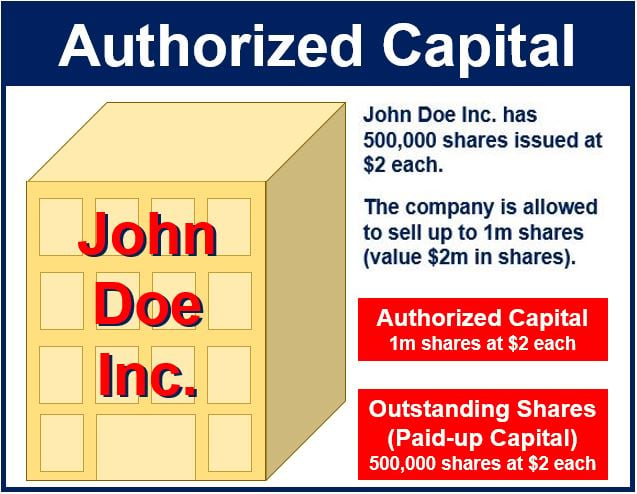

Authorized capital is the most capital a company can legally have in the form of stocks (shares). A company’s articles of incorporation state how much it may have. Shareholders sometimes vote to set this amount. The company can issue less than that amount, but not more.

Authorized capital does not equal the total value of the investment in a business; it equals the value of the shares.

We can also use the following terms with the same meaning: authorized share capital, authorized shares, authorized stock, nominal capital, or registered capital.

A business might not issue part of its authorized shares. Companies like to leave room for the future sale of additional shares. For example, you may want to raise capital later on for expansion. You can do this by issuing more shares. To change the number of authorized shares, the directors must get approval from the shareholders.

Most corporations do not sell their whole authorized capital.

Imagine your company, John Doe. Inc. has a factory that is working to capacity. In other words, you cannot raise production. The only way production can increase is by either expanding the current factory or building a new one.

However, John Doe does not have enough money for expansion. You still have 2,000 shares that the company can but has not issued yet. If you sell them at $500 each, you could raise one million dollars.

If you sell the shares you will be able to build a new factory. This means that John Doe’s production can increase significantly. In fact, you could double your production capacity with the new plant.

The concept of authorized shares was abolished in the United Kingdom under the Companies Act 2006.

Authorized capital contrasts with paid-up capital or outstanding shares, which is the amount of capital the company actually issues and has received payment from selling its shares.

Stock exchanges around the world may require that listed companies have a minim amount of authorized shares. The London Stock Exchange, for example, says a PLC (public limited company) must have a minimum of £50,000 of authorized share capital. A PLC is a British company whose share price appears on a stock exchange.

In most cases, the capital will be in the form of shares. However, we sometimes class the provision of money (cash) up to a certain amount as authorized capital.