Corporation tax is a tax that businesses pay on profits and other types of income. This tax includes any chargeable gains accruing in commercial enterprises. Corporation tax is a British term. In the United States and Canada, people say ‘corporate tax,’ while in Australia the term is ‘company tax.’

Businesses pay tax on their profits for the ‘financial year.’ In the UK, for example, the financial year runs from 1st April to 31st March.

The British Government says you have to pay corporation tax on profits from doing business as:

– A limited company. There are two types of limited companies in the UK; Ltd. and PLC.

– Any foreign company that has a UK office or branch. However, those companies only pay tax on the profits they make in the UK.

– A club, cooperative, membership organization, or other unincorporated association. For example, sports clubs or community groups have to pay tax.

You don’t get a corporation tax bill

Companies do not receive a bill from the UK Government. They need to do specific things to calculate, pay, and report tax:

Registration

When the business starts, you should register for corporation tax. If you restart a dominant business, you must also register it. Unincorporated associations have to write to HMRC (Her Majesty’s Revenue and Customs).

Accounts

The business must maintain accounting records and prepare a corporate tax return to calculate how much it must pay.

Pay on time

You must make sure you pay the tax by your deadline. The deadline is typically nine months and one day after the end of your ‘accounting period.’ If you have nothing to pay, report this by the deadline.

File a tax return

Make sure you file the tax return before your deadline. The deadline is usually twelve months after the end of your accounting period.

Remember that the deadline for paying the tax comes before the deadline for filing the tax return.

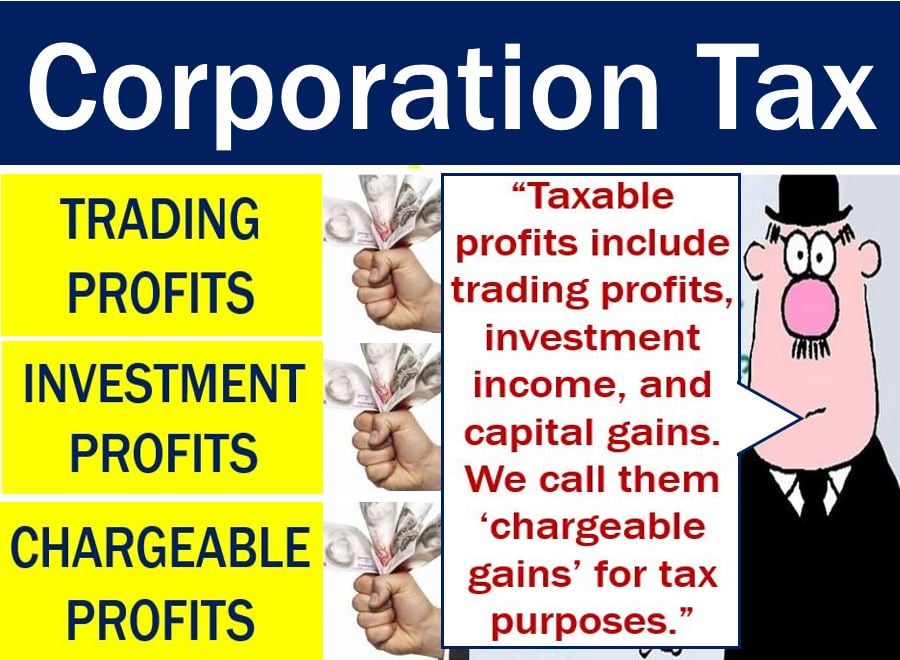

Firms pay corporation tax on profits

Taxable profits for corporation tax include all the money an association or company makes from:

– Trading profits, i.e. doing business.

– Investments.

– The sale of assets. Specifically, if the sale of the assets is worth more than the purchase. In other words, chargeable gains.

UK-based companies pay tax on all their profits made in the UK and abroad.

Companies based outside the UK are only taxed on the profits they make from their business activities in Britain. They are only liable if they have an office or branch in the UK.

Limited companies are separate entities

When you register as a limited company, you as a company director are subject to PAYE as well as national insurance. PAYE stands for pay as you earn (tax). You will also have to fill a personal self-assessment tax return.

Your company is another entity. The tax authorities see a limited company separately. It is liable for tax on its surpluses or taxable profits.