What is a discount loan? Definition and example

With a Discount Loan, the lender calculates the interest and other related charges and discounts them from the face amount before lending to the borrower. However, the borrower has to pay back the whole amount – the principal, the related charges, and the interest.

Interest is what the borrower has to pay on top of the principal when he or she takes out a loan. The principal is the original amount of a loan, i.e., the amount before interest and bank charges (administration fees) are added to the total.

Discount loans are typically issued for people who seek a short-term loan.

For the schedule of payments, the lender divides the total by the number of months the arrangement will last. However, in the vast majority of cases, the loan is paid back in one lump sum.

The Cambridge Dictionary has the following definition of “discount loan”:

“A type of loan, usually given for a short period, in which the person who borrows money gets an amount that is already reduced by the interest and other charges.”

Example of a discount loan

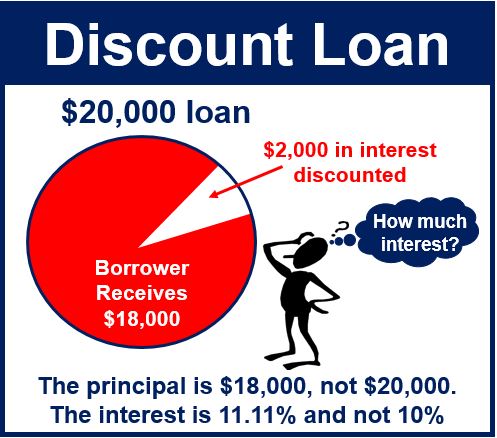

Imagine you wanted to borrow $20,000 and pay back twelve months later. The interest and charges came to $2,000.You would receive $18,000 from the lender. However, you would still have to pay back the whole $20,000.

Interest rates on discount loans tend to be higher than those on other types of loans.

The elevated interest rates on discount loans often reflect the increased risk assumed by lenders, as these loans are usually unsecured and based on the borrower’s creditworthiness.

This type of financing arrangement can be particularly attractive for lenders looking to secure immediate returns on the loans they offer.

“Discount loan” – vocabulary and example sentences

There are many terms related to “discount loans” in business/financial English, especially compound nouns. A compound noun, such as “discount loan agreement,” is a term that consists of two or more words. Here are seven such terms, their meanings, and examples of how we can use them in a sentence:

-

Discount Loan Rate

The interest rate charged by financial institutions on discount loans.

Example: “The bank’s discount loan rate was competitively low, which attracted numerous small business owners.”

-

Discount Loan Agreement

Definition: The contract between the lender and the borrower outlining the terms of the discount loan.

Example: “Before receiving the funds, Jane carefully reviewed the discount loan agreement to understand the repayment schedule.”

-

Discount Loan Repayment

The act of paying back the principal and interest of a discount loan.

Example: “The company’s financial strategy included a plan for early discount loan repayment to save on interest costs.”

-

Discount Loan Offer

A proposal by a lender to provide a loan where the interest and fees are deducted upfront.

Example: “The new discount loan offer in the market is targeting startups in need of immediate capital.”

-

Discount Loan Facility

An arrangement in which a financial institution offers discount loans to eligible borrowers.

Example: “The credit union launched a discount loan facility to help local businesses affected by the economic downturn.”

-

Discount Loan Terms

The specific conditions, including interest rate and repayment period, under which a discount loan is granted.

Example: “Borrowers should thoroughly evaluate the discount loan terms to ensure they are favorable and manageable.”

-

Discount Loan Application

The process by which an individual or business applies for a discount loan.

Example: “During the discount loan application, applicants must provide detailed financial information for the lender to assess creditworthiness.”

Video – What is a Discount Loan?

This interesting video presentation, from our sister channel on YouTube – Marketing Business Network, explains what a ‘Discount Loan’ is using simple and easy-to-understand language and examples.