What is an entity? Definition and meaning

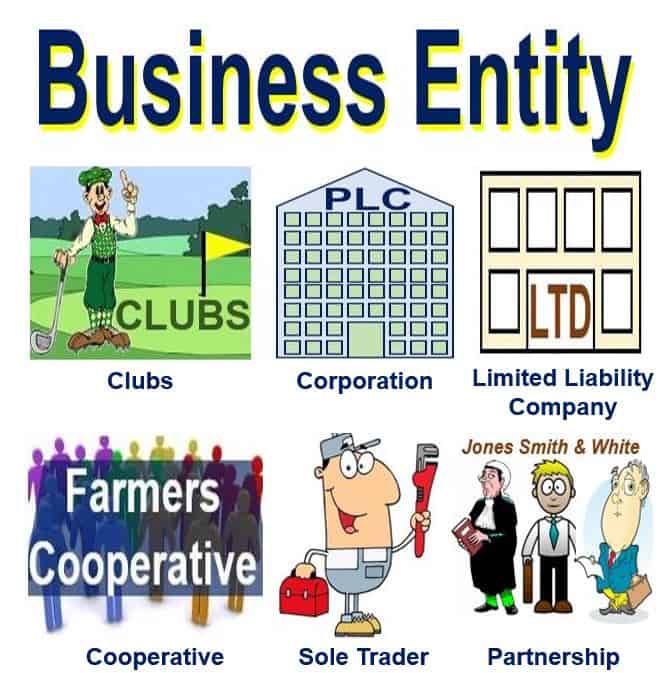

In the world of business and finance, an Entity is an individual, company, partnership, association, club, cooperative that has a legal and separately identifiable existence. For example, if you own 100% of the shares of a commercial enterprise, even though it is your company, it is a different entity from you as far as the law and the government’s tax department are concerned.

Legal entities have the legal capacity to enter into contracts or agreements, incur and pay debts, pay taxes, assume obligations, sue and be sued in their own right, and be held responsible for their actions. Economic entities are regarded by economists as consumers.

Entities – main types

There are two main types of entities:

-

For profit

The primary objective of for-profit entities is to earn profit for their owners or shareholders. These entities are characterized by their pursuit of financial gain and are typically divided into two categories: people-based and capital-based.

-

Not for profit (non-profit)

Non-profit organizations, in contrast, are driven by a mission to make a specific impact rather than financial profits. Their goals are diverse and can range from charitable, educational, scientific, to cultural pursuits. They reinvest surplus revenue to further their cause. Most of them rely on fundraising, donations, grants, and volunteers.

As far as regulations, taxation and liability are concerned, a subsidiary is a distinct legal entity, unlike a division, which is a business that is fully integrated within the main company.

A thing that exists

In non-business terms, the word refers to a real thing, a being – something that exists. In order to be one all it has to do is to exist – to be. The word also signifies separateness from other things that exist – from other existences.

It is a thing that has individual, definite existence outside or within our minds – anything real in itself.

Entities are described as follows by the Cambridge Dictionary:

“Something that exists apart from other things, having its own independent existence.”

Entity in engineering and computer programming

In engineering and computer programming, an entity is a unit – the term is used to identify it as such. It could be any object in the system that we want to model and store information about. This could be something abstract, such as an idea, or concrete, but it has no ready name or label.

This quote comes from Christopher Alexander, a widely influential architect and design theorist and emeritus professor at the University of California, Berkeley:

“In short, no pattern is an isolated entity. Each pattern can exist in the world only to the extent that is supported by other patterns: the larger patterns in which it is embedded, the patterns of the same size that surround it, and the smaller patterns which are embedded in it.”

Computer games

In computer games it is a dynamic object such as a non-player character or item.

Anything that is as yet unnamed and we are not sure how to refer to it may be described as an entity, as in: “As I approached the top of the hill, the entity rose into the night sky, glowing brightly and making an eerie humming noise. Then it flew straight up at incredible speed and disappeared above the clouds.”

What is a financing entity?

In the world of insurance, a financing entity is any party that has direct ownership of a specific policy or certificate that is the subject of a settlement contract. He, she or it (if it is a company) has a written arrangement with at least one licensed settlement supplier for financing the acquisition of a number of settlement contracts.

In insurance, the term may refer to lenders, underwriters, placement agents, or the buyer of a policy from a settlement provider.

More generally, but still in a business/finance context, the financing entity may be the party in a financing arrangement. Financing and financed entities represent two key parties in a financing arrangement.

Insuranceopedia has the following definition of ‘financing entity’:

“A financing entity refers to any entity that has direct ownership in a certain policy or certificate that is the subject of a settlement contract. In addition, the financing entity has a written arrangement with one or more licensed settlement suppliers for financing the acquisition of various settlement contracts.”

Etymology of ‘entity’

Etymology is the study of the origin and historical development of words and their meanings.

According to etymonline.com, the term ‘entity’ appeared in the English language in the 1590s, meaning ‘being.’

It derives from the Late Latin word “entitatem” (nominative “entitas”), which originated from the Latin root “ens,” meaning ‘a thing.’

Initially, its meaning was abstract, but by the 1620s, it also began to refer to physical things.

Compound phrases with ‘entity’

A compound phrase is a term that contains two or more words. The term ‘legal entity’ is a compound phrase. There are many such phrases with the word ‘entity.’ Let’s have a look at some of them:

-

Independent entity

An organization or unit that operates autonomously.

For example: “The subsidiary operates as an independent entity, distinct from the parent company.”

-

Separate legal entity

A business that is legally distinct from its owners.

For example: “The corporation was set up as a separate legal entity to limit personal liability.”

-

Distinct entity

Something unique and separate in identity.

For example: “Each department in the organization functions as a distinct entity with its own budget and goals.”

-

Corporate entity

A company recognized by law as a single body.

For example: “The merger resulted in the creation of a new corporate entity in the tech industry.”

-

Sovereign entity

A state or governing body with complete self-governance.

For example: “Each state in the federation is considered a sovereign entity with its own laws and regulations.”

Video – What is an Entity?

This interesting video presentation, from our YouTube partner channel – Marketing Business Network, explains what an ‘Entity’ is using simple and easy-to-understand language and examples.