What is a financial analysis? Definition and examples

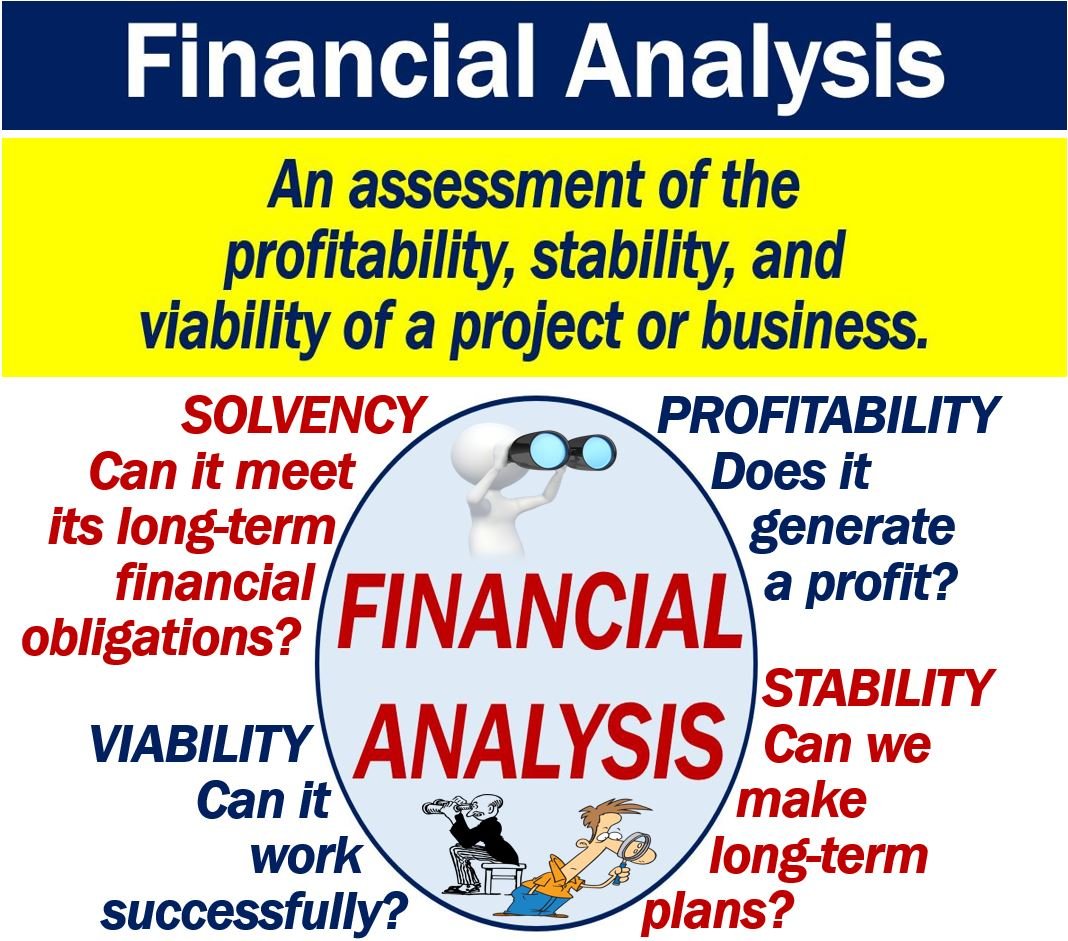

A Financial Analysis is an assessment of how viable, stable, solvent, and profitable a business or project is. The term may refer to an assessment of how effectively funds have been invested. By funds, in this context, we mean investments and debt. A financial analysis may also be an assessment of the value and safety of debtors’ claims against the company’s assets.

Additionally, such analysis can include evaluating market trends, industry benchmarks, and the regulatory environment to provide a comprehensive view of the company’s competitive position

Put simply; we undertake a financial analysis to determine whether a project, for example, is a good investment. Will the project be stable, solvent, liquid, or profitable enough to merit the investment?

When people carry out a financial analysis of a company, they examine the income statement and balance sheet. They also focus on the cash flow statement.

YourDictionary.com has the following definition of the term:

“A financial analysis looks at many aspects of a business from its profitability and stability to its solvency and liquidity.”

We also call it a financial statement analysis, analysis of finance, or accounting analysis.

Financial analysis – four elements

In a typical analysis, we usually review the profitability, solvency, liquidity, and stability of a project or business.

-

Profitability

Let’s suppose we are analyzing a project. We must first determine whether it will be profitable.

In other words, will it make money, i.e., a profit. Will the financial reward be worth the risk?

-

Solvency

If we are analyzing a company, we need to determine whether its debts are too high.

A company’s solvency is its ability to meet long-term financial obligations.

To determine solvency, we divide total assets by total liabilities. A total of one or more means the company is solvent.

If the total is less than one, the company is insolvent. In other words, the company is unlikely to be able to meet its long-term financial obligations.

Beyond this ratio, analysts often consider the quality and liquidity of these assets to assess if they can be quickly converted into cash without significant loss in value.

-

Liquidity

Liquidity refers to how much cash a company has or how quickly it could access cash.

A company’s liquidity tells us how easily a company can pay its bills. The most liquid of all assets is cash.

A business must be able to do two things at the same time: 1. Maintain a positive cash flow. 2. Pay for the things it needs immediately.

-

Stability

When making plans, business people hate instability more than anything else. Being able to make medium-term and long-term plans is important.

This is not possible if a business is unstable. Stability is not only important at company level, but also at national level.

Financial analysis helps us make decisions

After carrying out a financial analysis, senior management and investors can better determine whether to:

- Shut down part of a company or keep it going. It might also help people decide whether to sell it.

- Go ahead with a project. The analysis could also help decide whether to change some aspects of a proposed project.

- Get a bank loan or issue shares to increase the company’s working capital.

- Lend capital or invest in a company or project. In other words, become either a creditor or partner.

- Buy or rent/lease production machinery.

Compound phrases with ‘financial analysis’

A compound phrase is a term that consists of two or more words. ‘Compound analysis is a compound phrase. Here are some compound phrases with the term ‘compound analysis’ in them:

-

Financial analysis software

Tools used for analyzing financial data.

For example: “The company invested in advanced financial analysis software to streamline its quarterly reporting process.”

-

Financial analysis report

A document summarizing the financial health of a company.

For example: “After reviewing the financial analysis report, the investors felt more confident in their decision to fund the startup.”

-

Financial analysis techniques

Methods used to evaluate businesses, projects, budgets, and other finance-related transactions.

For example: “The CFO employed various financial analysis techniques to determine the viability of the new project.”

-

Financial analysis manager

A professional responsible for overseeing financial analysis processes.

For example: “The financial analysis manager presented a breakdown of the cost savings initiative during the annual general meeting.”

-

Financial analysis metrics

Quantitative measures used to assess the financial performance of a business.

For example: “Our financial analysis metrics indicate a strong return on equity compared to industry standards.”

Video – What is a Financial Analysis?

This video presentation, from our YouTube partner channel – Marketing Business Network, explains what ‘Financial Analysis’ means using simple and easy-to-understand language and examples.