Capital goods are things that we use in the production of goods and services. They are durable goods. In other words, they last a long time. They do not wear out quickly.

We must not confuse the term with ‘capital,’ which refers to wealth or money.

Capital goods are fixed assets such as machinery, equipment, buildings, vehicles, computers, etc. However, they may also include infrastructure items, such as railway lines, roads, and bridges.

We commonly use the term in a macroeconomic context. Above all, we use it when talking about capital formation and the creation of productive capacity. Macroeconomics refers to the whole economy rather than just parts of it.

To produce goods we need three things: 1. Capital goods. 2. Land. 3. Labor. We call these three components collectively as the primary factors of production.

We use intermediate goods, like capital goods, in the production process. However, intermediate goods are components or ingredients of the final product. In the production of bread, a baker’s oven is a capital good, while salt or flour is an intermediate good. The oven is not an ingredient of bread, but salt is.

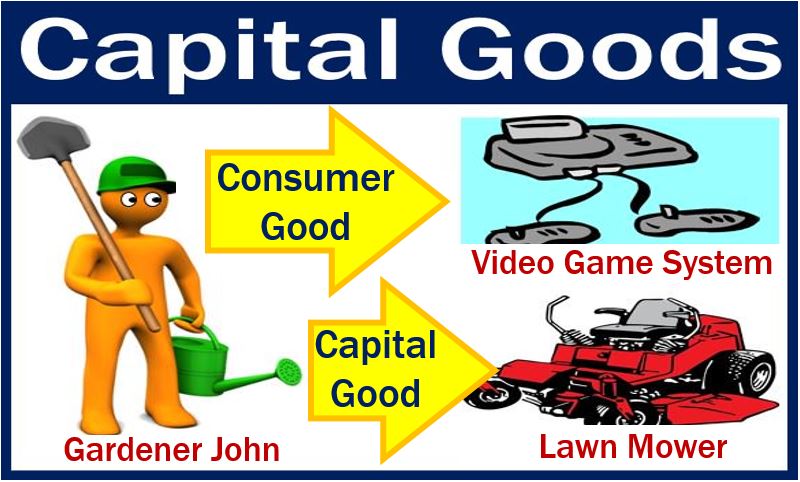

John is a gardener. The lawn mower in the image is a capital good. The video game system, on the other hand, is a consumer good. The lawn mower helps him be more productive.

Capital goods vs. consumer goods

We classify goods according to how we use them.

A consumer good is a product that consumers use. It has no future productive use. For example, we buy and then consume a chocolate bar. We do not subsequently use it to produce something else. Therefore, chocolate bars are consumer goods.

Put simply, we ‘consume’ consumer goods rather than use them again.

A capital good is anything that we use to make things or increase production. We refer to the most common capital goods as PP&E. PP&E stands for Property, Plant, and Equipment.

A capital good often requires a considerable investment on behalf of the producer. Such investments are typically amortized over the lifespan of the asset, reflecting their long-term value to the business. In accountancy, we refer to the purchase of a capital good is a capital expense.

Investment in capital goods is often seen as an indicator of an economy’s future productive capacity and potential for growth.

Video explanation

This educational video explains what ‘Capital Goods’ means using simple and easy-to-understand language and examples.