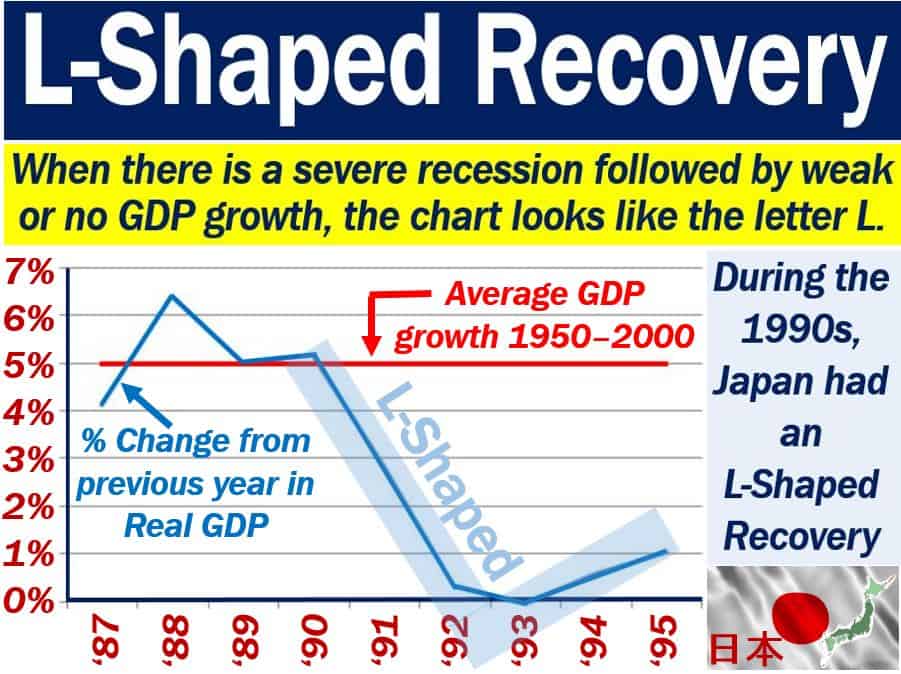

An L-shaped recovery refers to an economy that declines steeply and then flatlines, i.e., experiences weak or no growth. An L-shaped recovery refers to a graph which looks like the letter ‘L.’ The letter ‘L’ consists of a sharp fall which precedes a flat line at the bottom. Imagine a graph with that shape; it would represent a steep economic decline followed by a long period with no growth.

We also call it an L-shaped recession or depression. In most cases, the chart with an ‘L’ shape means that the economy did not return to trend line growth. In some cases, it may seem that it never returned.

When an economy is in the middle of an L-shaped recovery, it has a long road ahead. In other words, getting back to where it was before the decline is going to take a very long time.

The chart may refer to a national economy and also a company. In 2009, Gail Klintworth, chairman of Unilever South Africa, warned her staff to prepare for a long, hard slog.

Although green shoots were appearing here and there at the time, there was also an abundance of negative signals.

Japan’s L-shaped recovery

The most famous example in modern history of an L-shaped recovery occurred in Japan. In 1990, there was a Japanese asset price bubble.

From the end of World War II through most of the 1980s, Japan’s economy grew significantly. In fact, along with Germany, it underwent an ‘economic miracle.’

Towards the end of the 1980s, the bubble burst, and the country’s economy experienced deflation. Years of virtually no growth followed. In fact, the country never returned to its post-war GDP growth rate. GDP stands for Gross Domestic Product.

Economists feared that the US would enter an L-shaped recovery after the 2007/8 global financial crisis. However, by 2013, the US economy was growing strongly.

Many European Union countries, on the other hand, flatlined for a long time after 2007/8.

In 2007/8, the Greek economy shrank considerably. GDP growth subsequently remained weak or non-existent until the end of 2016. Therefore, we can say that Greece suffered an L-shaped recovery following the global financial crisis.

Different shapes

There are many names for different types of recovery, such as W-shaped, V-shaped, and U-shaped.

A W-shaped recovery, for example, means there are two back-to-back declines and recoveries in the economy. We also call it a W-shaped recession.

A U-shaped recovery, on the other hand, has a steep decline, a long-lasting trough, and then a slow recovery.

A V-shaped recovery is much shorter than a U-shaped one. Also, the trough is clearly defined.