Classical economics – definition and meaning

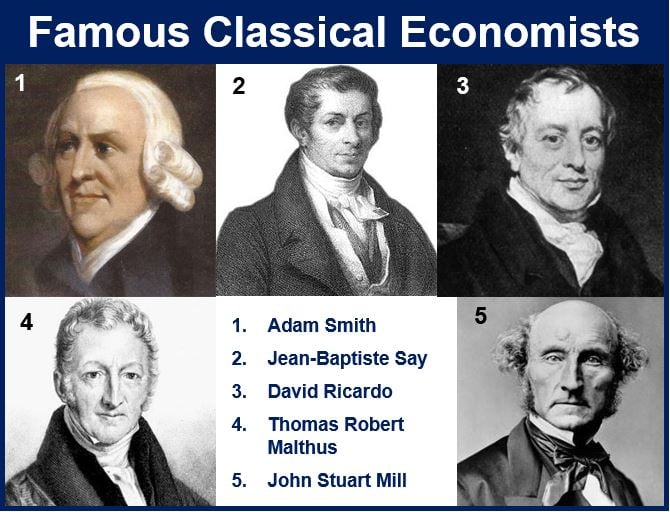

Classical economics claims that markets work best on their own. It states that there should be minimal government interference. It is a school of economic thought that Adam Smith’s exemplified in his writings in the 18th century. Adam Smith (1723-1790), a Scottish political economist and philosopher, is known today as the Father of Modern Economics.

Classical economics states that demand adjusts to changes in supply. Therefore, the economy always moves towards equilibrium.

In other words, we should leave the economy alone. We should leave it because it finds its own balance.

Apart from Smith, the following people contributed to classical economics:

- British political economist David Ricardo (1772-1823).

- French economist and businessman Jean-Baptiste Say (1767-1832).

- British cleric and scholar Rev. Thomas Robert Malthus (1766-1834).

- British political economist and civil servant John Stuart Mill (1806–1873).

Many writers were more convinced by Smith’s idea of free markets than protectionism. During Smith’s time, most people accepted and practiced protectionism. A protectionist government tries to limit imports by imposing quotas, tariffs, and other barriers.

The economy reaches a perfect balance when demand for a product is the same as supply.

Classical economics preceded neo-classical economics, which became popular during the second half of the 19th century.

Classical economics started with a book

Smith published a book – ‘An Inquiry into the Nature and Causes of the Wealth of Nations‘ – in 1776. Economists say the book triggered the birth of classical economics.

According to Smith, trade is the driving force of a nation’s wealth, rather than gold. Smith claimed that when two parties freely agree to exchange things of value, total wealth increases. They both freely agree to exchange things of value because they can see a profit in the transaction.

German revolutionary socialist Karl Marx (1818-1883) was the first to use the term ‘classical economics.’ He used the term when he described early economists like Adam Smith and his followers.

Classical economics says the state should intervene. However, it suggests that there are areas where the market is not the best way to serve the public good. For example, education does not excel in a free-market economy.

Smith believed that a greater proportion of the costs of these public services should be paid for by those with more money. Modern libertarian economists, however, differ from classical economists on this point.

Classical economics – the ‘invisible hand’

Classical economists claim that markets can self-regulate when free of coercion. In other words, the market finds its own way, and government should not interfere.

Smith referred to a metaphorical ‘invisible hand’ which guides markets toward their natural equilibrium.

When a product is scarce, there will be strong incentives to raise production. If on the other hand, there is a surplus, people want to produce less of it.

In a free market, buyers can choose from many different suppliers. Companies which do not compete effectively fail. Subsequently, new ones will emerge.

Smith stressed the importance of competition. He repeatedly warned of the dangers of monopoly.

Keynesian versus classical economics

Keynesian economics, which emerged in the 1930s, contrasts with classical economics. Keynesian economists support deficit spending and controlling the money supply. They also support a graduated income tax to combat recession and wealth inequality.

Keynesian theory asserts that the private sector sometimes makes decisions that harm the economy. When his happens, the government should intervene.

Classical economists reject Keynesian economics. They insist that state intervention exacerbates recessions.

Classical economists blame the Great Recession on government interference. The Great Recession followed the 2007/8 global financial crisis. America’s future is in danger unless it changes course, classical economists warn.

Classical economists say the market should freely determine the prices of goods and wages. They claim that supply can create its own demand. In other words, production will create enough income to purchase goods.

Classical economists give the Model T Ford as an example of this idea. The Model T was a car that the Ford Motor Company produced from 1908 to 1927. It was, in fact, the first affordable automobile.

‘Affordable’ means ‘within most people’s budget.’

Huge impact of Smith’s book

Smith’s ‘The Wealth of Nations’ was enormously influential. By the 1790s, people across the world were reading the book.

British Prime Minister William Pitt had already read it in college. It influenced the founders of the United States, especially Thomas Jefferson and James Madison.

By the time of the French Revolution, the book was extremely important in France. The book subsequently became popular in Germany.

It was the book to read when governments wanted to know what to do about the economy. It was also the book to read for governments to know what they should do in general.

Economics professors today use material in Smith’s book in their courses globally.

Many philosophy professors say that Smith provided a remarkable model. Namely, a model of how philosophy and social sciences could be brought together.

We refer to economies with the minimum of government intervention as open markets.

According to the Financial Times business dictionary, classical economics is:

“A school of economic thought, exemplified by Adam Smith’s writings in the 18th century, that states that a change in supply will eventually be matched by a change in demand – so that the economy is always moving towards equilibrium.”