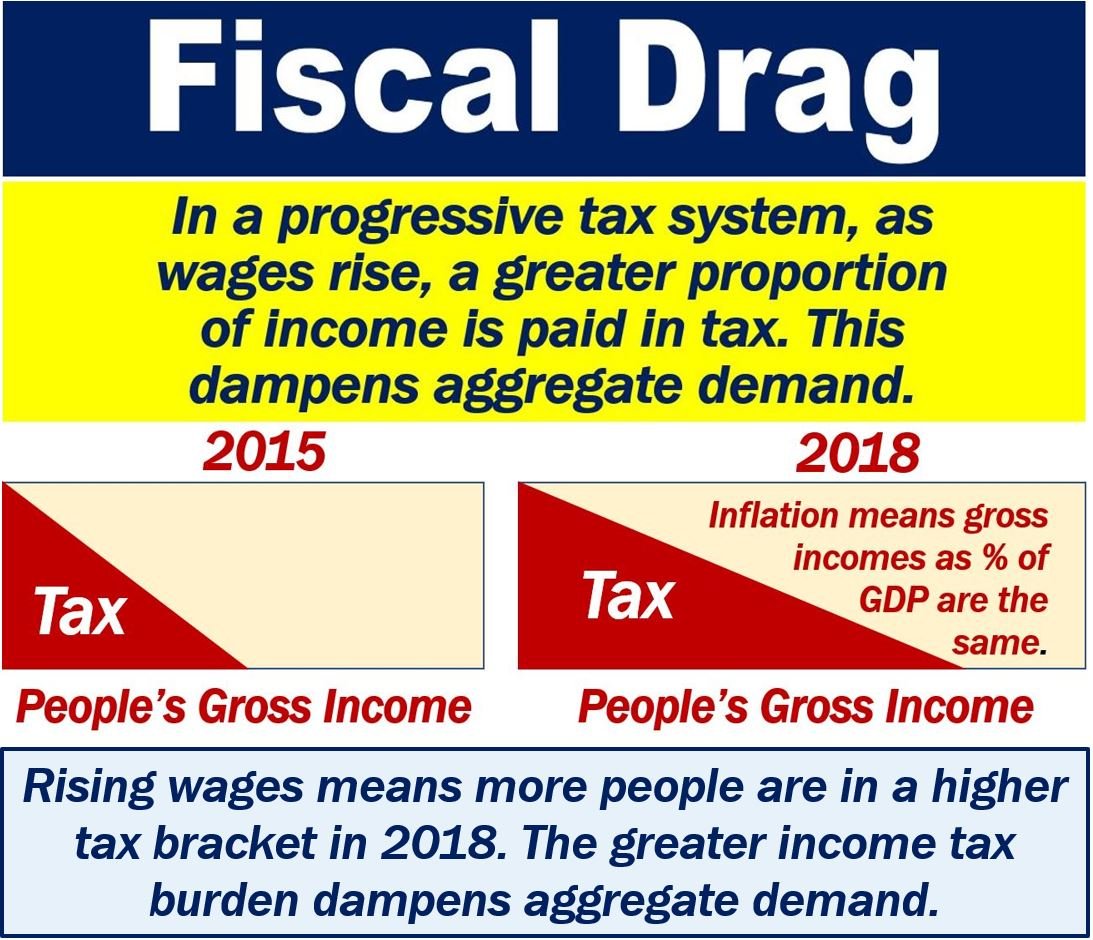

Fiscal Drag occurs when earnings growth and inflation push more earners into higher tax brackets. Consequently, the government’s tax revenue rises without any increases in tax rates. If earners pay a higher percentage of income in tax, their spending declines.

Fiscal drag refers to the automatic brakes that a progressive tax system applies to aggregate demand. Fiscal drag slows down or tames a rapidly-expanding economy.

Progressive tax is a system that taxes higher earners more than lower earners. In other words, higher earners pay a greater percentage of their income in tax than lower earners.

Higher tax brackets

When inflation is relatively high, people’s incomes also rise. Their incomes increase to keep up with rising prices. As people’s incomes increase, many earners enter higher income tax brackets.

The greater tax burden on incomes dampens spending, i.e., it undermines demand. This is a drag on the economy caused by taxation, i.e., it is a fiscal drag.

The adjective ‘fiscal’ means ‘related to government revenue, spending, and debt.’ Taxation is one type of government revenue. Therefore, fiscal drag means something from the government’s finances that acts as a brake on the economy. In this case, it is income tax.

Investor Words says the following about the term:

“The dampening effect on aggregate demand that occurs when an expanding economy creates additional tax revenues, especially under a progressive income tax. Thus an example of an automatic stabilizer.”

Fiscal drag prevents overheating

As people climb to higher tax brackets, their tax bills rise. Not only the total amount but also as a proportion of their total income.

This subsequently dampens spending, or aggregate demand for goods and services, i.e., fiscal drag results.

An economic stabilizer

However, fiscal drag is not necessarily a bad thing. If it stops demand from causing the economy to overheat, it’s a good thing, i.e., it’s an economic stabilizer.

Fiscal drag either limits or reduces aggregate demand. Thus, it becomes a deflationary fiscal policy.

Fiscal policy refers to the government’s policy regarding taxation, spending, and debt.

Fiscal drag – example

Let’s imagine that Jane earned $40,000 per year two years ago. In her country, the first $10,000 is tax free. From $10,000 to $40,000, she pays $25% tax. Therefore, Jane’s tax bill was $7,500.

Jane paid 18.75% of her annual income tax two years ago – $7,500 is 18.75% of $40,000.

Now, Jane’s salary is $50,000 per year. In her country, earners must pay 40% on those additional $10,000.

Therefore, Jane’s annual tax bill is now $11,500. Her tax bill today represents 23% of her annual income.

Prices have been rising at about the same rate as Jane’s income. Therefore, she will have to use a greater percentage of her income to pay for basic things. Subsequently, she will have less spare cash to spend on other things.

In Jane’s case, tax has dampened her spending. If this has happened across the country with millions of people, the result is a fiscal drag. In other words, there is weaker demand, i.e., a drag, due to a fiscal factor, i.e., government taxation.

The subtle impact of fiscal drag may also influence long-term investment decisions, potentially leading to a more cautious economic climate.