What is total return? Definition and meaning

Total Return is the total income earned, i.e., dividends plus capital gains, from an investment over a given period. In most cases, that period is one year.

Recognizing the importance of both the income generated and the appreciation of the asset’s value, total return provides a comprehensive view of investment performance beyond mere price fluctuations.

Expressed as a percentage

Total return is typically expressed as a percentage of the amount that was invested. It is the sum of all the different benefits resulting from investing in an asset, including any change in that asset’s market value – capital gains – as well as income paid to the investor.

With the equation below, you can work out the percentage of the invested amount:

Capital gains ÷ Initial Investment x 100 = Total Return

The income usually consists of dividends, interest, and securities lending fees. The term contrasts with price return, which only takes into account an investment’s capital gain.

Nasdaq.com has the following definitions of total return:

“1. In performance measurement, the actual rate of return realized over some evaluation period. 2. In fixed income analysis, the potential return that considers all three sources of return (coupon interest, interest on coupon interest, and any capital gain/loss) over some investment horizon.”

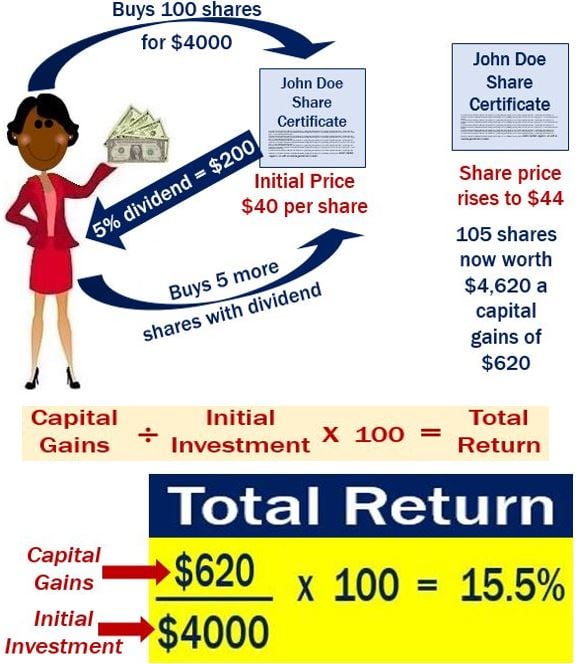

An example of total return

Imagine you purchase 100 shares of John Doe Inc. stock at $40 per share for an initial value of $4,000. John Doe shares pay a 5% dividend ($200), which you reinvest, i.e. you purchase five more shares. After twelve months, John Doe’s share price appreciates to $44.

-

What is your total return?

You divide the total investment gains by the investment’s initial value, and then multiply the result by 100 to get a percentage return.

– Total investment gain is $620 (105 shares x $44 per share = $4,620. Minus the initial value of $4,000 = $620 gain).

– The investment’s initial value was $4,000.

The equation is:

$620 (gain) ÷ $4,000 (initial investment) x 100 = 15.5%

Your total return is 15.5%.

Total return fund

This is a fund that aims to maximize gains from both generating investments, such as government bonds and dividend-paying shares, while at the same time aiming to invest in assets which gain in value.

If you invest in a total return fund, you should reinvest your income gains. The investment’s final return is the total generated by the capital appreciation of the assets that the fund invests in, plus the income they have provided.

Total return is an important metric for both individual and institutional investors to evaluate the performance of their investments over time relative to their financial goals

Video – What is total return?

This MBN Video Dictionary video explains what total return is using simple language and easy-to-understand examples.