Cash accounting – definition and meaning

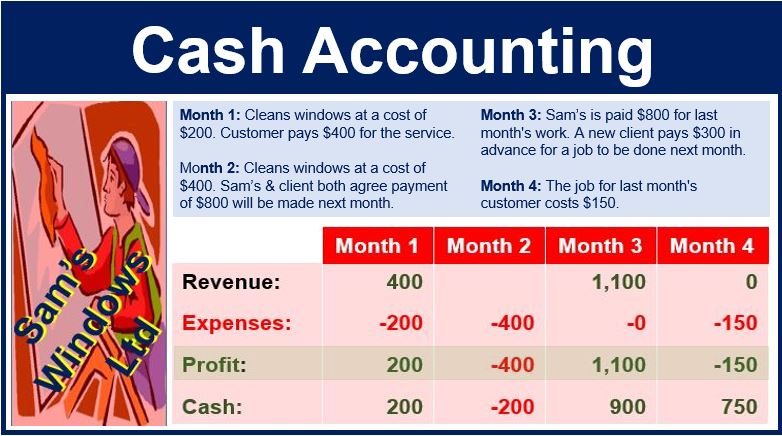

Cash accounting is a bookkeeping system. In the system, you only enter payments going out and coming in when they occur, rather than when people place the orders. With accrual accounting, on the other hand, we register income and expenditure when people place the orders.

Small enterprises tend to use cash accounting. They prefer it because it is straightforward and easy to understand. However, it can sometimes make profits appear to fluctuate wildly when, in fact, they are not.

Large companies have to comply with Generally Accepted Accounting Principles (GAAP). In other words, large corporations must use the accrual accounting method.

Cash accounting vs. accrual accounting

Imagine Mowers Ltd. receives an order for ten lawn mowers from ZZZ Golf Club. The lawn mowers sold at $100 each (total $1,000). The company got the order on January 5th and received payment on February 5th.

In a cash accounting system, the bookkeeper would record the sale as having occurred on February 5th. However, in an accrual accounting system, the bookkeeper would make the entry for January 5th.

Let’s suppose Technicians Forever sent an expert down for the day to service all Mower Ltd’s machinery on January 1st. Mowers Ltd. paid the invoice of $300 for this service on February 1st. The bookkeeper would register the expense as having occurred on February 1st using the cash accounting method. With the accrual accounting method, however, the entry would be for January 1st.

Cash accounting – disadvantages

Sometimes a business may seem more cash rich than it really is.

Imagine that several payments are due on April 3rd. The company may seem overly cash rich when presenting its first quarter accounts.

It had not paid the invoices it received during that quarter for orders it had placed in that quarter. Therefore, it would appear that the company has loads of money.

In an accrual accounting system, the bookkeeper would have entered those deductions already in the first quarter.

Conversely, the company that used the cash accounting method would appear worse off than it was. Especially if it had landed a giant order and the customer had not paid for it yet.

What would happen if it paid its bills on time, but the client was late? The company’s expenses to meet the large order would appear on the books, but not the large receipt.

Video – Cash Accounting

This video shows how a stable catering business may appear to have wildly fluctuating monthly profits and losses. This is because it uses a cash accounting system.