Gazelle company – definition and meaning

A Gazelle Company or simply a Gazelle is a young, very fast-growing company. This type of company maintains consistent and rapid expansion of both employment and turnover (sales). Additionally, the company maintains a high rate of expansion for at least four consecutive years. Although 20% growth annually is the common definition, there is no single description of a gazelle company’s growth rate.

Typical gazelle companies are publicly traded firms. In other words, we can buy and sell their shares in a stock market.

They have experienced sustained growth annually for the past four years. They also registered sales of $1 million or more in the first of those four years.

Gazelles not common

Gazelle companies are not very common in most economies. They usually represent from five percent to ten percent of all new entrants.

However, investors, economists, and even politicians are aware of them because some are likely to become major employers. Some of them will also become important future creators of wealth.

Despite their relative rarity, gazelle companies play a crucial role in job creation and innovation, often driving industry trends and consumer behaviors.

The Law Dictionary says that a gazelle company is “a company with sales revenue growth of 20 percent or higher annually. Usually known for many new job opportunities.”

MIT researcher and inventor of business demography, David Birch, first used the term gazelle in the 1980s. He used it to refer to young, rapidly growing companies.

Gazelle company – examples

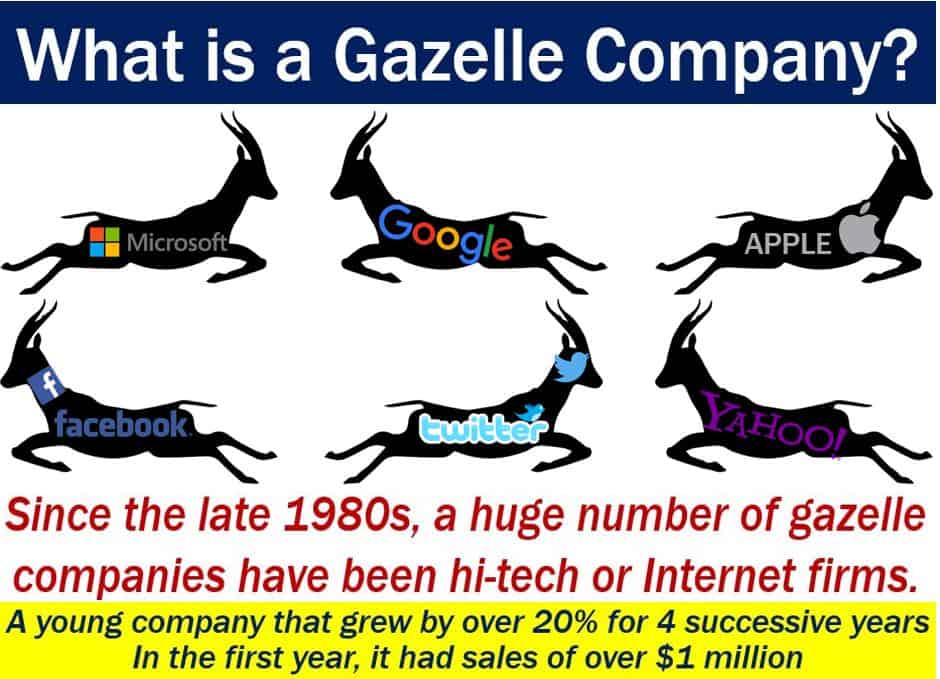

Many gazelle companies over the past three decades have been either hi-tech or Internet businesses. For example, Apple, Dell, Yahoo, Cisco, Microsoft, Amazon, and Google were gazelle companies during their initial years.

Facebook was a gazelle company, and so was Twitter. The two social networking sites grewn their user bases amazingly fast. However, it took them longer to leverage their user-base growth into spectacular sales and profit growth.

Think-tank Foundation iFRAP defines gazelles as firms whose starting capital was at least €100,000 ($118,000).

According to iFRAP, the average French gazelle company started off with €800,000 ($943,000) of equity capital and 13 workers. The average British gazelle company, on the other hand, began with €1.6 million ($1.88 million) and 26 workers.

Gazelle vs. unicorn

Both gazelles and unicorn companies (unicorns) are successful young businesses, yet they differ in definition and market status.

-

Unicorn company

Also known as a “Unicorn Startup” or simply “Unicorn,” this term refers to a startup that is now worth more than $1 billion.

The company is a private business, i.e., it is not listed or quoted on the stock market. If you want to buy shares in a unicorn, you must negotiate directly with the owners or shareholders.

Gazelle company

A gazelle is a young company experiencing rapid growth over a period of at least four consecutive years.

Gazelles can be either publicly traded on the stock market or privately held, with their rapid growth being the defining characteristic

Video – What is a Gazelle Company

This educational video, from Marketing Business Network, our sister channel on YouTube, explains what a ‘Gazelle Company’ is using easy-to-understand language and examples.