A credit card loan or credit card debt is money you borrow when you use your credit card. Credit cards allow us to buy things when we either don’t have cash or don’t want to use cash. People may also prefer to pay by credit card because it offers convenience, security, and easy tracking.

When you buy something using your card, the issuer loans you the money to make the purchase. You will have to pay back the loan at a later date. After a ‘grace period,’ you will also have to pay interest on that loan.

Unsecured Credit Card Loan

With most credit card loans, the borrower does not need to use any property as security. We call this is an unsecured loan. If the borrower defaults, the credit card issuer has no recourse to a rapid way of recouping its loss. In other words, if you don’t pay back your debt, the bank cannot come after your house or other assets.

As its loans are unsecured, the credit card issuer has to check the customer’s credit rating. It must check the customer’s credit rating for two reasons. First, whether to lend them any money; and second, how much to lend.

Borrowers with a bad credit rating might be able to get a ‘secured’ credit card loan. They will have to put up collateral. If they default, the issuer can then seize that collateral.

In most cases, the collateral is cash. For example, if you deposit $500 cash, your card will have a $500 credit line.

In fact, a secured credit card loan where the customer uses cash as collateral is not really a loan. The bank is lending the customer their own money. It is essentially no different from a debit card.

A credit card loan is expensive

When the ‘grace period’ is over, interest rates on credit card debts are the highest on the market for loans. Even though credit card debt is widespread, it is one of the worst types of debt.

If you already carry a balance on your credit card, you will not have a grace period. In other words, the lender will charge interest on any new purchases will immediately.

Credit card issuers prefer their customers to pay just the minimum payment. In fact, they encourage people to do this. They promote the use of the card for long-term borrowing.

You would be better off arranging a loan with your bank and clearing your credit card debt. Your repayments would probably be much lower.

A University of Michigan study found that individuals with credit card debt suffer serious consequences. They are more likely to forgo vital medical care compared to people with no credit card debt.

Their likelihood of forgoing medical care rises with the magnitude of credit card debt. In other words, the higher their credit card debt, the less necessary medical care they receive. Lucie Kalousova and Sarah Burgard reported their findings in the Journal of Health and Social Behavior.

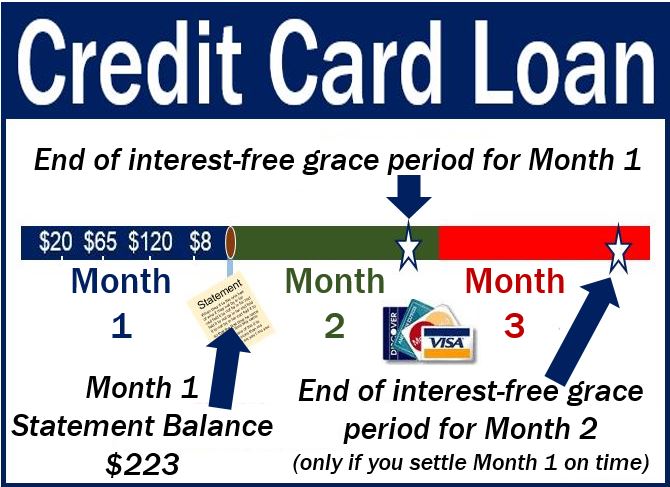

Video – Credit card billing

In this video, William Peterson shows how the interest-free ‘grace period’ works with credit cards. It is important to pay off the statement balance in full each month. He also talks about the hidden danger of carrying a balance.