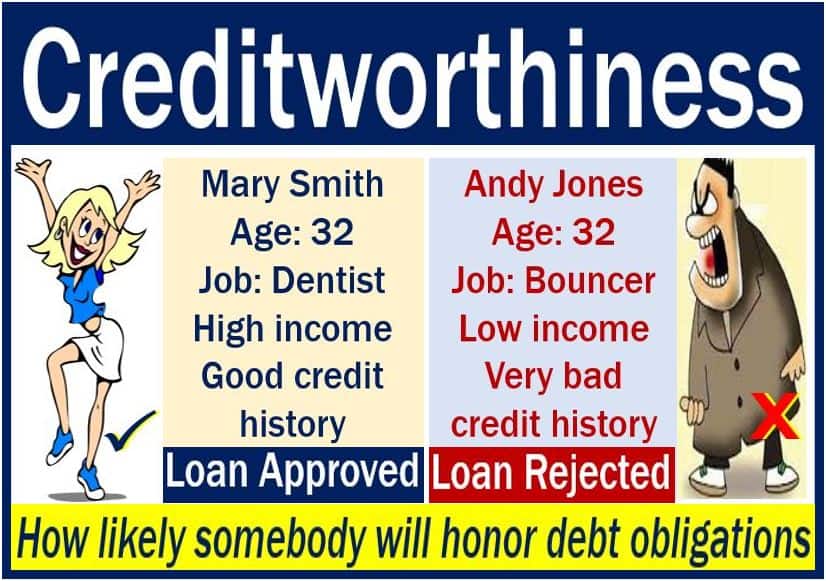

Creditworthiness or credit worthiness reflects a person’s, company’s, or entity’s ability to pay back a debt. In other words, how likely they are to repay a loan by meeting their financial obligations.

The more creditworthy you are, the more likely a bank will lend you money. You are also more likely to get a low interest rate on the loan.

Your credit history establishes your creditworthiness. Credit history refers to how you have met past loan obligations and how promptly you have paid bills.

Many other factors also influence how creditworthy you are. For example, your age, income, current debts, current expenses, and future job opportunities.

Building a consistent employment history can also be beneficial, as lenders may consider the stability and longevity of your income when assessing creditworthiness.

Banks and other lenders use this data to determine how much they are willing to lend.

Determining creditworthiness

Lenders pay credit rating agencies, which monitor consumers and follow their financial activities to generate a credit score. The higher your credit score is the better your creditworthiness.

We can increase our likelihood of getting a loan if we familiarize ourselves with how credit agencies evaluate creditworthiness. We should also monitor our credit reports for signs of negative information. Negative information reduces our chances of getting loans.

We can improve our creditworthiness by maintaining our debts within a manageable percentage of our income. We should also make sure we pay our bills on time.

Most US lenders us the FICO Score when deciding whether to lend money to someone.

Improving your creditworthiness

Any negative information regarding your credit history loses its impact on your overall rating with time. Even if you experienced problems in the past, it is possible to erase that stain eventually .

However, American business magnate, investor, and philanthropist, Warren Buffett, said:

“Creditworthiness is like virginity. It can be preserved but not restored very easily.”

According to the Macmillan Dictionary, creditworthiness is:

“The degree to which a person, organization, or country is considered likely to pay back money that they borrow.”

Experts advise young people to start establishing their creditworthiness early on. If you have absolutely no debts, nobody will know how to rate you effectively because you have no track record.

If you get one credit card and manage it well, your creditworthiness will improve significantly.

When US lawmakers reached an impasse and could not agree on a federal budget, President Barack Obama said:

“Nobody wants to put the creditworthiness of the United States in jeopardy. Nobody wants to see the United States default. So we’ve got to seize this moment, and we have to seize it soon.”

How to boost your creditworthiness

The following advice comes from credit rating agency Equifax:

- Pay your bills promptly. Late payments and collections can significantly worsen your credit score.

- If you have missed a payment, sort the problem immediately and stay current.

- Do not shift debts to other accounts. Pay them off.

- If you’ve had problems, re-establish your credit history. In the long term, opening new accounts and managing them well may help.

- Only apply for and open new credit accounts when you need them.

- Keep your credit cards. However, make sure you manage them properly. Having installment loans and credit cards and meeting your financial obligations helps your credit score in the long term.

- If you are finding it hard to cope, contact the lender. Additionally, you could see a credit counselor, ideally from a non-profit organizations.

- Keep your revolving credit and credit card balances low.

- Diversifying the types of credit you use, such as mixing installment loans, retail accounts, and credit cards, can positively affect your credit score by showing your ability to manage different forms of credit.

Things not to do

- Do not close unused credit cards if your only aim is to raise your credit score.

- Never apply for several credit cards just to raise your available credit. This strategy could actually harm your score.

- People who have been managing credit for a short time should avoid opening many new accounts too quickly.

Video – What is Creditworthiness?

This interesting video presentation, from our YouTube partner channel – Marketing Business Network, explains what ‘Creditworthiness’ is using simple and easy-to-understand language and examples.