Economic value added – definition and meaning

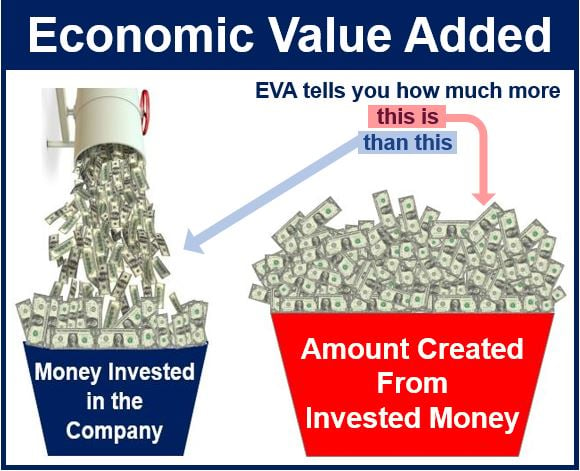

Economic Value Added (EVA), also referred to as economic profit, is the difference between how much profit a company makes from invested capital and how much it had to pay out to obtain that capital. In other words, how much more the company created than the required return of its investors (stockholders and debt holders).

In essence, economic value added is the value generated from money invested in a business.

If EVA is negative, it means the enterprise is reducing the value on the funds invested in it. If this is the case, the management must review all the components of this measure to determine which areas of the company can be changed to create a higher level of EVA.

EVA is a variation of profit. Profit alone does not tell us the cost of capital – EVA does.

EVA is a variation of profit. Profit alone does not tell us the cost of capital – EVA does.

If, after making the necessary changes, EVA is still negative, it would be best to shut down the business.

According to moneyterms.co.uk, economic value added is:

“A measure of by how much a company’s returns exceed those required by suppliers of capital. It therefore tells one how much wealth the company has created for providers of capital (meaning shareholders).”

EVA formula

Economic value added is calculated by deducting capital cost from the company’s operating profit (adjusted for taxes on a cash basis).

The formula for EVA is:

(Net investment) x (Actual return on investment – Percentage cost of capital)

So, imagine a company has:

- Net Investment: $2,000,000.

- Actual Return on Investment: 16%.

- Cost of Capital: 12%.

The calculation would be as follows:

($2,000,000 net investment) x (16% actual return on investment minus 12% cost of capital)

- which equals $2,000,000 net investment x 4%.

Therefore Economic Value Added is $80,000. It is generating a healthy economic value on the money invested in it. It more than covered its cost of capital.

Stern Steward & Co., based in Munich, Germany, is credited with devising economic value added (a trademarked concept).

Why does EVA matter?

EVA is an important measure because it shows us how profitable a company or its projects are, and tells us how successful its management is.

This measure tells us not only whether a business is profitable, but also whether it creates wealth for the investors.

EVA reveals how much and from where a business created wealth. It forces managers to think about assets when making their decisions, and not just expenses.

The term ‘value added’ has several possible meanings, which are used in agriculture, schools and education, accounting, and marketing.