Closed fund – definition and meaning

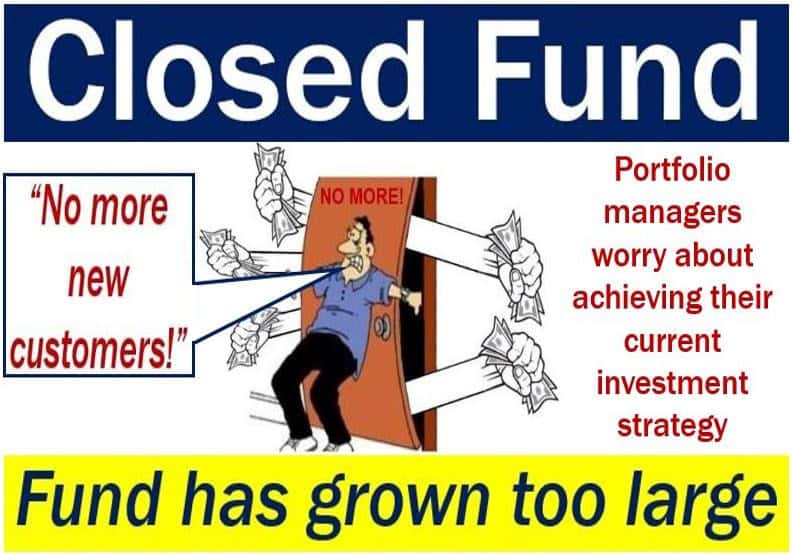

A closed fund is an open-end mutual fund that has suspended the sales of shares to new customers. The suspension is either temporary or permanent. It usually occurs because asset growth has been significantly higher than normal.

A mutual fund is a company that pools money from many investors. The mutual fund then invests the money in securities.

In some cases, existing shareholders may buy shares, while the fund still accepts outstanding shares for redemption.

Sometimes even current shareholders cannot make further investments.

Fund managers become worried about raising the asset base of the fund further. If they do, it might become too hard to achieve their current investment strategy. Therefore, they close the fund to new investors.

In other words, the fund managers feel that there are too many investors or assets in the fund. Specifically, too many to generate the kind of investment return they had originally foreseen.

Do not confuse a closed fund with a closed-end fund. A closed-end fund invests in specialized sectors and has a fixed number of shares. The issuers structure a closed-end fund as a stock and list it on a stock exchange.

Closed fund might reopen

Mutual funds that have closed to new investors can sometimes reopen. Fund managers may close a fund to new investors for one of several reasons, or a combination of them.

A fund may become so big in assets that the portfolio becomes virtually impossible to manage. Large investment positions in individual stocks can be difficult to buy or sell without affecting the securities’ prices.

Consequently, portfolio managers of extremely large funds lose flexibility. They lose flexibility because they mostly hold onto the stocks of large companies with massive numbers of shares outstanding.

Similarly, a mutual fund that specializes in investments in a specific market segment may not have many investment options.

A fund that specializes in businesses from emerging economies, for example, probably has too few shares available. If investors channel massive amounts of money into a successful mutual fund, the portfolio manager cannot invest it all.

Bull and bear markets

Mutual funds commonly close following asset growth during a long bull market. In other words, a long period of rising stock prices.

According to The Free Dictionary, Janus Capital closed seven of its twenty-one funds over a 24-month period starting in the middle of 1998. One of the seven was the popular Janus Fund, which had grown to $52 billion in assets.

If the fund size shrinks; it may subsequently reopen. If portfolio managers believe that new investment opportunities have become available, they may reopen the fund to new investors.

Funds are more likely to reopen following a long bear market, i.e., when prices are in decline. They may reopen during a long bear market because the size of the fund can shrink.

According to Nasdaq.com, a closed fund is:

“A mutual fund that is no longer issuing shares, mainly because it has grown too large.”