The Chief Financial Officer (CFO) is the person holding the purse strings, overseeing every aspect of an organization’s finances.

This means the CFO is responsible for managing all money matters – from tracking how much money comes in and goes out, to planning for the company’s financial future.

You can think of the CFO as the senior executive who makes sure the organization stays financially healthy, pay its bills, invest wisely, and grow sustainably.

As part of the C-Suite, the CFO plays a key key role within an organization’s executive leadership team.

Understanding the CFO Role

To put it simply, the CFO is the highest-ranking finance professional in an organization. They coordinate the finance and accounting team and ensure the company’s finances are in order and properly reported.

A CFO usually reports to the CEO (Chief Executive Officer) and often works closely with other top executives when big decisions need to be made.

In many cases, the CFO also presents the company’s financial performance to the board of directors and shareholders, acting as the financial spokesperson for the company.

Main Duties of a CFO

The CFO’s job involves a wide range of responsibilities that keep the company’s finances on track. Here are some of the main duties a CFO typically handles:

Financial Planning & Analysis (FP&A)

Budgeting for the company, forecasting future financial performance, and analyzing data to guide decisions.

Accounting and Record-Keeping

Overseeing the accounting team to ensure all financial transactions are recorded accurately. This includes producing correct financial reports (e.g., income statements, balance sheets) on time.

Financial Reporting

Presenting the company’s financial results to stakeholders (management, board, investors). The CFO must attest these reports are accurate and comply with regulations.

Cash Management & Investments

Handling the company’s cash flow, ensuring funds for operations, and deciding how to invest surplus cash. Also responsible for obtaining funding (loans, issuing stock) for growth.

Risk Management

Identifying financial risks (like market changes or non-paying clients) and protecting the company’s finances with measures like insurance, diversified investments, or emergency funds.

Strategic Advising

Providing financial advice to top executives when planning the company’s direction. Evaluating big moves (acquisitions, product launches) for their impact on budgets and profits.

Investor Relations

Communicating the company’s financial health and plans to investors and shareholders. CFOs often lead earnings calls, explaining quarterly results and answering questions.

History and Evolution of the CFO Role

The role of CFO has changed a lot over time. In the early days, CFOs were mostly seen as head accountants making sure the numbers were right, but today they are key strategists in the company. Here’s a brief look at how the CFO role evolved:

Early 1900s – “Bookkeepers in Chief”

Businesses began appointing finance heads as companies grew larger. The early CFO’s job was primarily to ensure accurate financial reporting and maintain controls on spending. Back then, the role was considered a support function and was not involved much in strategy.

1980s–1990s – Growing Strategic Involvement

As markets globalized and companies became more complex, CFOs started focusing more on financial planning and analysis to drive business growth. They became more involved in shaping business strategy, not just “counting the money.”

2000s–Today – The Strategic Partner

In the 21st century, CFOs are expected to be strategic business partners to the CEO, using data and analysis to guide decisions. Advances in technology and global competition have expanded the CFO’s role – today they play a critical part in shaping company strategy and ensuring long-term financial health. Many modern CFOs are even considered potential future CEOs because of their broad view of the business.

Real-Life Examples of Notable CFOs

To better understand what CFOs do, it helps to look at some real people who have held the job. Here are a few examples of famous or noteworthy CFOs, both past and present:

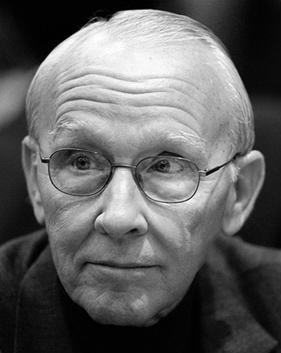

Jerome “Jerry” York (Chrysler & IBM, 1990s)

Jerry York served as CFO of Chrysler from 1990–1993 and helped turn the struggling automaker back to profitability through cost-cutting and smart financial moves.

He was so effective that he was considered a potential successor to CEO Lee Iacocca. York later served as CFO of IBM (where he aided in that company’s 1990s turnaround) and even became an advisor on Apple’s board in the late 1990s.

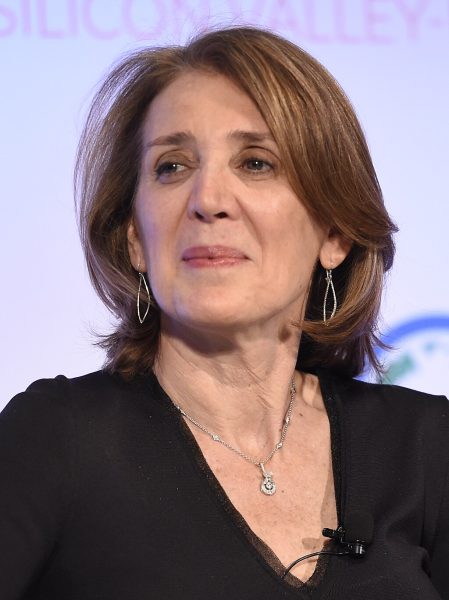

Ruth Porat (Alphabet/Google, 2015–2024)

Ruth Porat was the CFO of Alphabet (Google’s parent company) for a substantial time during its period of incredible growth. For this reason, she is often called one of the most influential women in finance. Before joining Google she was the CFO of Morgan Stanley.

She is credited with bringing greater financial discipline to the tech giant – for example, by closely managing costs and refocusing investments – which has helped Google (Alphabet) prioritize profitable growth.

In 2023, she became Alphabet’s President and Chief Investment Officer.

Amy Hood (Microsoft, 2013–Present)

Amy Hood became Microsoft’s first female CFO in 2013. Since then, she has overseen major investments and acquisitions that helped transform the company, including the $7.5 billion purchase of GitHub in 2018.

Hood’s leadership in managing Microsoft’s finances has been key to the company’s expansion into cloud computing and AI, showing how a CFO contributes to a company’s strategy and success.

Why CFOs Matter in an Organization

Every major organization – whether it’s a Fortune 500 company, a hospital, or a university – relies on a CFO (or someone in a similar role) to ensure financial stability. Without good financial leadership, a company could overspend, run out of cash, or misreport its finances. Here are a few key reasons why the CFO role is so important:

Financial Stewardship

The CFO ensures the company’s money is used wisely and financial risks are controlled. They enforce budgets and cost controls, preventing wasteful spending. By guaranteeing accurate record-keeping, the CFO upholds the organization’s financial integrity (no “cooking the books”!).

Strategic Partner to the CEO

Modern CFOs don’t just crunch numbers—they shape company strategy. CEOs rely on them to analyze big decisions from a financial viewpoint. Many CFOs today are seen as potential future CEOs, due to their broad understanding of the business through money and data.

Investor & Stakeholder Confidence

The CFO is often the public face of the company’s finances to investors, lenders, and regulators. Clear and honest financial reports build trust, encouraging people to invest or stay invested. On quarterly earnings calls, for example, the CFO explains financial performance and answers tough questions.

Long-Term Planning & Survival

A CFO keeps an eye on the future, planning for major goals (like new factories or market expansions). In crises, the CFO’s decisions—such as cutting costs or raising emergency funds—can spell the difference between survival and failure. For instance, during the COVID-19 pandemic, quick moves by CFOs helped companies stay afloat.

In short, a skilled CFO makes sure the organization’s finances are solid, advises on big decisions, and communicates the financial story of the company to those who need to know. This is why CFOs are considered essential to a successful organization.

FAQs: Common Questions About CFOs

What does “CFO” stand for?

CFO stands for Chief Financial Officer. “Chief” means highest-ranking, “Financial” relates to finance (money), and “Officer” means an executive or manager. So, the CFO is the top financial executive in an organization.

How is a CFO different from an accountant?

An accountant typically records and reports financial transactions – they handle the day-to-day bookkeeping and preparation of financial statements. A CFO, on the other hand, is a senior leader who uses those financial statements to make big-picture decisions. The CFO usually oversees the accounting department and interprets the numbers to strategize for the company’s financial future. In short, accountants manage the details, while the CFO focuses on the strategy based on those details.

Does every company have a CFO?

No. Very small businesses often do not have a formal CFO. In a small family business, for example, the owner or an accountant might handle the financial duties. Typically, once a company grows large enough (or becomes publicly traded), it will hire a CFO to manage its complex finances. Some startups and small companies might use a “fractional” (part-time) CFO or outsource the CFO role until they can afford a full-time CFO.

What qualifications do you need to become a CFO?

Most CFOs have a strong background in finance or accounting. Many have a bachelor’s degree in finance, accounting, or economics, and often an MBA (Master of Business Administration) or another advanced degree. They also tend to have professional certifications like CPA (Certified Public Accountant) or CFA (Chartered Financial Analyst). Just as important, a future CFO usually needs years of experience – often working their way up through roles such as financial analyst, accounting manager, controller, or treasurer. Leadership and communication skills are crucial too, since CFOs manage teams and must explain financial information clearly to others.

Can a CFO become a CEO?

Yes – it’s quite common for CFOs to move into CEO roles. Because CFOs have a deep understanding of the business’s finances and operations, they are often prime candidates to lead the whole company. Many companies see the CFO position as a training ground for future CEOs. However, making the jump from CFO to CEO also requires a broad vision beyond finance and strong leadership skills in all areas of the business.

The CFO is a crucial figure ensuring that an organization’s finances are well-managed. They might not always get as much public attention as a CEO, but without a capable CFO, even the best companies can run into trouble. Understanding what a CFO does gives insight into how organizations plan, protect, and propel their financial futures.