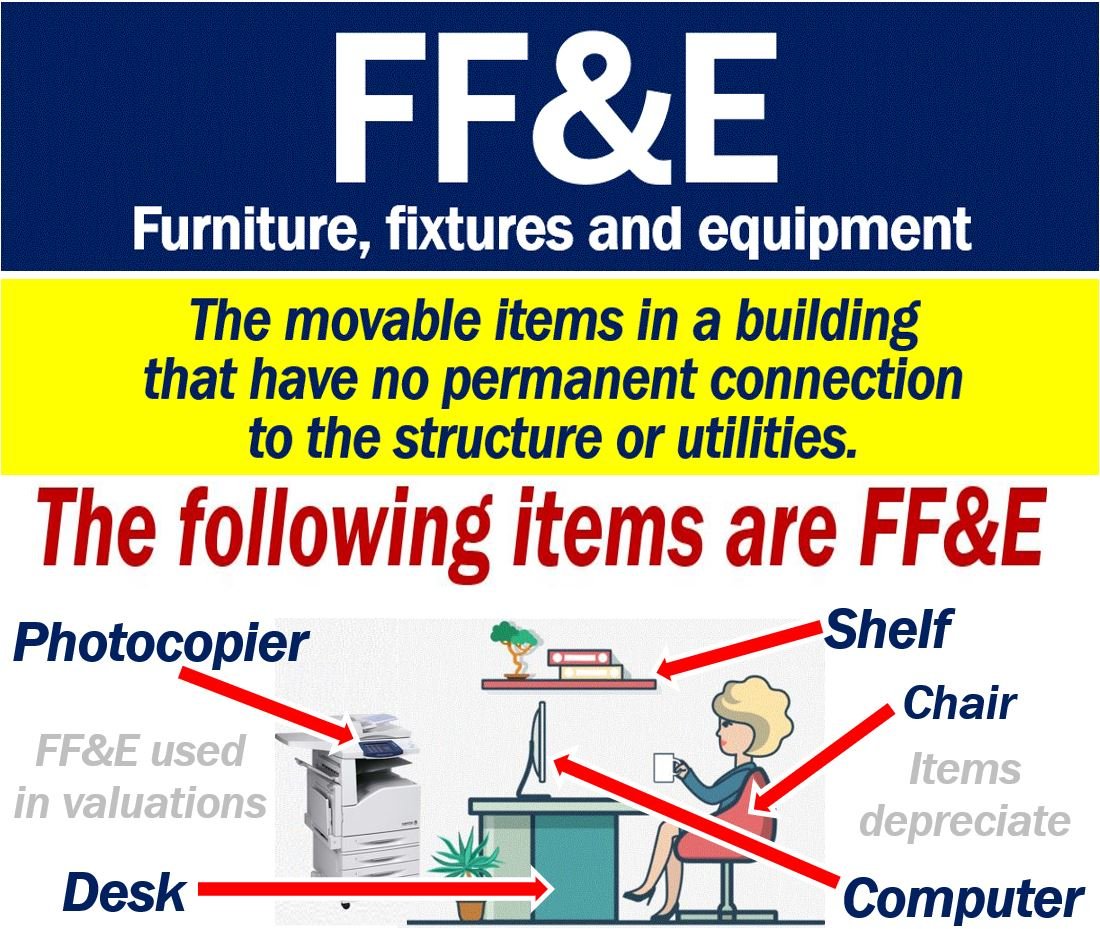

The term Furniture, Fixtures, and Equipment or FF&E describes the movable items in a structure that have no permanent connections to a building. They do not have permanent connections to utilities either. FF&E is not normally part of the contract between the building contractor and its owner.

Sometimes we use the terms FFE or FF&A. FF&A stands for furniture, fixtures, and accessories.

In the majority of building contracts, the general contractor does not have to provide any FF&E. Typically, the owner of the building or an interior designer provides the FF&E package.

Construction design drawings or blueprints rarely include FF&E. When they do include them, they are only there to depict scale and size.

These items typically have a useful life of three years or more and depreciate over time.

When valuing a company, we must take into account FF&E costs to calculate long-term depreciation. Depreciation refers to the decline in the value of assets over time.

FF&E – an accounting term

It is an accounting term that we use when selling, liquidating, or valuing a building or a business.

In accounting, we compile all the FF&E in a separate line item in a financial statement or budget under tangible assets.

Tangible items are things we can touch because they have physical form. Therefore, tangible assets are assets that we can touch, unlike intangible assets.

Furniture, fixtures, and equipment go into a project’s final cost.

Auditors can then determine whether a purchase comes under or over budget.

In most cases, these items have a lifespan of at least three years.

Determining depreciation

There are different ways accountants can determine depreciation of furniture, fixtures, and equipment. They must first estimate what the item’s useful lifespan is.

For example, a conference table may have a 20-year lifespan, while a computer’s life probably ends within three to four years.

FF&E – vital items

Furniture, fixtures, and equipment are vital to a business’ operations. For example, desks and chairs are crucial for a law or accounting practice to function or operate successfully.

A hospital would come to a standstill if it had no beds, chairs, computers, or medical devices.

If a company uses an item for its normal, everyday operation, we place it in the FF&E category.

The efficient management of FF&E can contribute to an organization’s environmental sustainability goals by reducing waste through reuse and recycling of assets.

Interior design

In interior design, a ‘furniture, fixtures, and equipment remodel’ of a house means working on the movable items of the house.

In interior design, ‘furniture, fixtures, and equipment’ does not usually include ‘finishes.’ Paint, wallpaper, tiles, for example, are ‘finishes.’

However, interior designers sometimes include finishes on residential (small) projects.

When interior designers include finishes, they usually use the term FFF&E. FFF&E stands for furniture, fixtures, finishes, and equipment.

FF&E usage

Here are some sentences containing “FF&E,” which will hopefully help you see how we use the term in context.

- “The new corporate office’s budget includes a significant allocation for FF&E to ensure a comfortable and practical work environment for staff.”

- “During the relocation, we must inventory all FF&E to account for each item before and after the move.”

- “The renovation proposal from the interior designer outlines an extensive list of FF&E that will modernize the lobby and conference rooms.”

- “After the flood damage, the insurance adjuster assessed the building and will provide coverage details for the FF&E losses.”

- “Our FF&E expenditure this quarter has been higher than usual due to the purchase of ergonomic chairs and standing desks.”

- “When drafting the financial statement, the accountant separated the FF&E from the leasehold improvements for clarity on depreciation schedules.”