Over-the-Counter, or OTC, refers to anything that is bought and sold directly between seller and buyer, away from a formal securities exchange – the trading is carried out directly by computer, email, and over the telephone. An over-the-counter stock is not listed on an exchange, such as the stock market. OTC derivatives are traded privately and bilaterally – between two parties – and not on a formal exchange platform.

For the meaning of over-the-counter medications, see the last section of this article.

OTC Trading

OTC trading has no physical location – it does not take place at the New York Stock Exchange, the London Stock Exchange, etc. Over-the-counter trading occurs through a dealer network.

Unlike financial instruments traded on stock exchanges, agreements on the features of the financial instrument in an OTC market – what, quantity, price and conditions – are based on mutual consent.

Over-the-counter may also refer to debt securities and a wide range of financial instruments that are not traded on a formal exchange but are usually sold by investment banks that seek to raise funds for particular purposes.

In most cases, non-prescription financial instruments and products are traded for smaller commercial entities that fail to meet the criteria for listing on the LSE (London Stock Exchange), NYSE (New York Stock Exchange) and other formal platforms. Sometimes they are traded as unlisted stock.

The OTC market is also instrumental in facilitating secondary markets for private company shares, offering liquidity options outside traditional exchanges.

Additionally, OTC markets can play a pivotal role in debt restructuring processes, allowing companies to negotiate terms directly with creditors without the formalities of an exchange.

Over-the-counter markets – transparency

In an OTC market, trade can be carried out between two participants without anybody else being aware of how much money was involved.

Over-the-counter markets are typically much less transparent than exchanges. Exchanges are subject to considerably more regulations and oversight compared to OTC markets.

When the financial market is stable, OTC markets generally function well. However, during times of financial stress, as occurred during the 2007/8 global credit crisis, their lack of transparency can exacerbate problems.

During the 2007/8 crisis, mortgage-backed securities, which were traded exclusively in the OTC markets, could not be priced reliably due to a lack of liquidity. Consequently, a large number of dealers withdrew from the market altogether, which made the liquidity problem considerably worse – the global credit crunch was mainly caused by a severe liquidity problem.

Over-the-counter markets

Over-the-counter markets are divided into two main branches:

– Customer Market: dealers trade with institutions and corporations (their clients).

– Interdealer Market: dealers trade with other dealers.

Prices that dealers quote their clients are not always the same as those quoted to other dealers. The bid-ask spread between dealer and client is often wider than between dealers.

OTC markets are mainly used to trade:

- bonds

- derivatives

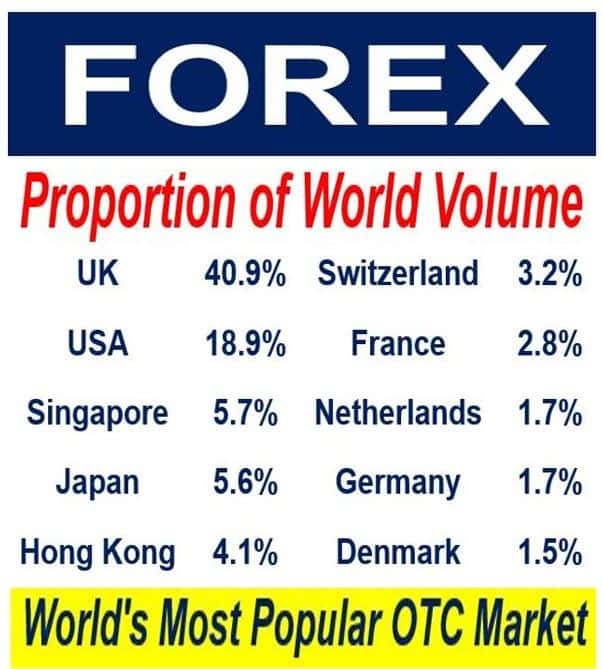

- currencies

- equities such as the OTC Pink marketplaces, the OTCQB, and the OTCQX (formerly the Pink Sheets and OTC Bulletin Board)

Over-the-counter – drugs

In the world of healthcare, over-the-counter medications, also known as nonprescription medicine, are those that can be purchased without needing to present a doctor’s prescription or Rx. For example, aspirin, Tylenol (paracetamol), and many cough syrups can be bought directly at a pharmacy without having to first go to your doctor to get a prescription.

The US Food & Drug Administration (FDA) has the following definition on its website:

“Over-the-counter medicine is also known as OTC or non-prescription medicine. All these terms refer to medicine that you can buy without a prescription. They are safe and effective when you follow the directions on the label and as directed by your healthcare professional.”

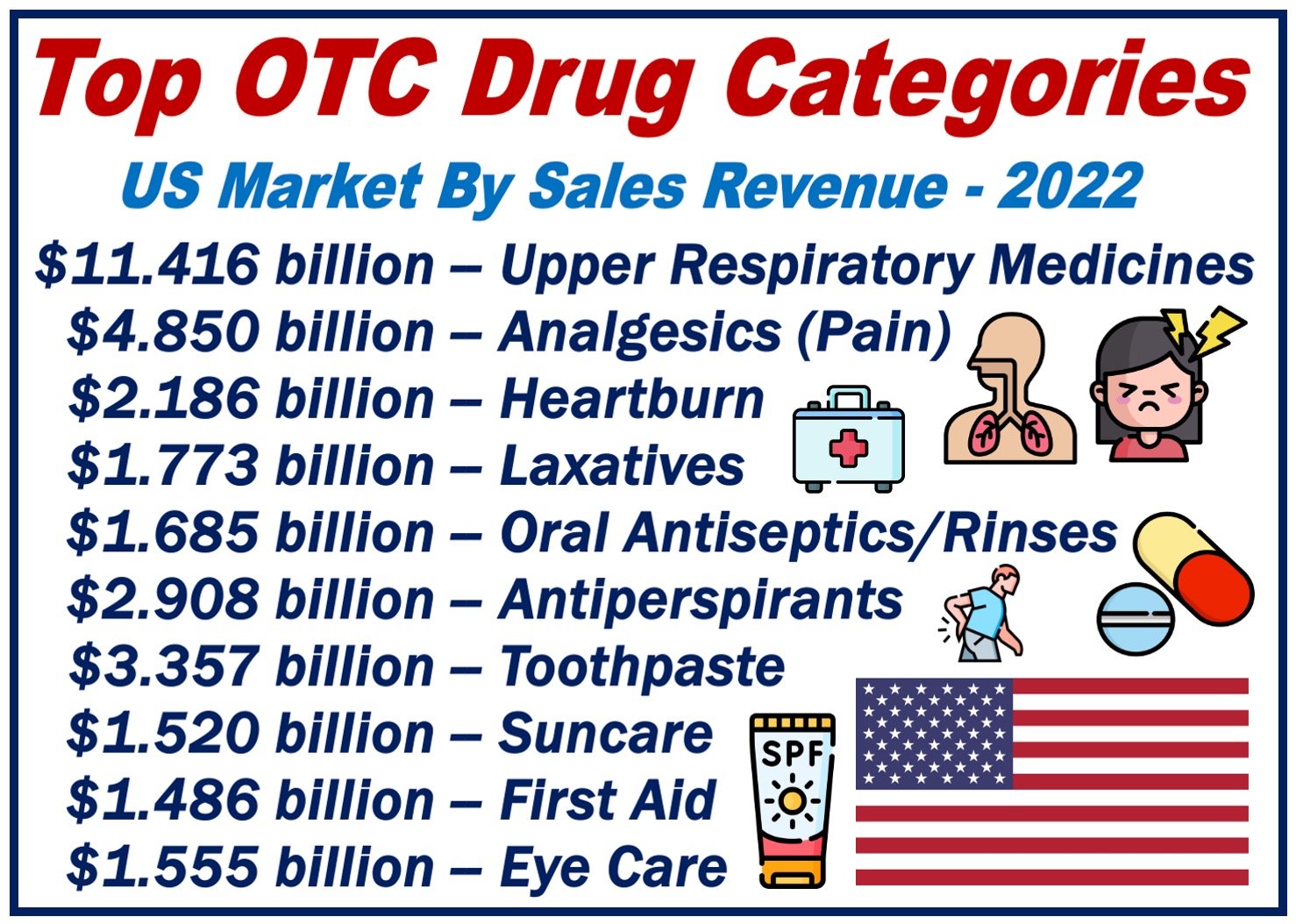

According to statista.com, the global OTC drug market (revenue/sales) is worth $193 billion (2023), and will be worth $243 billion by the end of 2028. This will represent annual growth (CAGR) of 4.76% over the five years.

While the global OTC pharmaceutical market is projected to reach $243 billion by 2028, it represents a segment of the broader pharmaceutical market, which, including prescription drugs, is estimated to grow to over $1.5 trillion by the same year, highlighting the significant scale of prescribed medications in comparison.

The per capita spend is also expected to rise, from $25.12 (2023) to $30.46 in 2028. In 2023, approximately 26.41% of global purchases of OTC pharmaceuticals will occur online.

Regarding the global OTC pharmaceuticals market, statista.com informs:

“A critical factor that limits the growth of the OTC Pharmaceuticals market are inaccurate self-diagnostics leading to medication errors. Government regulations and legal restrictions can also slow down the market growth.”

In this article, the term “pharmaceutical” means the same as “drug,” therefore, “the OTC pharmaceutical market” means the same as “the OTC drug market.”

Main OTC Drug markets

The top over-the-counter markets for OTC drugs in 2023 are the United States, China, European Union, Japan, the United Kingdom – which together accounted for more than half of global sales.

If we look only at regions, rather than individual countries, the largest OTC pharmaceutical market is Asia-Pacific.

Regarding the Asia-Pacific region, globaldata.com writes:

“The value sales of OTC healthcare products in Asia-Pacific are growing, spurred by the increasing health consciousness of consumers. OTC healthcare products are typically less expensive than prescription medications, making them an attractive option for people who do not have health insurance or have high deductibles.”

Video – What is Over-the-Counter (OTC)?

This interesting video, from our sister channel in YouTube – Marketing Business Network, explains what ‘Over-the-Counter (OTC)’ is using simple and easy-to-understand language and examples.