Your investment horizon, also known as investment time horizon, refers to how long you expect your money to remain invested before you cash it in. For example, when a young man invests for a private pension, his investment horizon is several decades away.

The treasury department of a large corporation generally measures its horizon in days. In most cases, the shorter people’s investment horizon is, the less risk they should be willing to accept.

When deciding what type of investment you should have in your portfolio, it is important to determine what your investment horizon is. If you do not need our money for a long time, for example decades, you can own a riskier mix of investments compared to a person who needs money within the next few weeks or months.

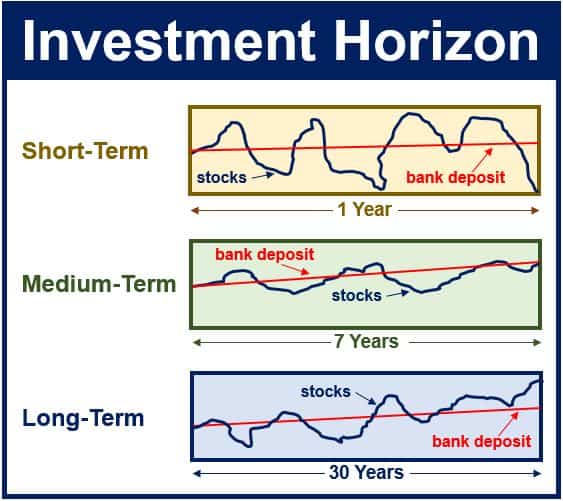

For those with a short investment horizon, stocks (shares) are not advisable, but they are for those planning to invest for several decades.

For those with a short investment horizon, stocks (shares) are not advisable, but they are for those planning to invest for several decades.

Types of investment horizon

Generally speaking, portfolio managers talk about short-, medium- and long-term horizons. Remember that these are arbitrary definitions (there is no standard).

Short Term: up to three years. The investor tends to have a low risk tolerance and should invest in guaranteed securities, such as certificates of deposit or high-interest savings accounts.

Medium Term: from 3 to 10 years. Investors tend to go for a conservative mix of bonds (70%) and stocks (30%).

Long Term: more than 10 years. With this type of investment horizon, investors typically include a higher percentage of risky investments. Remember that equities can go through prolonged periods of very little growth. Experts say it is advisable for go for a combination of stocks (75%) and bonds (25%).

Although the risks are generally lower with short-term fixed-income investments, the reward tends to be more modest compared to longer-term investments weighted strongly on equities.

Our horizon changes

Our horizons change with time. Imagine you invested $100,000 today and did not need the money for about 15 years. You could invest in a mix of 40% bonds and 60% stocks.

Ten years later your horizon would be just 5 years, so it might be advisable then to change to a less risky mix, raising the bonds portion and reducing the stocks portion of your portfolio. The practice of balancing risk versus reward is known as asset allocation.

Your investment horizon and level of risk tolerance all contribute to building your investment philosophy.