Business liability insurance – definition and meaning

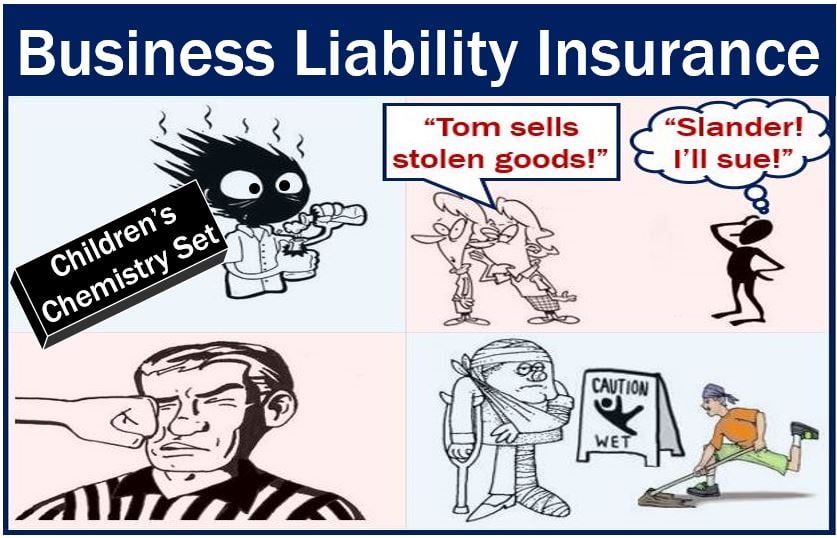

Business liability insurance is taken out by companies to protect them against damage or injury claims. The policies cover the costs of claims that their products or employees caused. The insurance also covers all or part of the legal fees.

Business liability insurance is one of the hundreds of different insurance products available on the market today.

Business liability insurance – three types

There are three main kinds of business liability insurance:

Product Liability Insurance

In many countries, manufacturers and suppliers must carry product liability insurance. In most cases, it forms part of a combined policy.

Professional Liability Insurance

This type of insurance protects professionals who provide advice and services against negligence claims. Some companies also buy this type of protection.

How much a policy should cover depends on the type of business. For example, private hospitals may face multi-million dollar claims. Therefore, their cover needs to be in the tens of millions of dollars.

General Liability Insurance

General liability insurance protects a company from a specific set of claims. Unless the policy stipulates, it might not cover, for example, employee injuries.

According to Nationwide.com “Workers compensation is the insurance you would need to protect your employees when they are hurt on the job.”

With business liability insurance, the insured does not usually receive payment. The payment goes to somebody who is not a party to the insurance contract.

The FT Lexicon defines business liability insurance as:

“Insurance against damage or injury caused by negligence. Companies take it out to cover injury caused by their products, or negligence by people who work for them.”

Intentional or expected acts

Business liability insurance policies do not cover damages or injuries resulting from intentional or expected acts. In other words, the policy will not cover for things people do on purpose.

For example, imagine you owned a coffee shop, and one of your employees assaulted a customer. Your policy would not cover the damages if the customer sued.

On the other hand, if the employee were defending himself from a criminal act, the policy would provide coverage.

Business liability insurance – importance

Business is inherently risky. A small business owner, for example, could be personally liable in the event of a lawsuit against the business. In fact, sole proprietors (UK: sole traders) or partners are always personally liable. A lawsuit is a case before a court in which one party sues another.

Lawyers say that even owners of limited liability corporations (US: LLC, UK: LTD) face some personal risk.

Business liability insurance could mean the difference between commercial life and death if something unexpected and unpleasant happens.

Liability insurance is not only a good idea but also compulsory in many parts of the world.

Video – Who needs business liability insurance?

In this video, insurance agent Leslie Saland explains what the three types of business liability insurance are, and who needs them.