The International Monetary Fund (IMF) is an organization that was formed in 1944 (at the Bretton Woods Conference). The forty-four nations at that conference wanted to build a framework for economic cooperation to make sure the competitive devaluations that contributed to the Great Depression of the 1930s never occurred again.

The IMF focuses on fostering global monetary cooperation, securing financial stability, facilitating the importation and exportation of goods and services (international trade), promoting sustainable economic growth and high employment, and putting an end to poverty.

It is an agency of the United Nations.

Unlike other agencies of the United Nations, the IMF has its own governing system, its own charter, governing structure, and is in charge of its finances. The current managing director of the IMF is Christine Lagarde, a former minister in the French cabinet.

The IMF was originally created after WWII to help reconstruct the global international payment system, and oversee the fixed exchange rate arrangements between countries.

However, after floating exchange rates emerged in 1971 its role changed to examining the economic policies of countries with IMF loan agreements.

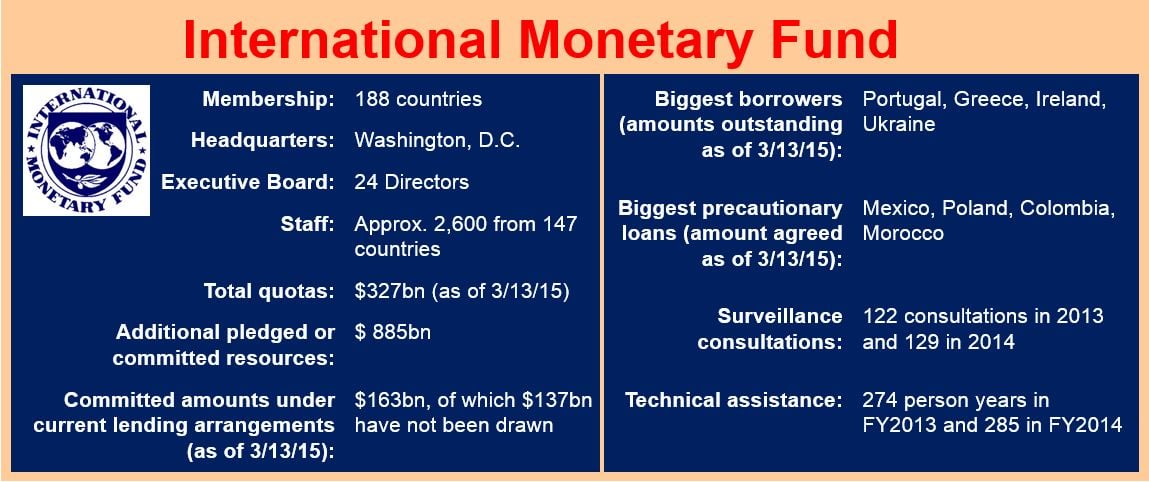

The 188 countries (to date) that form part of the IMF give money to a pool through a quota system. The IMF’s fund is used to help improve the economies of its member countries. Any country may apply to be a part of the IMF.

Voting power in the IMF is through a quota system, which is based on the number of basic votes and provides one more vote for every Special Drawing Right (SDR) of 100,000 of a member country’s quota. If a country’s SDR holdings are above its allocation, it generates interest on the excess. On the other hand, if it has fewer SDRs than allocated, then it has to pay interest on the shortfall.

The IMF is a big lender

The IMF says it helps countries that are going through difficult periods (through loans) because the private international capital markets do not always work perfectly, i.e. the troubled nations may not have proper access to funds through the private sector.

For low-income countries, the IMF doubled loan access limits and is increasing lending to the emerging markets, providing loans at a concessional interest rate.

Christine Lagarde is the current Managing Director of the IMF.

Christine Lagarde is the current Managing Director of the IMF.

When the IMF lends money to countries it does not require collateral. However, the country has to commit to a series of policy reforms.

Technical assistance and training

The IMF is a useful organization for member countries experiencing balance-of-payment difficulties. It also provides technical assistance and training to design and implement effective policies in four areas:

- monetary and financial policies,

- fiscal policy and management,

- improvement of statistical data, and

- economic and financial legislation.

It also publishes information on global and regional economic trends (multilateral surveillance). Its main outputs are three semiannual publications: the Global Financial Stability Report, the World Economic Outlook, and the Fiscal Monitor.

Gold holdings

The IMF has about 90.5 million troy ounces (2,814.1 metric tons) of gold, making it one of the largest official holders of gold globally. However, it can only sell or accept gold as payment if 85% of the total voting power of member countries agree.

In December 2010, it sold 403.3 metric tons of gold, about one-eighth of its holdings.

How does the IMF differ from the World Bank?

Most people would be unable to differentiate between the two. Both are based in Washington and seem to appear at the same conferences all over the world.

The main difference between the two is:

1. The IMF’s chief function is to ensure the world’s financial system, including exchange rates, is stable. For example, if a country’s economy is in trouble, say its currency is collapsing, it will go to the IMF for help.

2. The World Bank’s primary aim is to reduce world poverty. It focuses on development, improving health services, schools and infrastructure. For example, if a country wants to build a new dam to secure water supplies for farmers and produce electricity, and needs financial help, it will talk to the World Bank.

The IMF works closely with the Paris Club or Club de Paris, an informal group of officials from 22 creditor nations that attempts to find coordinated and sustainable solutions to repayment problems that debtor nations experience. The IMF is often present at Paris Club meetings between creditors and debtors, but just as an observer.

Video – Why the IMF lends