Back-end ratio – definition and meaning

Banks and other lenders use the back-end ratio to determine whether or not to approve a mortgage application. The total obligations ratio has the same meaning. Lenders use it in conjunction with the front-end ratio. The back-end ratio shows how much of a person’s monthly income paying off debts represents. Examples of debts include mortgages, student loans, car loans, and credit cards.

Most mortgage lenders will probably approve a loan if the applicant’s back-end ratio is between less than 36%. In fact, some lenders will even accept back-end ratios of up to 43%.

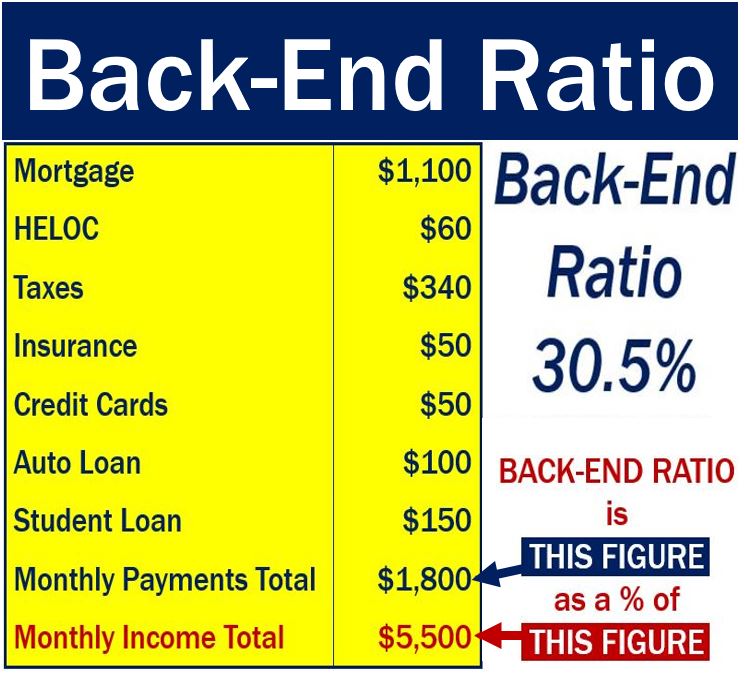

Lenders use the following formula. All the figures below are for monthly payments and income:

Back-End Ratio = (Loan payments + requested loan’s principal and interest payment + home insurance premium + property taxes on proposed real estate) ÷ Gross income

This mortgage application looks promising. The applicant’s monthly debt payments are well within most lenders’ bottom limit. HELOC (home equity line of credit), is a loan, using the borrower’s home as collateral, that lets them borrow up to a certain amount, rather than a set amount.

This mortgage application looks promising. The applicant’s monthly debt payments are well within most lenders’ bottom limit. HELOC (home equity line of credit), is a loan, using the borrower’s home as collateral, that lets them borrow up to a certain amount, rather than a set amount.

Work out your back-end ratio

If you are looking for a suitable mortgage to buy a home, you should first calculate you back-end ratio. In other words, what proportion of your gross monthly income you will use up paying off debts.

According to ncalculators.com, which has an online back-end ratio calculator:

“This calculation will help you to analyze your financial situation to make your mortgage payments in time with no obscurity.”

Back-end ratio example

Mary Smith wants to apply for a $600,000 mortgage. The mortgage comes with a principal plus an interest payment of $2,500. Insurance on the house she wants to buy costs $1,320 annually ($110 per month). Property taxes on the house cost $7,200 per year ($600 per month).

Ms. Smith has other debts:

– Student loan payments: $300 per month.

– Car loan payments: $450 per month.

She earns $138,000 per year ($11,500 per month).

We can use the information above to calculate Ms. Smith’s back-end ratio (all monthly figures):

Back-End Ratio = ($300 + $450 + $2,500 + $110 + $600) ÷ $11,500 = 34.43%

This is less than the 36% to 43% range. This means that if she has a good credit history, she will probably get the mortgage. However, the bank will need to make sure that the property is in good condition.

Not only does the bank calculate your back-end ratio, but it will also want proof of income. Additionally, the lender will want to see your tax records.

Not only does the bank calculate your back-end ratio, but it will also want proof of income. Additionally, the lender will want to see your tax records.

What is the front-end ratio?

The front-end ratio is a simpler calculation. We also use it to determine whether the applicant will be able to afford the monthly mortgage repayments.

The front-end ratio tells us what proportion of a person’s income will be used up in making mortgage payments. This calculation also includes what we call ‘housing expenses.’ Examples of housing expenses are property taxes and home insurance.

However, front-end ratio does not take into account other debts the applicant may have. In other words, it does not take into account car loans, student loans, credit card debts, etc.

The front-end ratio is calculated as follows (all figures are monthly):

Front-End Ratio = Housing Expenses ÷ Gross Income

However, the front-end ratio alone does not provide the lender with enough information.

Imagine John Doe earns $10,000 per month. He applies for a mortgage which means that his total housing expenses will be $1,000 per month. This may look promising, but the lender needs to know what other debts he has.

If John has to pay (monthly) $2,000 on a car loan, $800 on a student loan, $3,000 on a bank loan, and $3,500 on a string of other debts, his chances of getting his application approved don’t look so good.

Lenders on average prefer a front-end ratio of up to 28%. In the US, Federal Housing Administration loans will consider front-end ratios of up to 31%.

Most lenders use both the back-end ratio and front-end ratio when considering mortgage applicants.

Video – Income Qualification Ratios

This Gold Coast Schools video explains what the back-end ratio and front-end ratio are.