Indirect taxation or indirect tax refers to tax that does not come directly from employees’ incomes, company profits, or assets. It is the opposite of direct taxation and includes, for example, consumption tax – such as VAT (value added tax).

When lawmakers wish to raise taxes discreetly, they tend to look at indirect taxation sources rather than direct ones for two reasons: 1. They are harder to avoid paying. 2. They can be slipped in mostly unnoticed.

In other words, indirect taxation is charged on what people or companies spend – the money going out – while direct taxation is levied on what they earn – the money coming in.

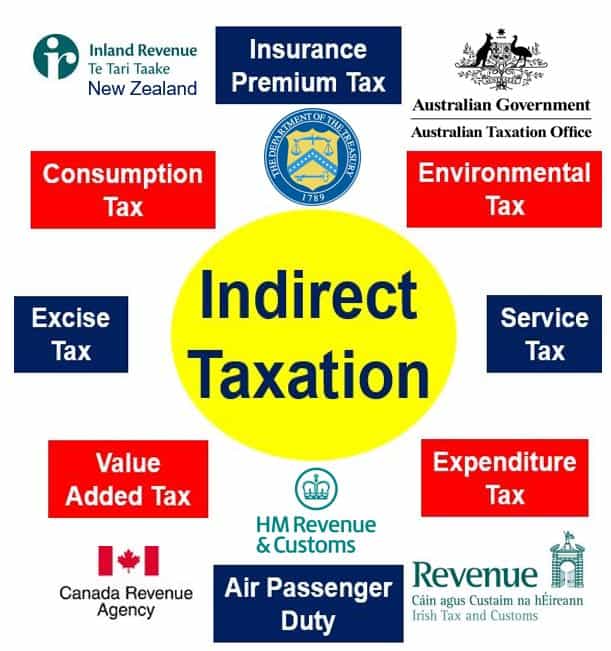

According to Fortunly, which has a comprehensive infographic about taxation around the world:

“Indirect taxation refers to taxes which are levied on what we spend rather than what we earn. Value added tax (VAT), excise duties, consumption tax, import duties, and sales tax, for example, are types of indirect taxation.”

Every government across the globe imposes taxes. They are needed to generate revenue, which is spent on infrastructure, public services, street lighting, the police service, firefighters, etc. The two main types are direct and indirect taxation.

Examples of indirect taxation

Indirect taxation are charges levied by the government on expenditure, consumption, right or privilege, but not income. Examples of indirect taxation include:

- Consumption Tax: tax on spending on products and services. It is usually referred to as value added tax or sales tax.

- Customs Duties: a tariff levied on imported products. Although rare, it may be placed on exported goods too. Goods that have not yet been cleared through customs are held in a bonded store until processed.

- Expenditure Tax: this is imposed on the total amount a person spends in one year, instead of on what he or she earns. Some people say this type of tax favors high earners, because low-income people spend a higher proportion of their income on basic necessities than rich people or those on high incomes.

- Excise: also known as excise tax or excise duty. It is an inland tax on the sale or production of specific goods. This type of taxation typically applies to a narrow range of products. In most countries, excise is levied on gasoline and other fuels, tobacco, and alcohol. It is often referred to as sin tax because it is levied on things we consider sinful, such as cigarettes and alcoholic beverages. In many countries today, gambling licenses are subject to excise. The Canadian Parliament and Nevada Legislature in 2005 and 2009 respectively proposed that prostitution should bear excise tax.

- Environmental Tax: a kind of economic instrument aimed at addressing environmental problems. It is designed to provide economic incentives for businesses and individuals to promote ecologically sustainable activities. One example of this type of taxation is carbon tax.

Regarding environmental taxation, the OECD (Organization for Economic Cooperation and Development) writes:

“Environmentally related taxes increase the cost of polluting products or activities, which discourages their consumption and production – regardless of whether this was the intended purpose of the tax or not.”

Indirect Taxation – United States

The US does not have a nationwide tax system. Indirect taxes are imposed at regional or state level. Each state is authorized to impose its own sales and use taxation.

Depending on the jurisdiction, taxpayers in the US may be subject to excise taxes, sales taxes, and property taxes.

As indirect taxation is done at state level, there is no national standard rate. Sales or use tax vary from state to state from 2.9% to 7.5%.

Thirty-five US states also impose an additional sales or use tax, which ranges from 1% to 5%.

According to KPMG, one of the world’s ‘Big Four’ auditors:

“The US continues to live up to its reputation as a complex jurisdiction to deal with indirect taxes. The US Congress remained stymied in 2015 in dealing with several bills affecting state indirect taxes, including a trio of bills that would give states the ability to impose collection requirements on remote sellers.”

Indirect Taxation – United Kingdom

Ever since the UK joined the Common Market (today called the European Union), indirect taxes as a percentage of government revenue have increased considerably.

According to HM Revenue & Customs, a department of the UK Government responsible for the collection of taxes, the country’s ten main sources of indirect taxation are:

- Value Added Tax (VAT)

- Aggregates Levy

- Air Passenger Duty (APD)

- Tobacco duties

- Alcohol duties

- Betting, gaming and lottery duties

- Landfill Tax

- Climate Change Levy and Carbon Price Floor

- Insurance Premium Tax (IPT)

- Hydrocarbon oils duties

Video – Direct and Indirect Taxation – Definition and Meaning

This video explains how government gets its revenue, plus the difference between direct and indirect taxation.