Blue Chip Stocks are the shares of blue-chip companies – well-established and financially stable firms that have been in business for many years, demonstrating resilience in reputable market indexes. They have stood the test of time – they have survived through business cycles, i.e. periods of economic expansion followed by contraction (boom and bust).

A market index consists of numbers that represent weighted values of, for example, different shares. The Dow Jones Industrial Average is a market index.

Less risky investments

Investors typically opt for blue chip stocks as they are much less risky than start-ups or companies that haven’t yet proved themselves in the market.

While blue chip stocks are known for their stability, their performance is also closely linked to the overall health of the economy and can be influenced by both domestic and global economic trends.

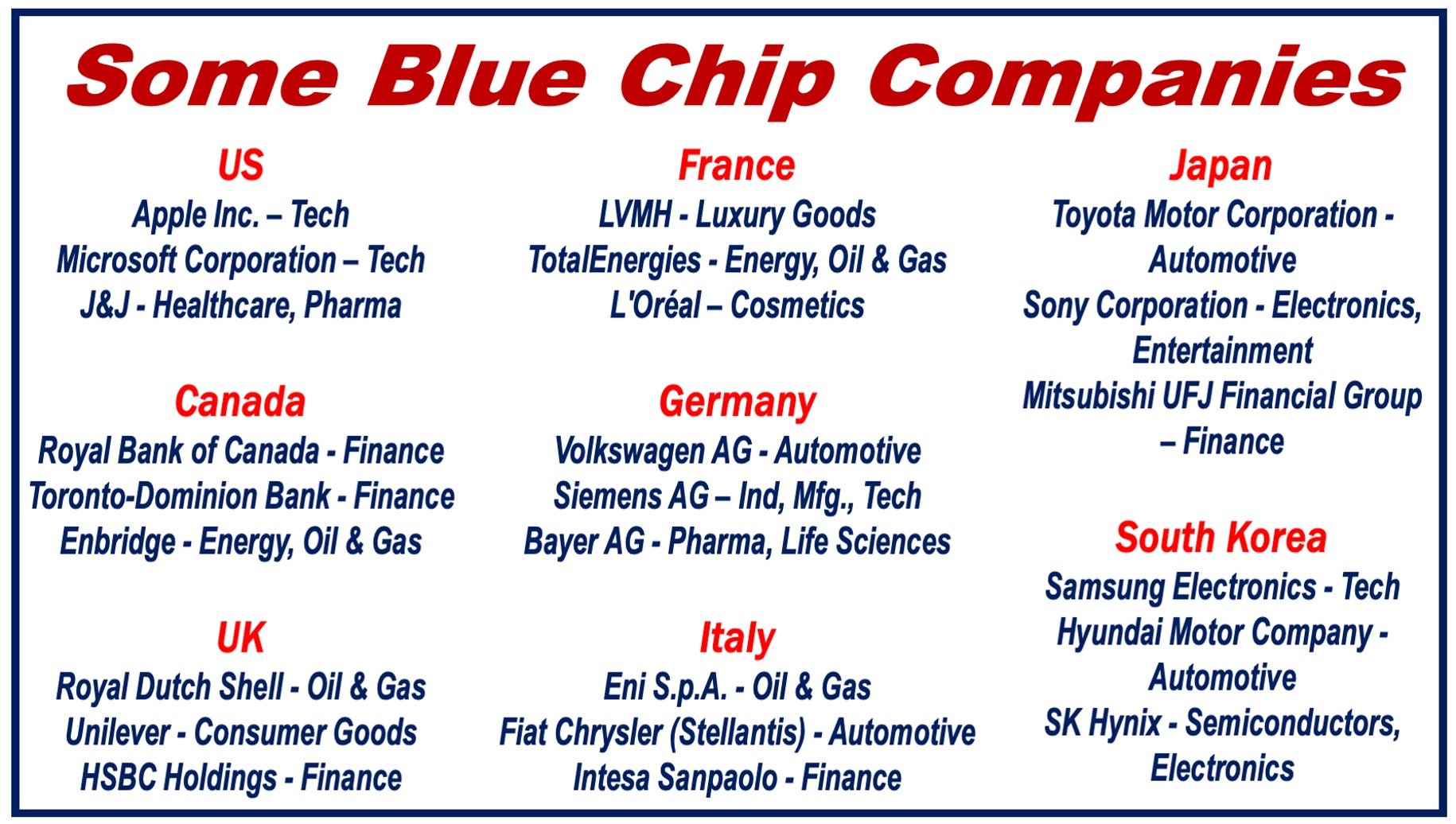

Additionally, many blue chip companies are multinational corporations, meaning their stock performance can offer insights into global market trends and international business conditions.

Blue chip companies are more likely to be able to ride market dips (bear markets) than most other companies. Put simply, they are the most trusted stocks. If you want to invest in the stock market, you would be wise to start off by placing your bets on blue-chip stocks, experts say.

However, they are only relatively safer than other stocks, and like any giant animal on top of the food chain, events can damage them, or even wipe them out, as occurred with dinosaurs.

Blue chip stocks sometimes in danger

During the Great Recession that followed the financial crisis in 2008, a number of leading banks and giant multinationals, including General Motors (all considered to be blue chip companies) went bankrupt. Had many of them not been bailed out by the taxpayer, they perhaps might not be here today.

Remember that while blue chips are more likely to survive market fluctuations, they are certainly not completely immune to them.

Where does the term blue chip come from?

The term was coined by Wall Street Journal editor Oliver Gingold in the 1920’s. Gingold was standing by the stock ticker at a brokerage firm (which later became Merrill Lynch) and spotted several pricey trades, worth at least $200 per share. He then said he intended to “write about these blue-chip stocks” as soon as he got back to the office.

Mr. Gingold was thinking about the chips used in the betting card game poker. Basic poker disks come in three colors, white, red and blue, worth $1, $5 and $25 dollars respectively. Everybody likes the blue chip because it is the most valuable.

Dow Jones Industrial Average

The Dow Jones Industrial Average is the most popular index that follows the performance of thirty blue chip stocks – from corporations that are leaders in their industry. Another popular index that follows US blue chip companies is the Standard and Poor’s 500 Index (S&P 500).

The Dow Jones Industrial Average is comprised of the following blue chip companies: AT&T, Verizon Communications, Chevron, General Electric, Intel, Cisco Systems, McDonalds, Pfizer, Coca-Cola, Procter & Gamble, Merck, Microsoft, Johnson & Johnson, Exxon Mobil, Dupont, JPMorgan Chase, Travelers, 3M, Wal Mart, Home Depot, Caterpillar, Boeing, IBM, United Technologies, UnitedHealth Group, NIKE, Goldman Sachs, Disney, American Express, and Visa.

In the UK, the FTSE 100 Index (Financial Times Stock Exchange Index) is a share index of the 100 most highly capitalized companies in the country that are listed on the London Stock Exchange. They are sometimes referred to as the ‘Blue-Chip List’.

Major Market Index

The NYSE Arca Major Market Index focuses on top blue-chip companies. It comprises 20 blue-chip stocks, of which 17 also appear in the DJIA (Dow Jones Industrial Average).