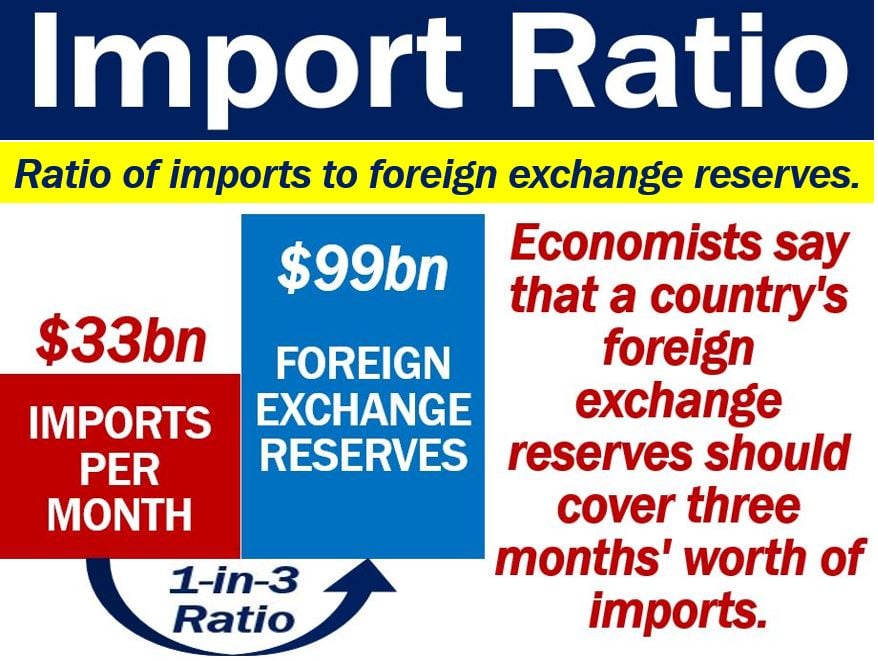

Import ratio refers to the ratio of a country’s total imports to its total foreign exchange reserves. In other words, what is the ratio between goods entering from abroad and the central bank’s foreign currency reserves? The import ratio may also refer to the ratio between total imports and a country’s GDP.

GDP stands for Gross Domestic Product, i.e., all the goods and services that a country produces.

Foreign exchange reserves are assets that a central bank holds in foreign currencies. For example, the Banco de Mexico, Mexico’s central bank, holds dollars, euros, and pounds. They form part of its foreign exchange reserves.

A country’s import ratio contrasts with its reserves-to-imports ratio. The reserves-to-imports ratio is the same thing but the other way round, i.e., the ratio of foreign reserves to total imports.

Foreign reserves refers to foreign currency, such as dollars and euros, that a central banks holds.

This term looks at how much a country is spending on imports (goods it buys from other countries) compared to either how much foreign currency it has saved up or its overall economic output—also known as GDP.

In simple terms, it’s a way to measure how much a country relies on buying things from other countries and whether it has the financial strength to keep doing so.

While countries such as China have an import Ratio of about 1-in-25, the USA foreign exchange reserves can barely cover one months’ worth of imports. However, the US can pay for things using its domestic currency. Everybody accepts US dollars.

Import ratio – sovereign risk

When arranging international credit for countries, the lenders need to determine that country’s credit rating. In other words, measure what type of credit risk that country is. We call that ‘sovereign risk.’

Emerging economies usually have to pay for their imports using hard currencies such as dollars or euros. They also have to make loan repayments in hard currencies.

Therefore, they need large amounts of foreign exchange reserves.

The more an emerging economy imports, the faster its foreign exchange reserves decline.

A country’s import ratio gives us an idea of how high or low its foreign exchange reserves are likely to be.

When foreign exchange reserves are low, the greater the probability of debt rescheduling. This is because paying for imports is a higher priority than repaying foreign creditors.

In other words, if a country only has enough to pay for imports, it will fail that month’s debt repayment.