The BCBS is the Basel Committee on Banking Supervision. It is the top international body on many aspects of banking regulation and oversight. In other words, the BCBS is the world’s highest authority on banking rules and supervision.

The Basel Committee on Banking Supervision is a forum for banking regulatory and supervisory affairs. Its aim is to improve understanding of key supervisory issues. Additionally, it tries to improve the quality of banking supervision globally.

The BCBS frames standards and guidelines in several areas, such as the international standards on capital adequacy. It also sets the standards of the Concordat on cross-border banking supervision and the Core Principles for Effective Banking Supervisions.

BCBS born in 1974

The governors of the central banks of the G10 set up the BCBS in 1974. G10 stands for the Group of Ten Nations, which comprises the world’s ten most powerful economies. Sweden, Germany, the US, the UK, the Netherlands, Japan, Italy, France, Canada, and Belgium are G10 members.

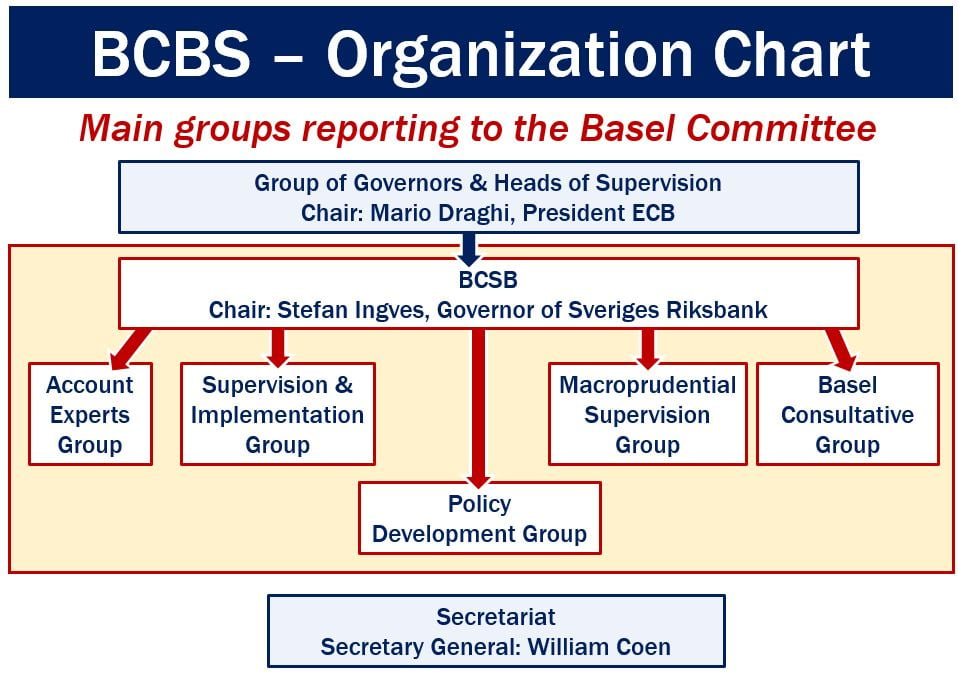

The BCBS usually meets four times annually. The Committee reports to a joint committee of central bank governors and heads of supervision from member countries.

The official observers on the Committee are the European Banking Authority, the European Central Bank, and the European Commission. The Financial Stability Institute and the International Monetary Fund also have observer status.

The current BCBS chairman is Stefan Ingves, Governor of Sveriges Riksbank, and the Secretary General is Wayne Byres.

Basel Accords

BCBS is responsible for creating the Basel Accords. The Basel Accords are a set of banking regulation recommendations with which financial institutions must comply.

The Basel Accords have many aims, including making sure capital levels in banks are high enough. Above all, they want to ensure that banks continue lending during financial crises.

In fact, regulatory bodies say it is thanks to banks’ higher capital levels that the world’s economy is safer today. In other words, banks can withstand financial crises more effectively today compared to before the 2007/8 crisis.

Not only does the domestic economy suffer when a major bank collapses, but so do economies abroad. For example, the Wall Street Crash of 1929 affected the United States’ economy, and subsequently other countries too.