Capital Formation refers to the increase in the stock of real capital in an economy during an accounting period. In other words, the creation of things that help us produce more. We commonly use the term in the study of macroeconomics. The term capital accumulation has the same meaning. I use the two terms interchangeably in this article.

Capital formation is often seen as the backbone of a nation’s long-term economic development, as it provides the essential tools for productivity and growth. It involves the creation of more capital goods. For example, buildings, equipment, tools, machinery, and vehicles are capital goods. We use capital goods to make products and provide services.

In economics, capital means the factors of production that we use to create goods. A country uses capital stock together with labor to produce goods. Capital accumulation occurs when this capital stock increases.

The greater the capital accumulation of an economy is, the faster it can grow its aggregate income.

When a country’s capital stock increases, its production capacity grows too. In other words, the economy can produce more. When we produce more, national income levels subsequently rise.

American economist Simon Smith Kuznets (1901-1985) pioneered the concept of capital formation in the 1930s and 1940s. Kuznets was awarded the 1971 Nobel Memorial Prize in Economic Sciences.

From the 1950s, most countries began using it to measure capital flows.

Economists say that the formation of capital is an essential way of assessing the true financial state of a country. In fact, without it economists would find it extremely difficult to identify the rate of GDP growth. GDP stands for Gross Domestic Product.

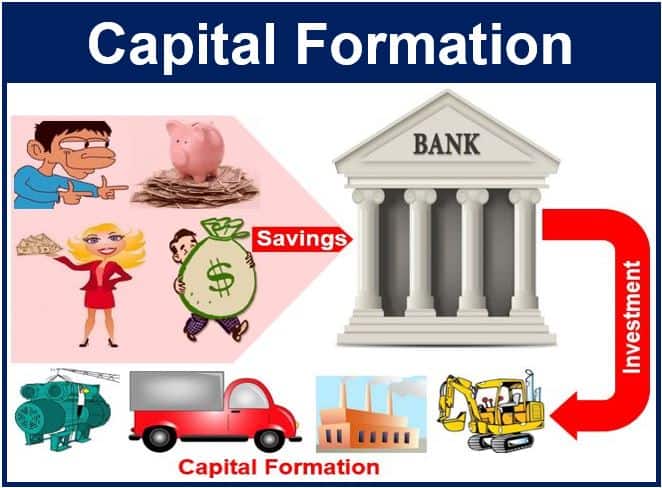

Capital formation depends on the mobilization of savings, which relies on people wanting to save money.

Capital formation in national accounts statistics

In national accounts, gross capital formation is the total value of GFCF (gross fixed capital formation), plus net changes to inventories, plus net acquisitions less disposals of valuables for a unit or sector.

In national accounting, total capital formation equals net fixed capital investment, plus the increase in the value of inventories held, plus lending to foreign countries.

We ‘form’ capital when we use our savings for investment purposes – often investment in production. In other words, the formation of capital occurs when we invest in making things.

Capital formation process – 3 steps

Capital accumulation follows a process of three steps:

- First, growth in the volume of real savings.

- Second, savings mobilization through credit and financial institutions.

- Third, investment of savings.

Hence, the formation of capital is not just a question of saving more, but also using those savings to boost production.

Capital formation also refers to the issue of new securities, which occurs in the primary market. In this context, ‘new securities’ refers to shares and bonds.

Technological advancements in production and manufacturing can significantly contribute to capital formation by enhancing efficiency and productivity.”

Video explanation

This video presentation explains what ‘Capital Formation’ is using simple and easy-to-understand language and examples.