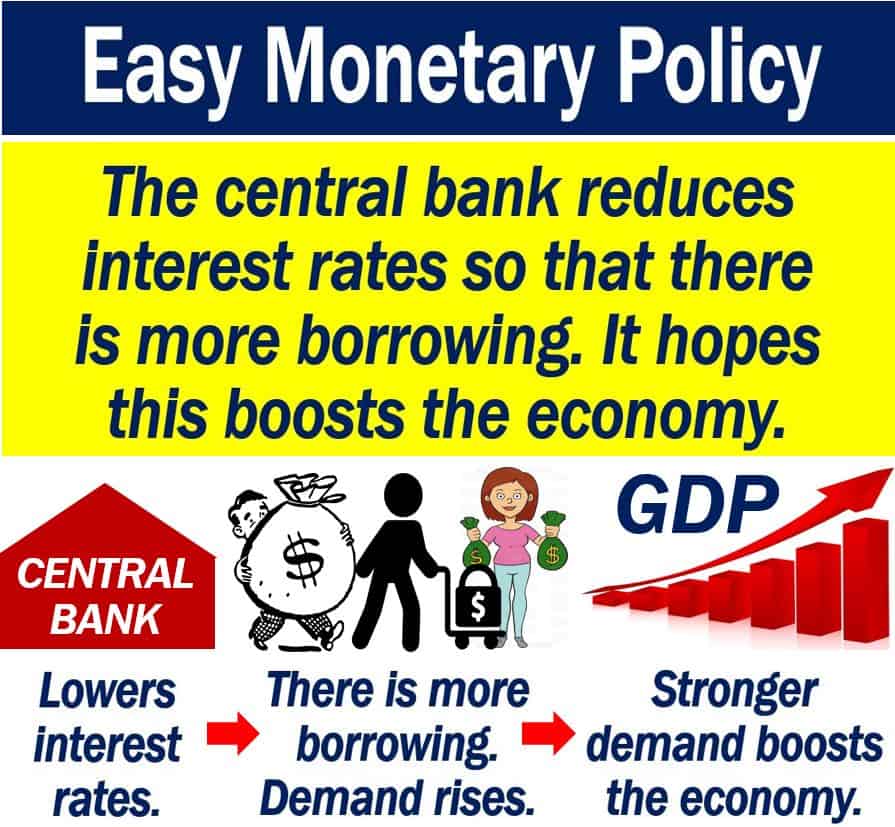

Easy monetary policy is a policy that a central bank introduces in which it lowers interest rates. If the central bank lowers interest rates, then borrowing becomes cheaper. They introduce easy monetary policy to boost economic activity.

We also call it ‘easy money policy.’

If businesses and individuals can borrow more, then demand will grow. Greater demand means more orders for business. More business means greater economic growth. Hence, the policy boosts economic growth.

After the 2007/8 Global Financial Crisis, most central banks adopted an easy monetary policy. National economies had ground to a halt, and it was necessary to kick-start them.

Easy monetary policy – stocks

When the central bank lowers interest rates, stock prices immediately rise. Over the medium term, the central bank achieves its goal of boosting the economy.

However, if easy monetary policy continues for too long, it can lead to high inflation.

Lower interest rates boost the amount of money in circulation. If the increase in supply does not match the increase in the money supply, i.e., the increase in demand, prices rise.

Market forces

Prices go up and down according to market forces.

Market forces are the forces of supply and demand. In a free market economy, when demand rises faster than supply, prices go up. When demand declines or supply rises, prices fall.

Central banks alternate

Therefore, central banks usually alternate between cheap and tight money.

They want to boost the economy but need to prevent it from overheating. So, when prices start rising too rapidly, they raise interest rates.

Easy monetary policy – criticism

Many critics say that to try to boost the economy artificially is harmful over the long-term. All it really achieves, they argue, is high inflation and long-term economic problems.

A study that S.P. Kothari carried out found that lower interest rates do little to stimulate corporate investment.

Kothari, from the MIT Sloan School of Management, looked at the growth rate of aggregated fixed investment by companies in the US from 1952 to 2010.