The term ‘credit freeze’ has two meanings. It may refer to when the government forces banks to stop lending completely. The term may also refer to people preventing credit bureaus from selling their data. We also call it a credit lock down, credit lock, security freeze, or credit report lock down.

With a credit freeze, the credit bureau locks the person’s data until they give permission to unlock it.

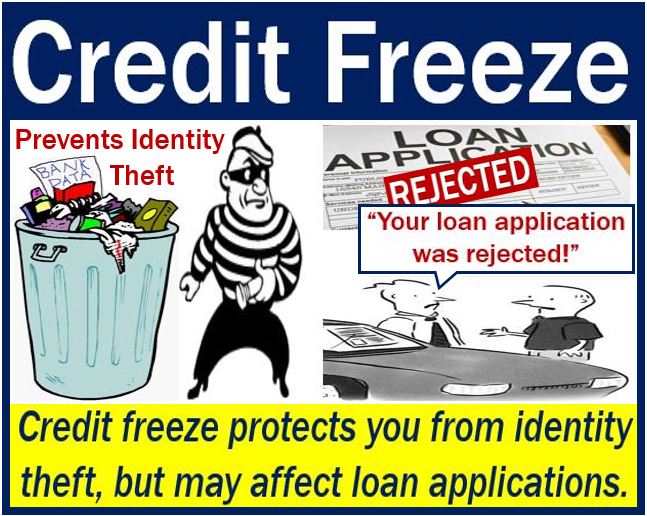

However, if you seek a credit freeze, remember that it may slow down a loan application approval. It may also affect a rental tenancy agreement, utility provision contract, and several other commercial services.

In fact, the credit freeze might even cause a loan application rejection.

US states recently started introducing laws allowing individuals to impose credit freezes. By 2007, America’s three leading credit bureaus announced that they would allow consumers to freeze their credit reports. They would even allow people to do this in states without such laws.

America’s three leading credit bureaus are Experian, TransUnion, and Equifax.

A credit bureau is a firm that specializes in gathering people’s or companies’ payment and credit histories. They sell this data to lenders, who then decide whether to approve loan applications.

Security freeze procedure

When people place a security freeze on their file, they will receive a personal identification number or password. They can use the password if they decide to remove the freeze on their file. They can also use it to authorize the temporary release of their credit report data.

To provide that authorization, you will need to contact the credit bureau and present identification and your password. You will also need to state that you have chosen to remove the security freeze from your file.

“A security freeze generally does not apply to circumstances in which you have an existing account relationship, and a copy of your report is requested by your existing creditor or its agents or affiliates for certain types of account review, collection, fraud control or similar activities.”

A credit freeze is an effective way of preventing people from stealing your details. In other words, it protects you from identity theft.

Credit freeze does not block out everybody

When you place a security freeze on your credit report, there will still be some entities that have access to your data.

Even with a security freeze, people may still access your details for pre-screened credit purposes. Law enforcement agencies also have access when conducting criminal background checks.

Government agencies may obtain your personal data when investigating some matters For example, when they are investigating taxes, child support payments, or medical fraud.

According to Cambridge Dictionaries Online, a credit freeze is:

“A situation in which actions by a government force banks to stop lending money,” or “a service that allows consumers to prevent credit bureaus from selling the information in their files.”

Video – Credit freeze

In this CreditCard.com video, the presenter explains what a credit freeze is, and how it can protect you from identity theft.