Forecasting is determining what is going to happen in the future by analyzing what happened in the past and what is going on now. It is a planning tool that helps business people in their attempts to cope with the uncertainty of what might and might not occur. Forecasting relies on past and current data and analysis of trends.

Company management, government departments, economists, and investors utilize forecasting to decide how to allocate their resources and prepare reports. They also use it to plan for anticipated expenses.

As far as companies are concerned, this is mainly based on predicted demand for its goods or services.

Economists, for example, might estimate some variable of interest rates at a specific date in the future. Forecasting is similar to prediction, which is a more general term.

It is similar to, but not the same as futurology, which is more systemic or holistic.

The Economist made the following comment regarding forecasting: “Best guesses about the future. Despite complex economic theories and cutting-edge econometrics, the forecasts economists make are often badly wrong. Indeed, following economic forecasts has been likened to driving a car blindfolded, following directions given by a person who is looking out of the back window.”

Forecasting the weather

We also use forecasting in predicting the weather. In hydrology, for example, it involves determining at what levels rainfall will be at specific future dates.

There is one thing all forecasters have in common – they all agree that the future is unpredictable.

Any forecast they make always comes with a clear warning that what they are providing are only calculated guesses and that things may turn out quite differently.

Forecasting – calculated guesses

Despite the complex theories and state-of-the-art econometrics that forecasters use today, their predictions are often completely wrong.

In fact, following economic forecasts is similar to driving a car with your eyes closed, following the directions of a passenger who is looking out of the back window.

Regarding attempting to make predictions, movie mogul Sam Goldwyn once said: “Never prophesy, especially about the future.”

Budgeting vs. forecasting

Forecasting and budgeting are commonly linked together, but they are not the same.

Budgeting

A budget is a detailed financial outline of what the company thinks is going to happen over a future period – usually the next twelve months.

It includes details on the business’ expenses, revenues, cash flow, and financial position.

This information is included in a company’s financial reports. Depending on the size of the business, there may be a budgeting process – usually performed later in the year.

The majority of budgets are static. The directors set them for the firm’s financial year. Some commercial enterprises use a continuous budget, which people adjust during the year as business conditions change.

Forecasting

Forecasting is a projection of what is going to happen at a much higher level and includes revenue items, overall expenses, and other business components. Forecasts may be short- or long-term.

People generally make short-term forecasts for operational reasons. However, long-term ones, which project over a number of years, provide data for a longer-term business plan.

Put simply; budgeting includes a plan for where a company wants to go, while forecasting gives us an indication where it is actually heading.

A budget estimates how much revenue and expenses a business may incur over a future period. Forecasting, on the other hand, estimates the business’ financial outcomes by gathering and analyzing historical data.

Forecasting – advantages

Helps Predict the Future

It helps give management a general idea of what to expect. This provides the company with a sense of direction which will allow it to function better in the marketplace.

Good for Customers

If a company can predict demand, it is more likely always to make sure its products are available. There is a greater chance of meeting orders and delivering on time.

Keeps a Company Up-to-date

Businesses that forecast regularly must think ahead all the time. This helps them anticipate changing market trends.

Keeping up with the times makes us better able to compete with our rivals.

Learn from Past Experience

Gathering and analyzing past data helps people remember what worked and what didn’t.

Learning from experience makes us stronger. It also increases our chances of making a profit.

Stay on Top of Costs

If you can predict future demand, you will know what production levels to plan for in future. You can use this information to determine whether you will need more or fewer workers more accurately.

Receiving Financing

If a company needs a loan for a project, the lender will need information about the future, such as sales, profits, etc. The lender needs that data before it will consider approving the loan.

Forecasting methods

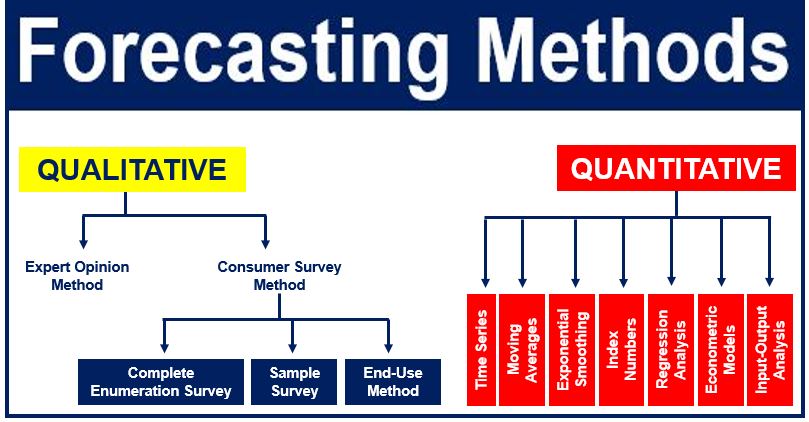

Qualitative Methods

These are subjective and are based on the judgment and opinion of experts or consumers. We use them no past data is available.

People use qualitative methods for making medium-to-long-range decisions. Market research is a type of qualitative forecasting method.

Quantitative Methods

With quantitative methods, we forecast future data as a function of past data. These methods are appropriate when we have past numerical data.

They are also appropriate when we can reasonably assume that some of the data patterns are likely to continue in the future.

We generally use quantitative methods for making short-term and medium-term decisions.

Average Method

Forecasts of all future values equal the mean of the historical data. This method is appropriate for any type of data where past data is available.

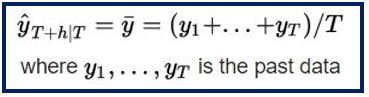

If we denote historical data as yT, then we can write the forecasts as:

Naïve approach

The Naïve approach is the most cost-effective prediction model. It provides a benchmark against which we can compare other models.

This approach is only appropriate for time-series data. With the naïve approach, the forecasts are equal to the last observed value.

Drift Approach

The drift approach is a variation on the naïve approach. It allows forecasts to increase or decrease over time, where the drift (amount of change over time) is set to be the average seen in the historical data.

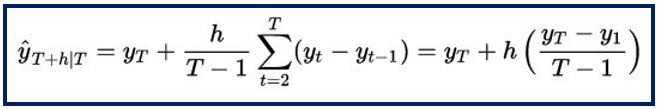

Hence, the forecast for T + h is given by:

– Seasonal Naïve Method

The seasonal naïve method accounts for seasonality. It sets each forecast to be equal to the last observed value in that season.

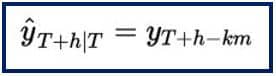

For example, the prediction value for all future months of May will be equal to all previous May values. The forecast for T + h is:

The seasonal naïve approach is especially useful for data that has a particularly high level of seasonality.

Advanced algorithms and machine learning models are increasingly being utilized to enhance the accuracy of forecasting in various industries.

The incorporation of big data analytics into forecasting models is transforming how businesses predict consumer behavior and market trends.

Video – What is Forecasting?

This interesting video, from our sister channel on YouTube – Marketing Business Network, explains what a ‘Forecasting’ is using simple and easy-to-understand language and examples.