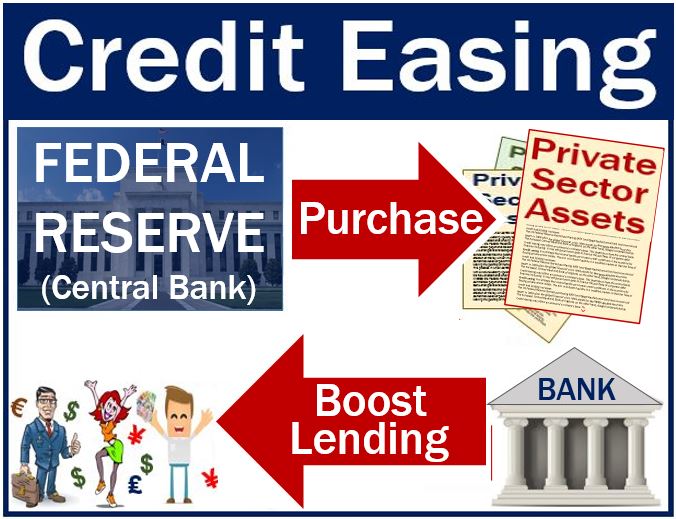

Credit Easing is a strategy that central banks use to ease credit conditions in the economy by buying private sector assets. The aim is to boost liquidity in a troubled market so that the flow of credit and lending increases.

This strategic infusion of liquidity is intended to prevent the tightening of credit markets that can exacerbate economic downturns.

The US Federal Reserve started purchasing MBS and commercial paper in 2009 after the global financial crisis. MBS stands for mortgage-backed securities

The European Central Bank and Bank of England, on the other hand, bought corporate bonds.

Credit easing may affect an economy’s monetary base. This depends on how the central bank finances its buying. It may sell government debt to finance the purchase of corporate debt.

When the central bank finances the purchases through the creation of money, the monetary base subsequently grows.

By increasing the monetary base, credit easing can also help to restore consumer confidence and spending, essential for economic recovery and growth.

Monetary easing during a crisis

Ben Bernanke, a former Federal Reserve Chairman, said regarding the central bank’s strategy:

“These three sets of policy tools – lending to financial institutions, providing liquidity directly to key credit markets, and buying longer-term securities – have the common feature that each represents a use of the asset side of the Fed’s balance sheet, that is, they all involve lending or the purchase of securities.”

“The virtue of these policies in the current context is that they allow the Federal Reserve to continue to push down interest rates and ease credit conditions in a range of markets, despite the fact that the federal funds rate is close to its zero lower bound.”

The Federal Reserve wanted to push interest rates down. It also wanted to make credit more available to businesses and individuals, even though the federal funds rate was already close to zero.

Credit easing vs. quantitative easing

Credit easing (CE) does not target the level of reserves. The Bank of Japan, for example, targeted reserve levels at the end of the last century.

CE focuses on expanding the asset side of the balance sheet. It does this by extending different kinds of credit. In fact, credit easing has just one aim – to kick-start the credit markets.

With quantitative easing (QE), the focus is on the liabilities side by raising the reserve base to a target. By the reserve base, we mean mainly currency and other liquid items.

The two strategies are similar in that they both involve the expansion of the central bank’s balance sheet.

However, in a purely QE approach, the focus is on the level of bank reserves. For the central bank, these are liabilities.

The Fed’s CE approach focused on a combination of securities and loans that it held. It also focused on how this mix of assets affected credit conditions for private individuals and businesses.

Video – What is Credit Easing?