A bank reference or banker’s reference is a statement from a bank regarding one of its customers. The bank informs whether the customer can meet a specific financial commitment. Many people who work in financial institutions call it a status inquiry.

Do not confuse the term with the bank reference rate. The bank reference rate is an interest rate upon which we base an interest rate swap or floating-rate security.

Before approaching the bank for a reference on somebody, you will need to get their permission.

A supplier, for example, who wants to offer credit terms to a new customer will usually seek a bank reference.

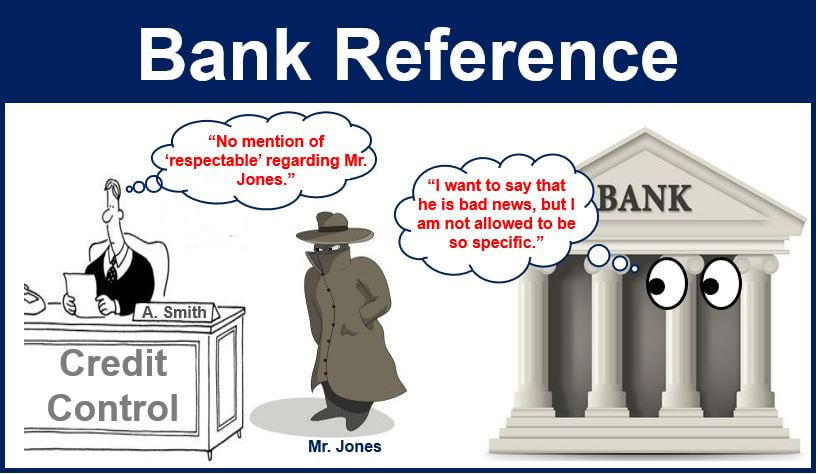

Bank references are not specific

You need to interpret the reference according to how much praise the bank has included or omitted. This is because banks will not go into specific details. Put simply; most bank references are vague.

The bank will charge a fee for sending the reference. The inquirer usually pays the fee.

The bank will warn the inquirer not to rely solely on the reference when making a decision. The institution will use standard phrases such as ‘respectable and good for your figures,’ ‘capital/resources fully employed,’ or ‘customer not known to us for long.’

Any reply that does not include a phrase such as ‘good for your figures’ is usually taken as a warning. A stronger warning sign is if the word ‘respectable’ does not appear in the letter.

Bank references never contain specific information or advice. Banks will never write, for example, ‘don’t trust this guy’ or ‘he is unreliable.’

Don’t rely on a bank reference

If you are deciding whether to offer a new customer credit, you should widen your search. Do not rely just on the bank reference.

You could also contact other suppliers or a credit rating agency. Credit agencies have information on the person’s credit history. Their credit history helps determine how good they are at paying back debts. Not only will it help you decide whether to offer credit, but also how much.

Additionally, you could get in touch with their accountants. To do this, you should get the customer’s permission first.

What do you do if you are a landlord and the prospective tenant’s bank reference is not reassuring? One option would be to request a larger deposit.

In many advanced economies, inquirers will instruct their own bank to ask the third party’s bank for a reference.

Such references play a critical role in facilitating trust between parties in financial transactions.

When might a bank reference be required?

Here are ten situations in which a bank may be asked for a reference concerning a customer:

- Mortgage application

- Business loan approval

- Leasing a vehicle

- Rental agreements

- Credit card applications

- Supplier credit terms

- Overseas transactions

- Business partnerships

- High-value purchases

- Investment opportunities

Video explanation

This video presentation explains what a bank reference is using simple and easy-to-understand language and examples.