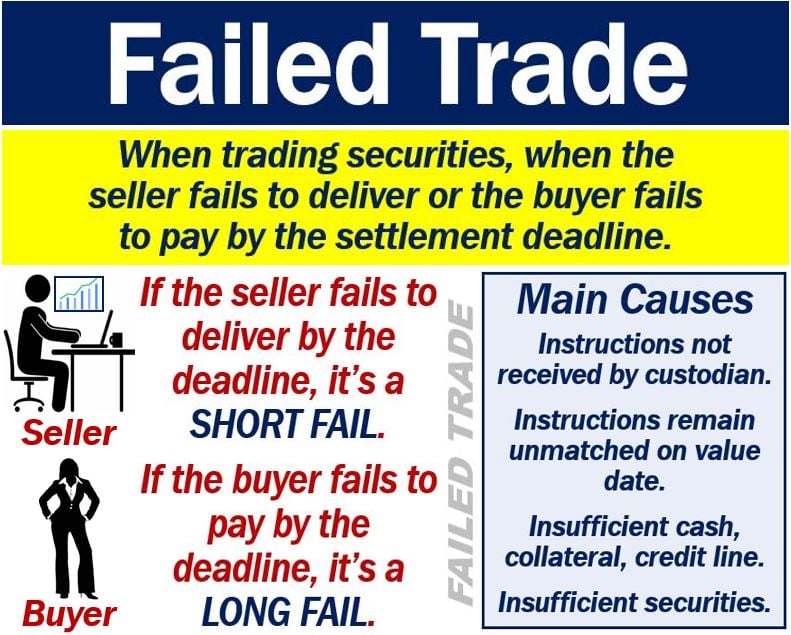

A failed trade occurs when the seller fails to deliver a security or the buyer fails to pay. We also call them unsettled trades. In both cases, the parties fail to fulfill their obligations by the settlement date. Put simply; it is a transaction that does not settle by the settlement deadline.

According to many dictionaries, a failed trade happens when the parties do not agree on the quality of the items that they have delivered.

Securities

We use the term when people are trading securities. Securities are financial instruments, i.e., contracts that we give a value to and then trade.

Bonds, mortgage-backed securities, and shares, for example, are securities. We divide securities into equities, debt equities, and derivative contracts.

PwC UK has the following definition of a failed trade:

“A failed/unsettled trade is a trade that fails to settle on the previously agreed settlement date.”

“Failure to settle principally arises if one counterparty is unable to deliver all or part of the security, or if the other counterparty fails to provide sufficient funds to meet the settlement consideration.”

When talking how common failed trades are, people may use the term ‘trade fail rate.’ See the caption below the image on this page.

A failed trade is not an unusual occurrence. According to SS&C: “Some estimates suggest more than a quarter of Wall Street institutions have a trade fail rate over 20%.”

Failed trade types

There are two types of unsettled trades. One is when the seller does not deliver, what he or she should, by a specific date. Another is when the buyer does not pay by a specific date. We call that date the settlement date or settlement deadline.

Short fail

When the seller fails to deliver the securities by the settlement deadline, we call it a short fail.

Long fail

When the purchaser fails to pay the money by the settlement deadline, we call it a long fail.

Settlement terms vary

How long buyers and sellers have to settle after the date of a trade depends on the security.

If they are trading stocks (shares), for example, they have three days. In other words, the parties must deliver the shares and money to the clearinghouse for settlement within three days.

Stocks, futures contracts, options, and fixed-income securities, for example, have different settlement requirements.

Fail in banking

A fail in banking occurs when one bank cannot pay its debt to another financial institution.

A banking fail can trigger a domino effect, i.e., it can cause several banks to become insolvent.

Failed trade vs. failover

Do not confuse the term with ‘failover.’ A failover is a mechanism that allows something to continue working properly even when there is a problem. The system automatically and seamlessly switches over to a backup.

For example, a website with a failover mechanism switches over to the backup server if the main server goes down.

Therefore, the website’s risk of downtime, i.e., not being online, is reduced significantly. ‘Online,’ in this context, means connected to the Internet.