Combined ratio – definition and meaning

The combined ratio is a calculation insurance companies use that shows how profitable they are. We calculate it by adding up all the losses and expenses the company incurred. We then divide that total by all the money it earned from premiums.

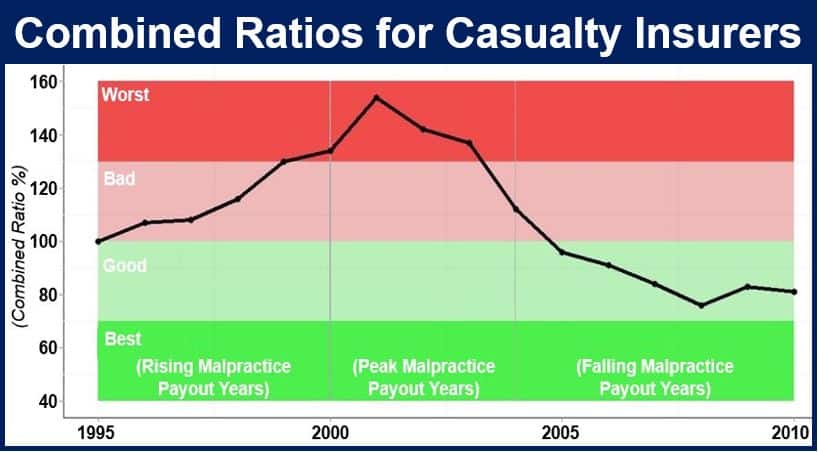

Analysts and investors usually express this ratio as a percentage. In other words, operating costs plus claims as a percentage of premium income.

If it is less than 100%, the company is making a profit in its underwriting operations.

Even a combined ratio of more than 100% might still mean the insurance company is making an overall profit. Especially if it has significant investment income.

Combined ratio – underwriting profitability

Experts say the combined ratio is the best way to determine whether a company is making a profit. It is the best calculation because it excludes investment income. In fact, it just focuses on the firm’s underwriting operations.

Insurance companies must bring in more revenue from premiums than it is paying out in claims. In other words, they must have more money coming in than going out. Otherwise, they will not be profitable.

If companies are not profitable, they cannot provide a service to customers for long.

A company that can continuously make a profit from its underwriting business thrives. It is also more likely to be around for a long time.

Imagine an insurer pays out $70 in claims and expenses, plus $20 in operating **expenses for every $100 it collects in premiums. It would subsequently have a combined ratio of 90%. This means it is profitable.

** Expenses are costs a company incurs over a specific period.

According to the FT Lexicon, combined ratio is:

“The ratio between the amount of money that an insurance company receives from customers in premiums, and the amount that it has to pay out when people make claims.”

If you are thinking of buying shares in insurance companies, look at their combined ratios. In fact, look at the combined ratios of several firms. Then pick the most profitable insurers.

Don’t just look at the combined ratio of a single year in each company. You must get data on their underwriting profitability over several years.