Gift – definition and meaning

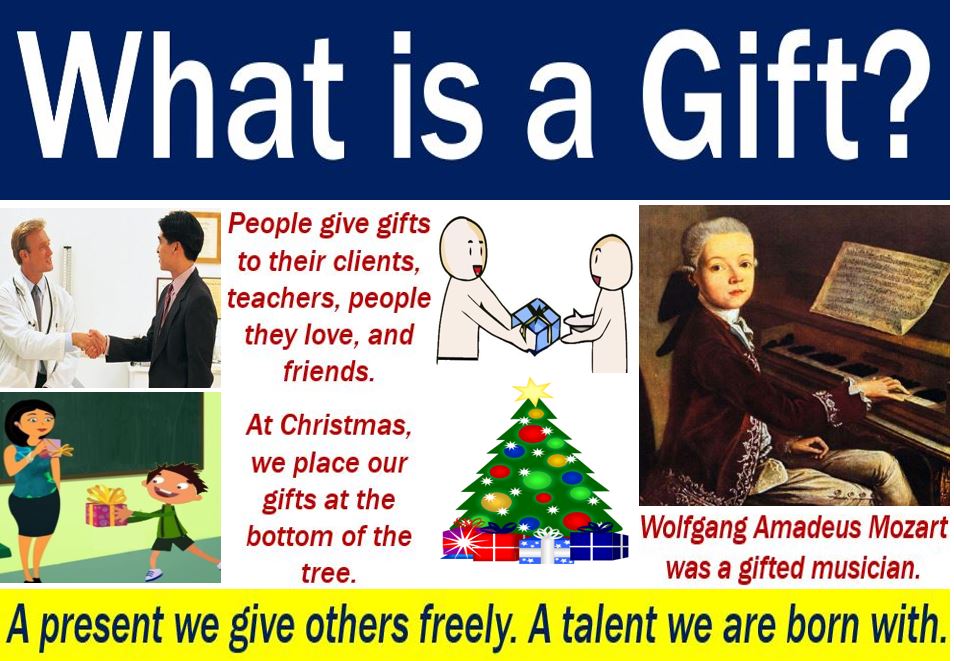

A gift is something that we give away freely, without receiving anything in return. In other words, it is a present. The word originates from the Old Norse word was gipt around 1125-1175 AD.

The word may also refer to a talent we were born with. For example, some people have a gift for music or numbers. In other words, some of us are naturally musical or good at math (UK/Ireland: maths).

When referring to a talent, we often use the adjective ‘gifted.’ For example, Mozart, Beethoven, and Tchaikovsky were gifted musicians.

Gifts may also be intangible things. If something is intangible it means that we cannot touch it, i.e., it is an abstract thing. For example, vacations and trips are intangible.

People commonly give presents on the following occasions:

- Birthdays

- Weddings

- Wedding anniversaries

- Birth or baby showers

- Graduations

- Father’s/Mother’s Days

- Retirement

- To congratulate people

- Engagements

- Housewarming parties

- Christmas

- When we apologize to people

People may give a present to honor an event, to show preference, or to provide monetary aid. Gifts of money or property may be taxable. How taxable they are depends on the local laws.

In business, gifts may be valuable items that company representatives give clients. American pharmaceutical sales representatives commonly give healthcare professionals presents.

In the United Kingdom pharma reps also give presents to doctors and other healthcare professionals. However, in the UK and the rest of the EU, there are strict limits.

For example, in the UK, a pharma rep cannot give away more than £75 per head per year.

In fact, in Britain’s National Health Service (NHS), doctors and managers must record any ‘wining and dining’ worth over £25 ($33.50). No NHS employee is allowed to receive a gift worth more than £50 ($67).

Gift policy in the US Government

In the United States, government employees and civil servants have to follow strict rules regarding receiving presents.

The US Department of the Interior defines gifts as follows:

“Under the ethics regulation, a gift is anything that has monetary value which you obtain for less than ‘market value.'”

“The gift might be tangible or intangible. A gift may include but is not limited to a gratuity, favor, discount, cash, gift certificate, gift card, entertainment, hospitality, loan, forbearance, or other item having monetary value. It also applies to services, training, transportation, travel, lodging, and meals.”

Forbearance occurs when a lender gives the borrower more time to catch up with his/her repayments.

There are some situations in which the US Government allows civil servants to accept things. It allows it because it does not see them as direct presents.

For example, let’s suppose you work for the Bureau of Land Management and you attend a hi-tech conference hosted by XYZ Inc. The conference is free to attend and open to anybody including the general public.

Your supervisor gives you permission to attend. You then participate in a raffle. This raffle, which costs nothing to participate, is also open to anybody.

You win the raffle; the prize is a laptop computer. You may accept and keep the prize because you did not win it with any special advantage. XYZ Inc. did not give the laptop to you as a direct gift.

An employee’s salary is not a gift. It is not a gift because they worked for it, i.e., it is not a present.