What is market equilibrium? Definition and meaning

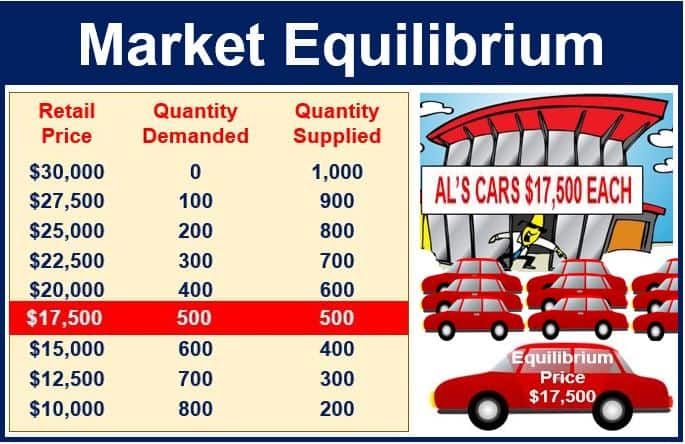

Market Equilibrium, also known as the Market Clearing Price, refers to a perfect balance in the market of supply and demand, i.e. when supply is equal to demand.

When the market is at equilibrium, the price of a product or service will remain the same, unless some external factor changes the level of supply or demand.

According to economic theory, in a market economy there is a single price which brings demand and supply into balance – the equilibrium price.

Digital marketplaces have amplified the fluidity of achieving market equilibrium, allowing for more rapid adjustments to supply and demand curves in real time.

Market equilibrium evolves over time

Eventually, over time, the constant interaction of buyers and sellers brings about a stable price for a product or service.

As consumers, we are often not aware of the power we have regarding the price of things. If the majority of potential buyers refused to buy a product, the seller would rapidly reduce its price.

Collectively, as consumers, we have influence over the market price. Sellers experiment with price until market equilibrium is reached – a price where good sales are achieved, supply matches demand, and the seller can still make a profit.

Market dynamics, such as consumer preferences and technological advances, continuously shape and redefine the equilibrium price, making market equilibrium a dynamic rather than a static state.

Demand, supply & equilibrium

If a market is not at equilibrium, market forces – supply and demand – will eventually push towards an ideal balance.

-

Excess supply

If the current market price is above the equilibrium value, supply is greater than demand.

Market equilibrium: a market state where supply is equal to demand.

Market equilibrium: a market state where supply is equal to demand.

When supply exceeds demand, sellers will typically lower the price of their good or service, and reduce production or order less.

The reduction in price encourages people to buy, which further reduces supply. This convergence in supply and demand will gradually bring the product to its equilibrium price.

-

Excess demand

This occurs when the market price is lower than the equilibrium value. There is a supply shortage.

When supply is lower than demand, buyers are willing to pay more for a good or service. Sellers will start raising their prices. They will also increase production.

Eventually, as more buyers stop purchasing the good or service, and more of it is made available, the price will stabilize and market equilibrium is reached.

When market equilibrium is reached, there will be nothing ‘left over’. It is also called the market clearing price because it is at this price that all the supply is bought by consumers – it is all cleared.

It is the ideal market situation, because there is neither wasted output due to excess supply, nor a shortage.

Classical economics

Classical economists say that markets work best on their own, without any interference from government. They belong to a school of thought that was exemplified by Adam Smith’s publications in the 18th century that claimed that any changes in supply would eventually be matched by adjustments in demand levels – so that the market, if left to find its own way, would naturally move towards equilibrium.

Most economists say the market tends towards equilibrium. George Soros, a Hungarian-born American business magnate, investor, author, and philanthropist, disagrees. Mr. Soros said:

“The reality is that financial markets are self-destabilizing; occasionally they tend toward disequilibrium, not equilibrium.” By financial markets, he meant banks and other financial institutions that bring investors (lenders) and borrowers together.

According to Cambridge Dictionaries Online, market equilibrium is:

“A situation in which the amount of goods or services people want to buy is equal to the amount of goods or services being supplied.”

“Market equilibrium” vocabulary

There are many compound phrases in the English language that contain the words “market equilibrium.” Let’s have a look at some of them:

-

Market Equilibrium Price

The price at which the quantity of goods demanded equals the quantity supplied.

Example: “After much fluctuation, the market equilibrium price for local honey stabilized at $8 per jar.”

-

Market Equilibrium Analysis

A study to determine the balance point in a market.

Example: “The economist conducted a market equilibrium analysis to predict the impact of a tax increase on product prices.”

-

Market Equilibrium Model

A theoretical construct explaining the balance between supply and demand.

Example: “Their market equilibrium model successfully forecasted trends in the housing market.”

-

Market Equilibrium Point

The specific price and quantity at which a market is in balance.

Example: “At the market equilibrium point, the company was able to sell all its manufactured goods without any surplus.”

-

Market Equilibrium Shift

A change in the market balance caused by external factors.

Example: “New legislation caused a market equilibrium shift, affecting prices and demand for renewable energy.”

Video – What is Market Equilibrium?

This video, from our YouTube partner channel – Marketing Business Network – explains what ‘Market Equilibrium’ is using simple and easy-to-understand language and examples.