Do you believe that governments or central banks should implement measures to revitalize the economy during a recession or unexpected crisis? If so, you are a supporter of Economic Stimulus.

Economic stimulus is a series of policy measures implemented by governments or central banks with the objective of boosting economic activity. It usually aims to address slowdowns or recessions by increasing the amount of money circulating in the economy, encouraging consumer spending, business investment, and, consequently, economic growth.

Economic stimulus can take various forms, including tax cuts, increased government spending, or lowering interest rates. Near the end of this article, there is a list of different types of economic stimuli (the plural of ‘stimulus’ is ‘stimuli’).

The two primary types of economic stimulus are fiscal policy and monetary policy.

Nasdaq.com has the following definition of the term ‘economic stimulus’:

“A plan to boost the economy and achieve positive effects like increased job creation, jumpstart frozen credit markets, restore consumer spending etc. through the use of fiscal policy like government spending and tax measures. This program is controversial because many economists disagree on the stimulus multiplier.”

Understanding Economic Stimulus

Economic stimulus is typically introduced in response to economic challenges such as a recession or stagnation.

During these periods, unemployment rates rise, production declines, and consumer confidence weakens, leading to reduced spending and further contraction in the economy.

By injecting financial resources (money) into the economy, the government or central bank seeks to reverse these trends, stimulating demand, increasing production, and boosting employment. They seek to ‘kickstart’ the economy.

Stimulus measures are not limited to national governments; local or state governments may also introduce policies to stimulate regional economies.

The ultimate goal of any stimulus plan is to encourage spending and investment, which in turn drives economic growth.

There are two main types of economic stimulus: fiscal stimulus and monetary stimulus.

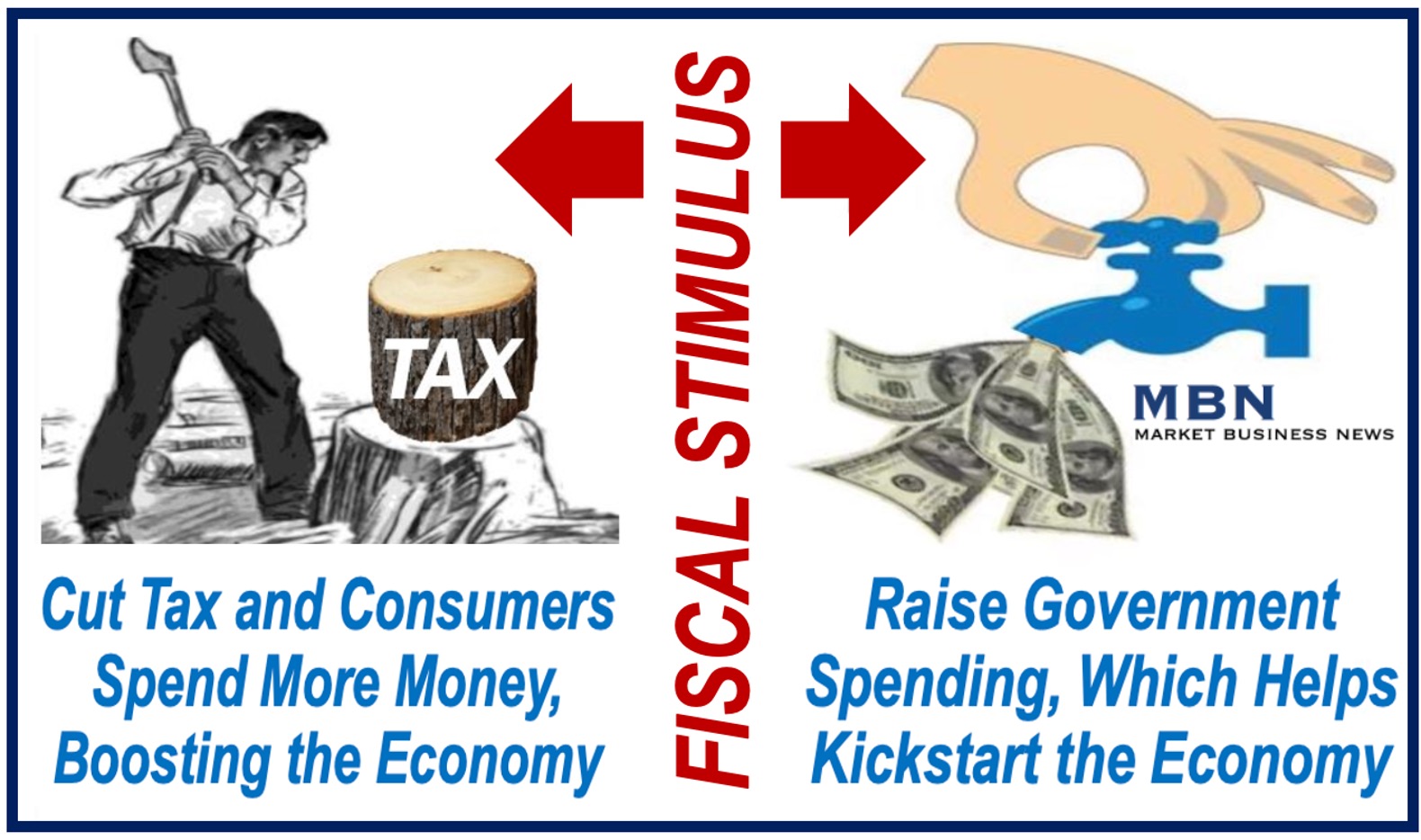

Fiscal Stimulus

Fiscal stimulus involves increasing government spending or decreasing taxes. By reducing taxes, individuals and businesses are left with more disposable income, which is expected to lead to increased consumption and investment.

-

Public Spending

Government spending on infrastructure projects, healthcare, or education also injects money directly into the economy, creating jobs and boosting demand.

-

Lowering Taxes

When governments reduce taxes, it gives businesses and consumers more capital to spend. This increased spending stimulates the demand for goods and services, which encourages businesses to hire more workers to meet that demand.

-

Deficit Spending

Deficit spending, where the government spends more money than it earns, is also a common component of fiscal stimulus. This strategy, while criticized by some economists for increasing national debt, aims to create immediate economic benefits by fostering job creation and spurring business activity.

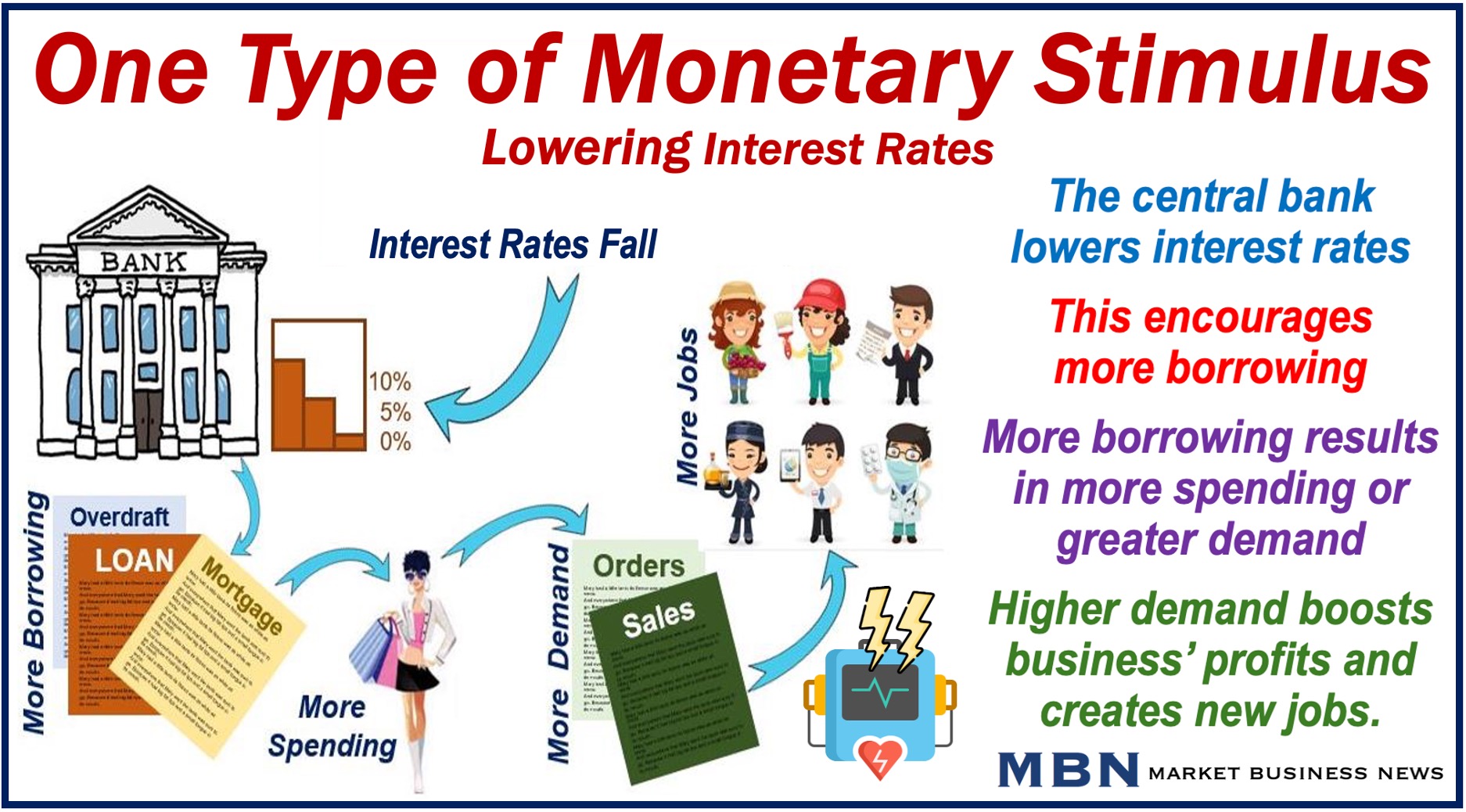

Monetary Stimulus

Monetary stimulus is managed by central banks, such as the Federal Reserve in the U.S. or the Bank of England in the U.K., and involves adjusting interest rates or controlling the money supply to stimulate economic activity.

-

Interest Rates

The central bank can lower interest rates to make borrowing cheaper, encouraging businesses and individuals to take loans and spend more money.

-

Reserve Requirement (Banking)

By lowering the reserve requirement for banks, central banks can also increase the amount of money banks have to lend, further boosting economic activity.

-

Quantitative Easing

Another key method of monetary stimulus is quantitative easing (QE), where central banks buy government bonds and other securities, increasing the money supply and encouraging investment. This method was used extensively by the Federal Reserve during the 2008 financial crisis and again during the COVID-19 pandemic.

Economic Theories Behind Stimulus

Economic stimulus is largely based on Keynesian economic theory, which argues that active government intervention is necessary to manage economic cycles.

John Maynard Keynes, an influential British economist, suggested that during economic downturns, private sector demand often falls short, leading to higher unemployment and underutilized capacity.

According to Keynes, the government can counteract this by increasing spending or cutting taxes to boost aggregate demand.

While Keynesian economists advocate for stimulus during economic slumps, other schools of thought, such as the Austrian School or Rational Expectations Theory, criticize stimulus policies. These critics argue that stimulus efforts distort markets, encourage excessive risk-taking, and lead to higher inflation or debt.

The Multiplier Effect

A critical concept in evaluating the success of economic stimulus is the multiplier effect or multiplier. The multiplier effect refers to the idea that every dollar of stimulus generates more than a dollar of economic activity.

For example, when the government spends money on building infrastructure, it pays wages to workers, who in turn spend their income on goods and services, further boosting the economy.

-

Government Spending vs. Tax Cuts

However, not all forms of stimulus have the same multiplier effect. Government spending on infrastructure projects, for example, tends to have a higher multiplier effect than tax cuts for high-income individuals, as lower-income earners are more likely to spend additional income quickly, while wealthier individuals may save or invest it instead.

Notable Examples of Economic Stimulus

Throughout history, various countries have implemented economic stimulus packages to recover from financial crises or prevent economic slowdowns. Some of the most notable examples include:

-

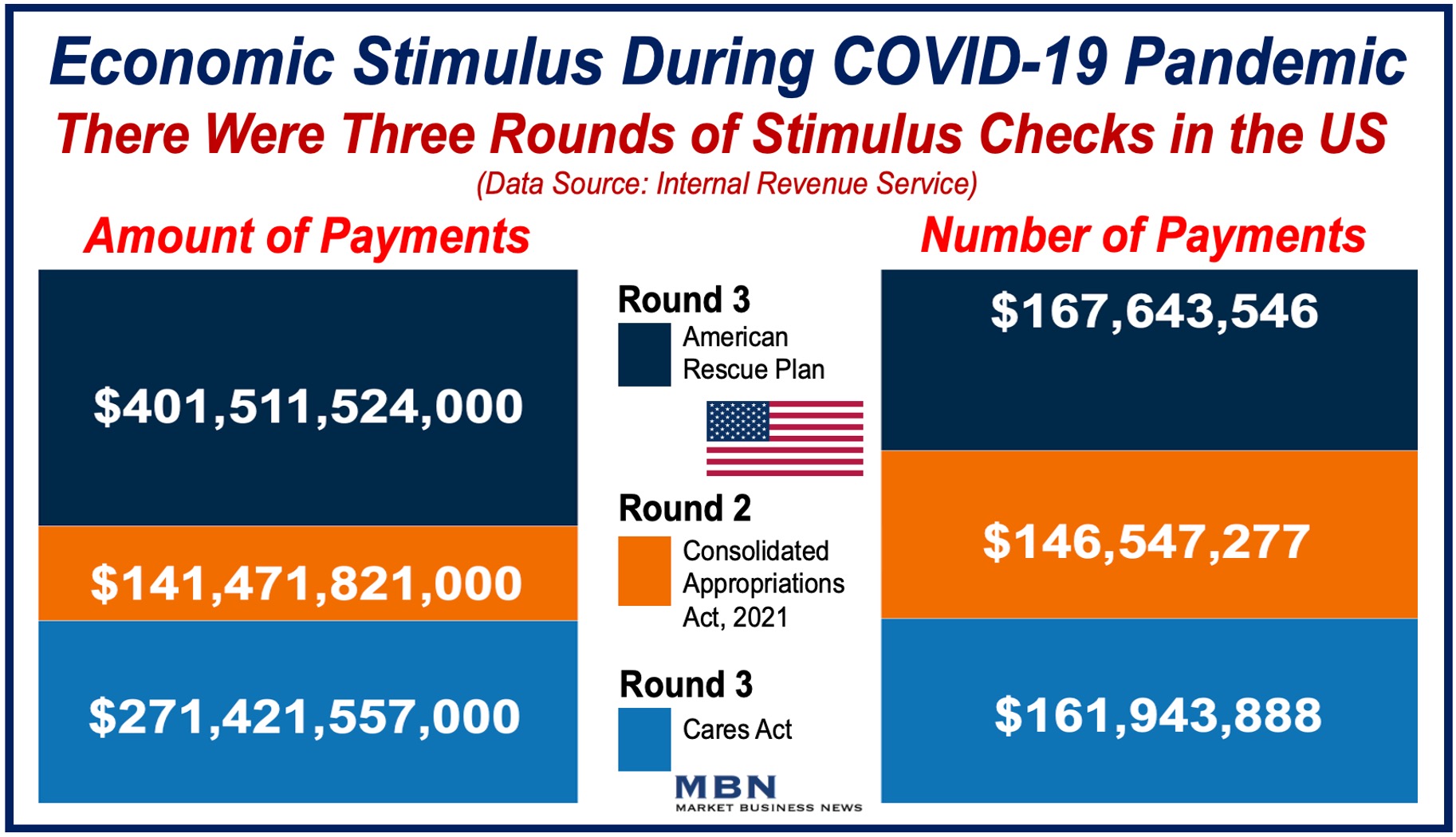

United States

The New Deal during the Great Depression in the 1930s, where the U.S. government increased spending on infrastructure projects to create jobs.

-

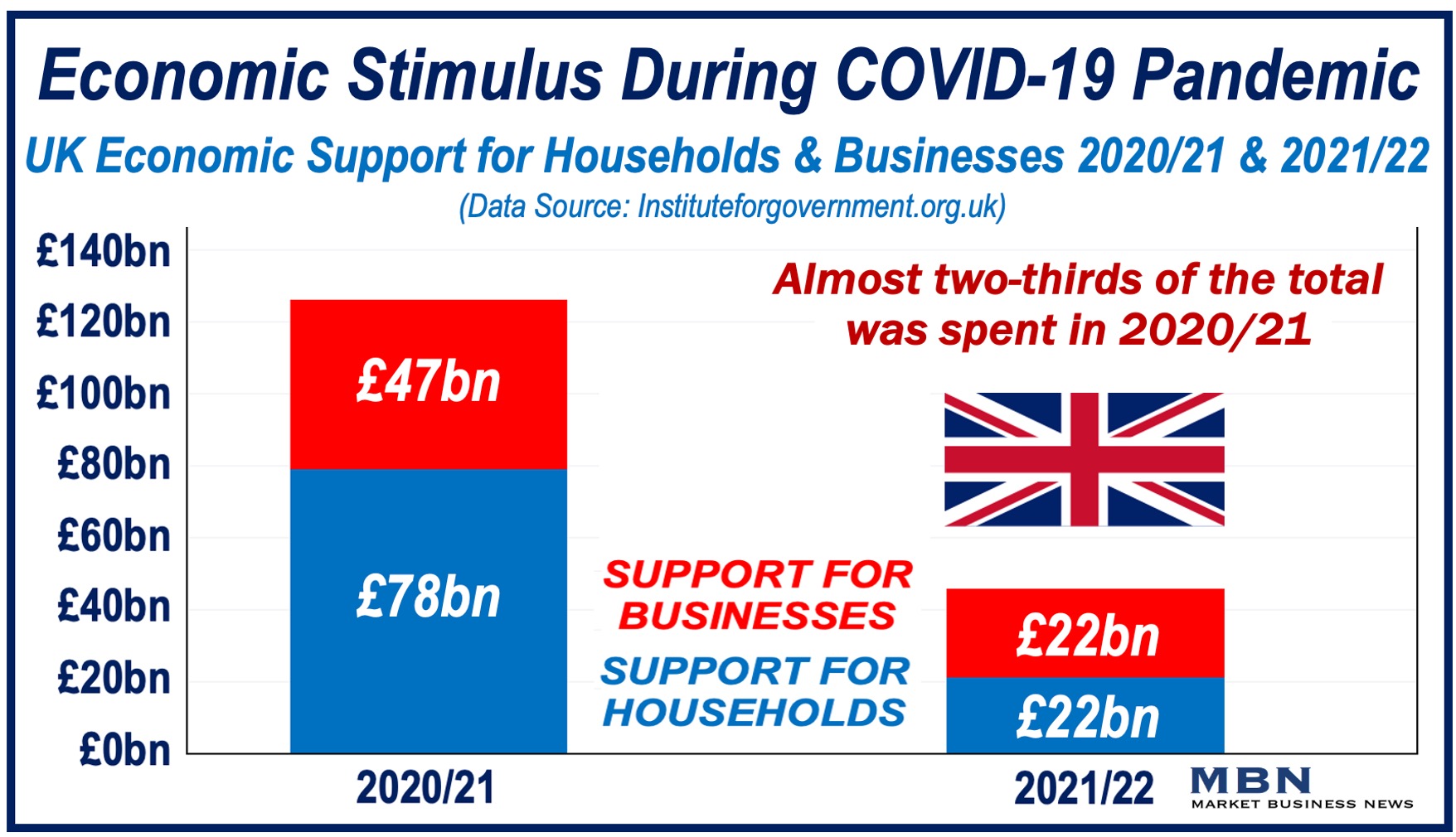

United Kingdom

The UK’s Coronavirus Economic Support Measures (2020-2021): The UK government introduced stimulus measures such as the furlough scheme, business grants, and the Eat Out to Help Out program to support the economy during COVID-19. These initiatives helped protect jobs and stabilize affected industries.

-

India

India’s Atmanirbhar Bharat Stimulus Package (2020): In response to the COVID-19 pandemic, India launched the Atmanirbhar Bharat package worth ₹20 lakh crore (about $266 billion), aimed at boosting self-reliance and reviving the economy.

The measures included support for small businesses, agriculture, manufacturing, and infrastructure projects, along with direct cash transfers and food security programs for vulnerable populations.

-

European Union

The European Economic Recovery Plan (2008): In response to the global financial crisis, the European Union implemented a coordinated fiscal stimulus plan focused on infrastructure, energy projects, and tax incentives to boost investment and growth.

-

China

China’s 2024 Economic Stimulus Package: In late 2024, China’s central bank introduced measures including interest rate cuts, reduced reserve requirements, and support for the property market to stimulate growth and stabilize the economy amid concerns of missing its 5% growth target.

Benefits of Economic Stimulus

-

Job Creation

By investing in infrastructure or providing incentives for businesses to expand, stimulus measures can create jobs and reduce unemployment.

-

Increased Consumption

Tax cuts and direct payments increase disposable income, encouraging consumers to spend more, which drives demand for goods and services.

-

Economic Growth

Stimulus packages can kickstart economic activity during slowdowns, helping economies recover more quickly.

Risks of Economic Stimulus

-

Inflation

Excessive stimulus, particularly if poorly timed, can lead to inflation by increasing the money supply without a corresponding increase in goods and services.

-

National Debt

Fiscal stimulus often involves increased government borrowing, which adds to national debt. Over time, this can become unsustainable and lead to higher interest rates or reduced government spending on essential services.

Some people argue that raising the national debt is unfair to future generations, as they may be burdened with higher taxes to repay the debt, potentially limiting their economic opportunities.

-

Inefficiency

Some stimulus measures may be poorly targeted, benefiting industries or individuals who do not need assistance. This can lead to wasted resources and reduced effectiveness.

List of Economic Stimulus Types

Economic stimulus can take various forms, including:

- Tax cuts (personal income, corporate, or payroll tax cuts).

- Increased government spending on infrastructure (roads, bridges, etc.).

- Lowering interest rates by central banks to reduce borrowing costs.

- Quantitative easing (QE): Central banks purchasing government or corporate bonds to increase money supply.

- Direct cash transfers or stimulus checks to individuals or households.

- Unemployment benefits extension or increase.

- Grants or subsidies to businesses, especially small or medium-sized enterprises (SMEs).

- Job creation programs, such as public works or infrastructure projects.

- Lowering reserve requirements for banks, allowing them to lend more money.

- Targeted support for specific industries, like the automotive or tourism sectors.

- Mortgage and loan payment deferrals or holidays.

- Tax incentives for businesses to invest in capital equipment or hiring new workers.

- Temporary reduction or suspension of sales taxes or VAT.

- Government-backed loans or credit guarantees for businesses.

- Bailouts for critical industries, such as airlines or financial institutions.

- Business rate reductions for companies to lower operating costs.

- Support for local governments to prevent layoffs and ensure public services continue.

- Childcare subsidies to support working parents.

- Investment in green energy projects or other environmentally sustainable initiatives.

- Rent subsidies or housing assistance for tenants and landlords.

- Educational grants or scholarship programs to enhance workforce skills.

- Temporary reductions in fuel or energy taxes to lower costs for consumers and businesses.

- Support for research and development (R&D), encouraging innovation in the private sector.

- Increased funding for healthcare to ensure capacity and support public health initiatives.

- Targeted assistance for sectors severely impacted by economic crises, such as hospitality or entertainment.

- Debt forgiveness or restructuring programs for individuals or companies in financial distress.

- Subsidized training programs to help workers transition into new industries or careers.

The Rise of Economic Stimulus as a Popular Tool

Economic stimulus has become a widely used strategy for leaders over the past century, largely due to the influence of John Maynard Keynes, a British economist whose ideas transformed economic policy.

Keynes developed his theories in response to the Great Depression of the 1930s, when conventional approaches failed to restore growth. He argued that during deep recessions, private sector demand is insufficient, leading to unemployment and economic stagnation. To address this, Keynes advocated for active government intervention through increased public spending and tax cuts to boost demand. This became known as Keynesian economics.

Keynes believed that in tough times, governments should “prime the pump” by creating jobs and stimulating spending, with the expectation that long-term growth would outweigh short-term deficits. His ideas became widely accepted after World War II, as governments used fiscal stimulus to rebuild and recover.

The success of Keynesian policies in the mid-20th century helped cement economic stimulus as a key tool for combating downturns, including during the 2008 financial crisis and the COVID-19 pandemic. Today, Keynes’ ideas still shape modern economic strategies, making stimulus measures a preferred option for leaders facing financial challenges.

Final Thoughts

Economic stimulus is a powerful tool for addressing recessions and boosting economic activity.

By injecting financial resources into the economy through fiscal or monetary policies, governments can help stimulate demand, create jobs, and drive economic growth.

However, the effectiveness of stimulus measures depends on careful planning, proper targeting, and timely implementation.

While stimulus packages have been crucial in addressing crises like the Great Depression, the 2008 financial crisis, and the COVID-19 pandemic, they must be managed carefully to avoid unintended consequences such as inflation or unsustainable debt levels.