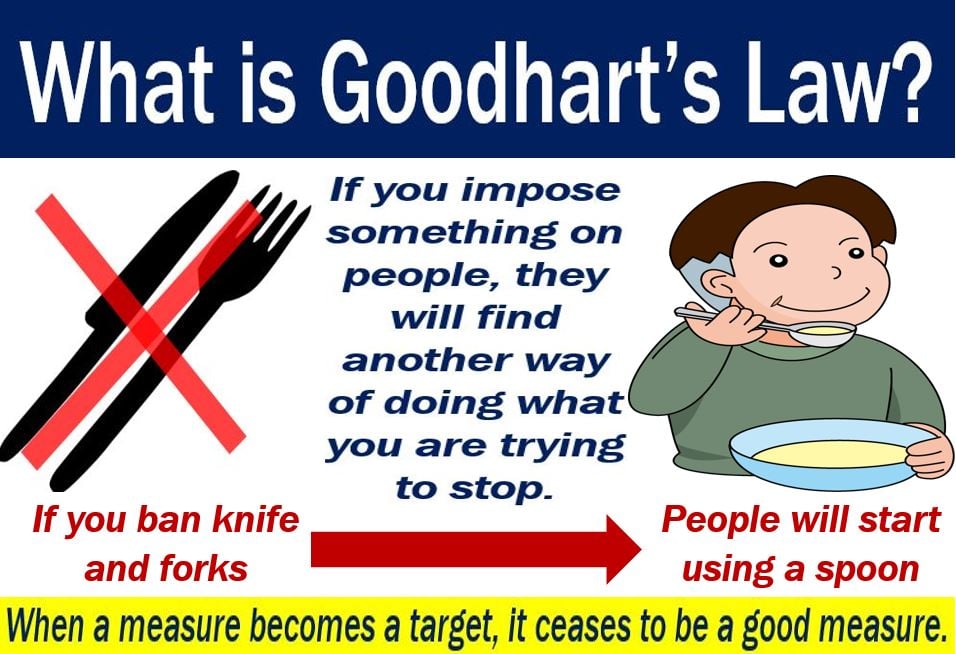

Goodhart’s law says that when a measure becomes a target, it is subsequently no longer a good measure. For example, if people anticipate the effect of a policy, and their actions alter the policy’s outcome, the target was a bad measure. In other words, as soon as you announce a new policy with new regulations, people will find ways around it.

Charles Goodhart, a British economist, first advanced the idea in a 1975 paper. Hence the law’s name. He was a member of the Bank of England’s Monetary Policy Committee for three years.

Critics of Britain’s former Prime Minister Margaret Thatcher’s monetary policy frequently used Goodhart’s arguments. Goodhart was a professor at the London School of Economics from 1985 to 2002 (Emeritus since 2002).

Thatcher based her monetary policy on targets for broad and narrow money.

In an article titled ‘Problems of Monetary Management: The UK Experience,’ Goodhart wrote:

“Any observed statistical regularity will tend to collapse once pressure is placed upon it for control purposes.”

Goodhart’s law – then and now

Goodhart’s law was initially applied to the stability of economic spending. However, now it also points out the problem of assigning a value to one specific variable. Especially if you use that variable as an indicator.

When a measure’s value becomes the target, you can no longer use that value as a measure.

Let’s suppose a central bank tries to regulate the level of lending by commercial banks. It does this by imposing controls over certain types of lending.

However, the commercial banks find ways of circumventing the controls. In other words, they find alternative methods of lending. Specifically, methods that are not subject to the central bank’s new regulations.

Goodhart’s law and rational expectations theory

Goodhart’s law is implicit in the economic theory of **rational expectations. It originated in the context of market responses. However, the law also has implications for the selection of high-level targets in companies and other organizations.

** Rational Expectations theory is a behavioral economics theory. It states that, on average, most of us can predict future conditions fairly accurately. Our predictions are accurate because we analyze all available data. We subsequently take measures accordingly.

Jon Danielsson, who teaches economics at the London School of Economics, once said regarding Goodhart’s law:

“A risk model breaks down when used for regulatory purposes.”

Danielsson was referring to Goodhart’s statement “Any statistical relationship will break down when used for policy purposes.”