The term ‘capital flows’ refers to the movement of capital, i.e., money for investment, in and out of countries. When money for investment goes from one country to another, it is a capital flow.

All capital flows represent funds driven by investment activity rather than the purchase of goods and services — the term does not include money people and businesses use to purchase each others’ goods and services.

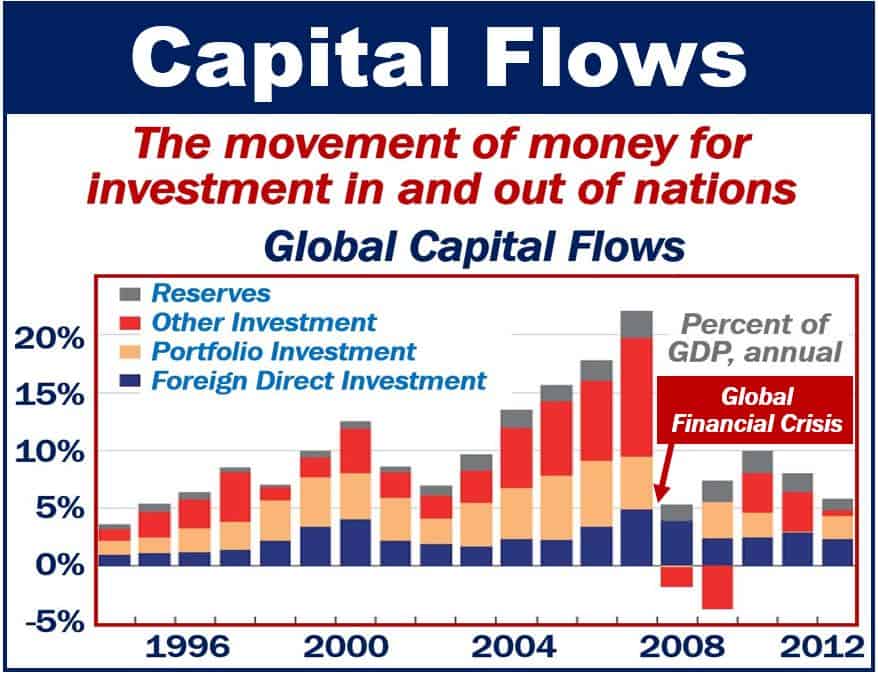

Capital flows can take several different forms, including: portfolio investments (buying shares or bonds), direct investments (building factories or purchasing local businesses), and other financial instruments (bank loans or deposits).

Capital flows – the Internet

Since the emergence of the Internet, online trading, and e-commerce, barriers to investment in foreign countries have declined significantly.

Today, it is much easier for fund managers and other investors to take advantage of opportunities globally.

If a country’s stock market today, for example, is doing particularly well, capital flows will instantly go in its direction. In other words, it will attract investors from other countries immediately.

The Internet has changed how investment products respond to market forces (the forces of supply and demand). While in the past, local demand and supply were the main drivers of prices, today international factors determine market forces.

Capital flows – currency values

Capital flows can influence the value of a country’s currency.

If the Zurich stock market becomes incredibly attractive one week, demand for Swiss francs will rise. This could push up the value of Switzerland’s currency.

The same can happen if one giant company takes over another huge company in another country. If US pharmaceutical multinational Pfizer acquired Swiss multinational Novartis, demand for Swiss francs would increase while the supply of dollars would rise. Pfizer would need to sell dollars for Swiss francs in order to complete the acquisition.