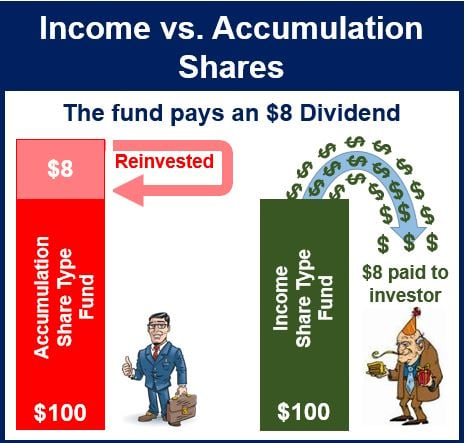

An income share is a type of share offered by a dual purpose fund (income or capital appreciation) that appreciates very little but gives the shareholder all the fund’s net income in cash.

Income shares are sought by investors who want a steady income stream rather than capital appreciation (increased share value).

The opposite of income shares are accumulation shares, which provide little income but are likely to appreciate.

Retired individuals, who want the money now, generally prefer income shares, while those of working age, who are looking for long-term investments, should opt for accumulation shares.

Retired individuals, who want the money now, generally prefer income shares, while those of working age, who are looking for long-term investments, should opt for accumulation shares.

Income versus accumulation shares

Experts advise most people to invest in accumulation shares. They say the reinvestment of the dividends provides a large portion of the investor’s total return (dividend or interest payments plus the rise in the value of the asset).

The Morning Star quotes Mark Preskett, investment consultant for Morningstar Investment Management Europe, who said:

“You should choose the income share class if you are going to be relying on the fund’s income for your living expenses. But that should typically only happen in retirement.”

Financial experts generally advise investors to go for accumulation share classes throughout their working years, and then transition into income share classes when they retire.

Even though it is great to see money entering your account regularly, it does not justify the differences in returns over the long term.

People wanting to switch to income shares from accumulation shares within the same fund may incur charges. This will depend on the rules stipulated by the fund provider and the platform on which the funds are traded.

Many life insurance companies offer investors the option to switch free of charge.

Focus on charges

When deciding what type of shares to buy, Kyle Caldwell writes in The Telegraph that investors should focus first on the lowest annual charges and ignore whether they are income or accumulation share class funds.

The shares classes that charge the most are the old ones that used to include a commission payment to the fund broker. Fund shops or brokers are no longer allowed to receive commission.

Mr. Caldwell writes:

“Instead investors should now only buy “clean” funds, which are commission-free (fund shops now make their money by charging you directly).”

According to Cambridge Dictionaries Online, an income share is:

“A share in a company that pays dividends (= part of the profit of a company that is paid to shareholders) rather than increasing in value.”