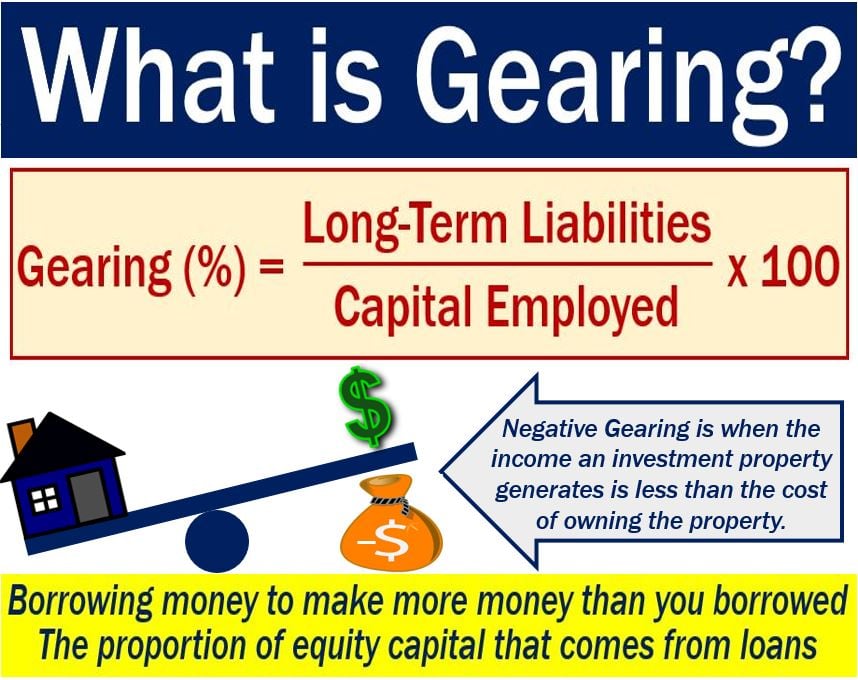

In business, gearing means using debt to fund a company. For gearing to be successful, the fixed interest on the loan must be less than the business it generates for you. Gearing, therefore, means taking a fixed interest loan which you use to produce more income than the interest on that loan.

It is similar to leverage. In fact, North Americans tend to use the term ‘leverage’ while people in Britain, Ireland, and Australasia use ‘gearing.’

The term also refers to the amount of debt a business has as a proportion of its equity capital. Therefore, a highly geared company has a high debt/equity ratio. That company is highly leveraged.

It represents the proportion of funding from loans versus the funding by stockholders. For example, a 70% gearing means that debts represent 70% of a company’s equity capital.

To reduce the proportion that comes from loans, a company may sell shares to pay down debts. It can also convert debts into shares or reduce working capital.

Gearing in mechanical engineering

In mechanical engineering, the term refers to the arrangement or set of gears in a machine. It may also refer to the technique or act of providing gears for transmitting motion.

This article focuses on the business meaning of the term.

Gearing and balance sheets

When investors are researching companies, they often come across ‘gearing’ in their balance sheets.

Every serious investor must understand what it means and what risks it represents.

As mentioned above, it is the process in which companies borrow money to purchase assets. Investment trusts, for example, purchase the assets because they want to boost their income. They also want to boost the returns for investors. They use this money to make additional investments.

The company hopes that the additional investment subsequently makes enough money to pay off the loan. It also hopes to make a healthy profit on top.

However, leveraging is not risk-free. It magnifies a business’ performance. In other words, it makes companies do bad things in a big way and good things in a big way.

The more geared a business is, the greater the risk.