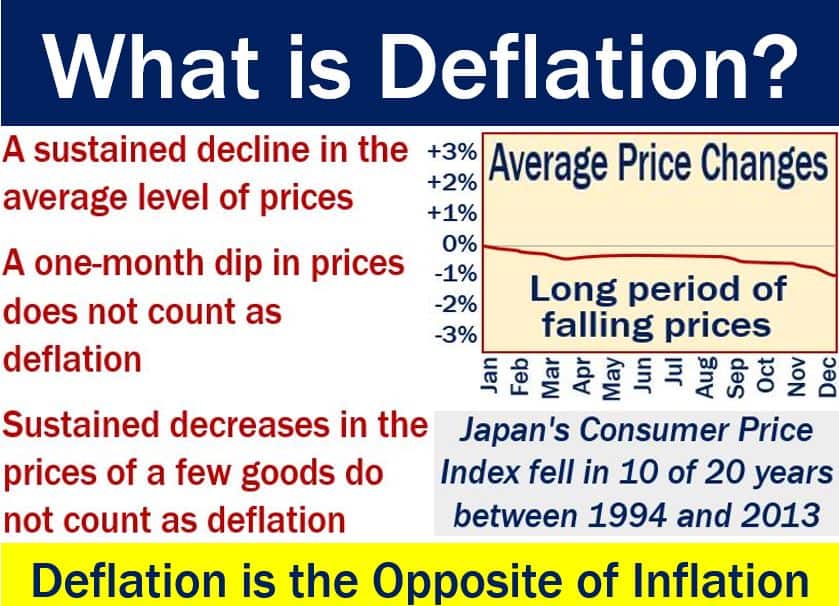

Deflation occurs when the prices of goods and services decrease, i.e., when inflation goes below zero or into negative figures. Do not confuse deflation with disinflation, which refers to a slowing down in inflation, i.e., prices rising more slowly.

Deflation is the opposite of inflation. Inflation refers to the increase in prices of goods and services. Both these terms describe the real value of money over time.

With inflation, the value of money declines. With deflation, the opposite occurs – the value of money rises.

When an economy experiences deflation, we can buy more goods with each unit of currency. In other words, we will be able to buy more with $100 next month than we can this month.

Most of us would think that declining prices are a good thing. However, in the long run, falling prices can raise the real value of debt.

In fact, declining prices can be very bad for a country’s economy.

What causes deflation?

Several factors can cause deflation. Sometimes, more than one factor may be present. In fact, in some cases, they may all be present simultaneously.

The main driver of deflation, by far, is a drop in demand for goods and services. While growing demand fuels a rise in prices, falling demand can trigger a decline.

If the value of a currency rises internationally, imports become cheaper. For example, a 10% euro rise against the dollar means eurozone citizens will pay less for goods coming from America.

The effects of deflation

When prices fall, several things that are bad for the economy begin to happen.

If you expect prices to fall, you are more likely to delay your purchases. You postpone your purchases because you expect to get better deals if you wait.

As more and more people do wait, businesses experience declining sales.

If businesses sell less, everybody suffers because the whole economy slows down. Companies eventually have to lay off workers if their sales are down.

Put simply; falling prices can trigger a vicious cycle of declining demand, shrinking business activity, and job cuts.

Debt burden rises deflation

People with debts will eventually be worse off in a deflationary environment. Let’s suppose your mortgage payments cost you $400 per month and your net income is $4000 per month. Your mortgage payments represent 10% of your net income.

If declining prices has slowed down the economy, companies may have to reduce workers’ wages. Let’s suppose your net income drops to $3,600 per month. Your mortgage payments have now risen to 11.11% of your net income.

In other words, your debt burden has increased.

During a long period of inflation, personal debts gradually get smaller. However, the opposite occurs during a long period of falling prices.

Nobel laureate Friedrich Hayek said the following about deflation concerning the Great Depression:

“I agree with Milton Friedman that once the Crash had occurred, the Federal Reserve System pursued a silly deflationary policy. I am not only against inflation, but I am also against deflation.”

Austrian economists believe the market should find its own way without any government intervention.

Money illusion

When prices are declining, employers find it harder to negotiate lower wage hikes (in real terms). This is because of money illusion.

Money illusion occurs when workers focus on the nominal value of a unit of currency rather than its real value.

For example, let’s look at two situations:

- Situation 1: Workers get a 0.5% wage rise when inflation is at 0%.

- Situation 2: Workers get a 5% raise when inflation is at 7%.

The first situation is a better deal than the second. In the first situation, the workers are half-a-percent better off. In the second situation, they are two percent worse off.

However, many workers see the second situation as a better deal. They think it is better because they are just looking at the nominal value of their currency. The workers see a 5% raise as bigger than a 0.5% raise. They are not looking at their currency’s real value. We call this mistake ‘money illusion.’

Moreover, money illusion can lead to decreased consumer spending and investment, as people perceive their money to be worth more in the future, thereby aggravating the economic downturn associated with deflation.

This cycle of reduced consumption due to deflation can lead businesses to lower production, potentially resulting in a downward economic spiral where both supply and demand continue to decrease.

Derivatives of ‘deflation’

The word ‘deflation’ has many derivatives, encompassing nouns, verbs, adjectives, and adverbs. Let’s have a look at them:

-

Deflate (verb)

To release or reduce the air or gas in something; in economics, to reduce the level of prices, or to reduce the value of something. As in:

“The government’s measures to deflate the housing bubble were controversial but ultimately effective.”

-

Deflated (adjective)

Feeling less confident or important; in economics, pertaining to a state where inflation is reduced or prices are lowered. As in:

“After receiving critical feedback on his project, he felt deflated and unsure about his abilities.”

-

Deflating (adjective)

Causing someone to feel less confident or important; in economics, relating to the process of reducing inflation or price levels. As in:

“The deflating news of another quarter of economic downturn weighed heavily on investors.”

-

Deflationary (adjective)

Relating to or tending to cause economic deflation. As in:

“Analysts were concerned about the deflationary effects of the new fiscal policy on consumer spending.”

-

Deflater (noun)

An agent or factor that causes deflation. As in:

“In this scenario, the central bank acted as a deflater by tightening the money supply.”

-

Deflationist (noun)

A person who advocates or believes in economic deflation. As in:

“The deflationist argued that a period of deflation could help correct market imbalances.”

Video – What is deflation?

This video presentation, from our sister channel on YouTube – Marketing Business Network, explains what ‘Deflation’ is using simple and easy-to-understand language and examples.