Market Forces are the factors that influence the price and availability of goods and services in a market economy, i.e. an economy with the minimum of government involvement.

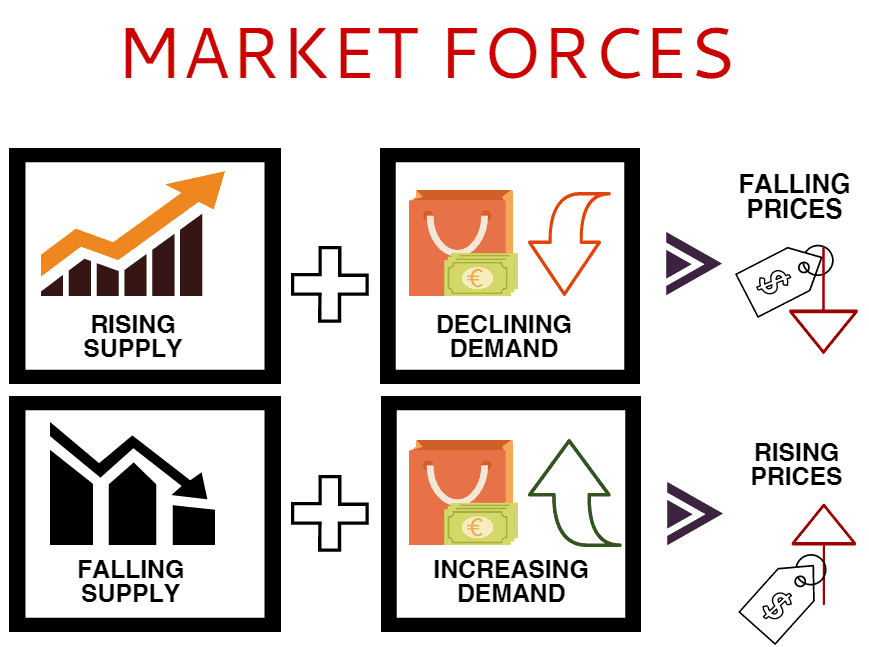

Market forces push prices up when supply declines and demand rises, and drive them down when supply grows or demand contracts. When demand equals supply for a product or service, the market is said to have reached equilibrium.

To supply means to provide something that is wanted, i.e., to make it available.

Invisible hand

Adam’s Smith’s ‘invisible hand’ referred to market forces.

British moral philosopher and pioneer of political economy, Adam Smith (1723-1790), cited by many as the father of modern economics, wrote in his books about the ‘invisible hand’ that determined levels of supply, demand, the prices of goods and services, as well as wealth creation and distribution.

This ‘invisible hand’ represented market forces – supply and demand – and how if left to its own devices, an economy could thrive.

Mr. Smith’s influence spread across the world and is often quoted by economists who support the market economy.

Mr. Smith wrote:

“Every individual necessarily labors to render the annual revenue of the society as great as he can. He generally neither intends to promote the public interest, nor knows how much he is promoting it … He intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. Nor is it always the worse for society that it was no part of his intention. By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good.”

In other words, the invisible hand is essentially a natural phenomenon that drives free markets through competition and scarce resources.

Examples of market forces

When a cold snap hits Florida, the price of orange juice across supermarkets in the United States rises. When the weather turns sunny and warm in northern USA, prices of hotel rooms in Cancun decline.

The price of gasoline across the world rises when major wars break out in the Middle East. Also, the sale of large gas-guzzling SUVs drops.

What do all these events have in common? They all show how market forces affect supply and demand. They also show that they ultimately affect the price of goods and services.

The advancement of technology and globalization has amplified market forces, making the economic environment more interconnected and dynamic than ever before.

Additionally, the rise of digital marketplaces and e-commerce has significantly lowered barriers to entry, enabling more players to participate in the market and affecting traditional market dynamics.

Market forces determine how much of each good we produce, and at what price they go on the market.

If anybody wants to know how an event or policy will affect the economy, they must think first about how it might affect supply and demand.

Market vs. command economies

In so-called market economies, governments try not to intervene and allow market forces allocate resources. Prices bring supply and demand into equilibrium, and they guide decisions of producers and consumers.

In centralized or command economies, the government tries to supplant these decentralized decisions with its own. North Korea and Cuba, for example, are command economies. In command economies, the market does not set prices.

George Soros, a Hungarian-born American business magnate, investor, author, and philanthropist, said:

“If we care about universal principles such as freedom, democracy, and the rule of law, we cannot leave them to the care of market forces; we must establish some other institutions to safeguard them.”