There are two types of Insider Trading, also known as Insider Dealing – legal and illegal.

When directors, officers, and employees – corporate insiders – buy and sell shares in their own companies based on information that is available to everybody, they are taking part in legal insider trading. When they trade in their own securities in the United States, for example, they have to report their sales and purchases to the SEC (Securities and Exchange Commission).

Insider trading is illegal when the buying or selling of a security occurs in breach of a fiduciary duty or other relationship of confidence or trust, while in possession of information about a security that is not available to the public – this is known as material non-public information.

In other words, insiders are allowed to trade as long as they do not rely on material information not in the public domain. As soon as they rely on such material – relevant information that the public does not have access to – their activity is illegal by definition.

The Securities Exchange Commission in the US and the Financial Conduct Authority in the UK have the authority and responsibility to investigate and prosecute insider dealing.

Examples of illegal insider trading cases

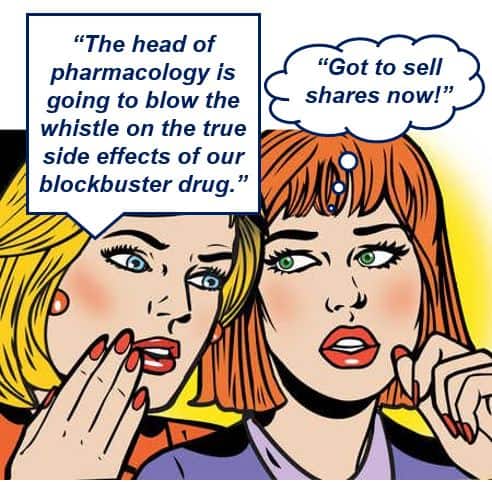

Examples of illegal conduct include ‘tipping’ the information, securities trading by the person ‘tipped’, and securities trading by individuals who misappropriate such information.

‘Tipping‘ is the act of providing confidential information about a publicly-traded company to an individual who is not authorized to receive such information – it is an illegal act. It means giving a person a tip with confidential information they should not have access to.

A person who illegally receives this information is known as a ‘tippee’.

Martyn Dodgson, a former Deutsche Bank managing director, was among a group of individuals who were found guilty by a London court of making £7.4 million ($10 million) on confidential information about six stocks. It was the largest insider trading case in the UK. (Image: bloomberg.com)

Martyn Dodgson, a former Deutsche Bank managing director, was among a group of individuals who were found guilty by a London court of making £7.4 million ($10 million) on confidential information about six stocks. It was the largest insider trading case in the UK. (Image: bloomberg.com)

In many countries, insider trading is seen as unfair to other investors who are not privy to the information – the investor with access to insider information can potentially make much more money that a typical investor is able to.

In the United States, insiders have to file a Form 4 with the SEC when trading shares of their own companies.

Insider trading regulations vary

The rules governing insider trading and the enforcement of those regulations varies considerably from country to country. In one jurisdiction, the definition of insider may be broad, and may also include individuals related to insiders, such as family members, associates and brokers.

Additionally, insider trading regulations often extend to include immediate family members and close associates of corporate insiders, to prevent indirect illegal trading activities.

Any individual who becomes aware of material non-public information and acts on that data by trading may be guilty in some countries and not in others.

There is some controversy among scholars and experts regarding the harms and benefits of insider trading. Some studies suggest that illegal insider trading increases the cost of capital for securities issuers, and consequently slows down overall economic growth. Others, however, claim that it should be allowed, and could potentially benefit markets.

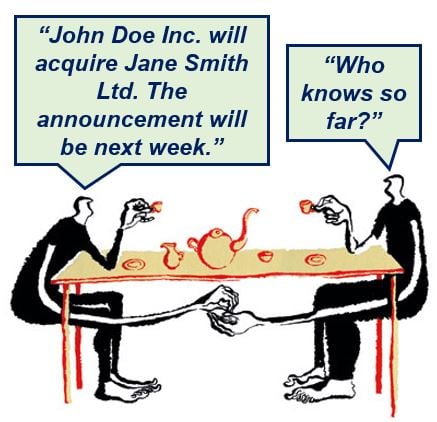

Both people above are breaking the law. The person on the left is disclosing material non-public information to an outsider and is being paid. The man on the right is paying for the information – acting on that tip and buying John Doe shares or passing on the information would also be illegal.

Both people above are breaking the law. The person on the left is disclosing material non-public information to an outsider and is being paid. The man on the right is paying for the information – acting on that tip and buying John Doe shares or passing on the information would also be illegal.

What is a corporate insider and what does it mean?

In the European Union (EU), Australia, Canada and the US, corporate insiders are defined as the company’s directors, officers, as well as any beneficial owners of at least 10% of a class of company’s equity securities.

These types of insiders, if they trade in their company’s own stock, using material non-public information, are committing fraud, as far as the authorities of the US, EU, Canada and Australia are concerned.

Simply by agreeing to work for their company, corporate insiders have undertaken a legal obligation to the shareholders to put their interests before their own in matters related to the company.

When insiders trade securities based upon company-owned information, they are in breach of their obligation to the shareholders.

For example, imagine you were on the Board of Directors of John Doe Inc., and you knew – several days before a public announcement – that your company was going to be taken over by another company. You then bought John Doe shares, knowing that the value of the stocks you purchased would shoot up as soon as the announcement was made. Your action – insider trading using information that the public did not have access to, for personal gain – would be illegal.

In 2014, Mathew Martoma, an American former hedge fund trader, began serving a nine-year prison sentence for generating possibly the largest single insider trading transaction profit in US history, at a value of $276 million.

In 2014, Mathew Martoma, an American former hedge fund trader, began serving a nine-year prison sentence for generating possibly the largest single insider trading transaction profit in US history, at a value of $276 million.

What is an ‘insider’ by definition?

In many countries, including the USA, an insider is not just a corporate official or shareholder, but also any individual who acquires information about a company that is not available to the public, in violation of some duty of trust.

The SEC gives the following examples of cases of illegal conduct that it has had to deal with:

– Corporate employees, directors and officers who traded the company’s securities after learning of significant, confidential developments within the company.

– Tippees who traded after receiving such information.

– Employees of printing, banking, law, and brokerage firms who were given such information, and acted on it by trading securities.

– Civil servants who learned of such information because of their at work.

– Other individuals who misappropriated and exploited the confidential information from their employers.

In July 2016, the European Commission published its new rulebook – an updated Market Abuse Regulation – to fight insider dealing and market manipulation in the EU’s financial markets.

The Commission said that its new framework would strengthen the fight against market abuse across commodity and related derivative markets.

According to the European Commission:

“The Market Abuse Regulation ensures that rules keep pace with market developments, such as new trading platforms, as well as new technologies, such as high frequency trading (HFT).”

What is material non-public information?

Material non-public information is data that can affect a company’s stock price, as opposed to immaterial non-public information.

An example of material non-public information would be to know that Organic Eggs Inc. has just discovered that its products are not as organic as it claimed. As soon as this information becomes public, its share price will definitely plummet.

Immaterial non-public information would be to know that the CEO’s sister suffers from claustrophobia – this data would not affect the company’s stock price. ‘Material’ and ‘immaterial’ in this context mean ‘relevant’ and ‘irrelevant’.