Lapping – definition and meaning

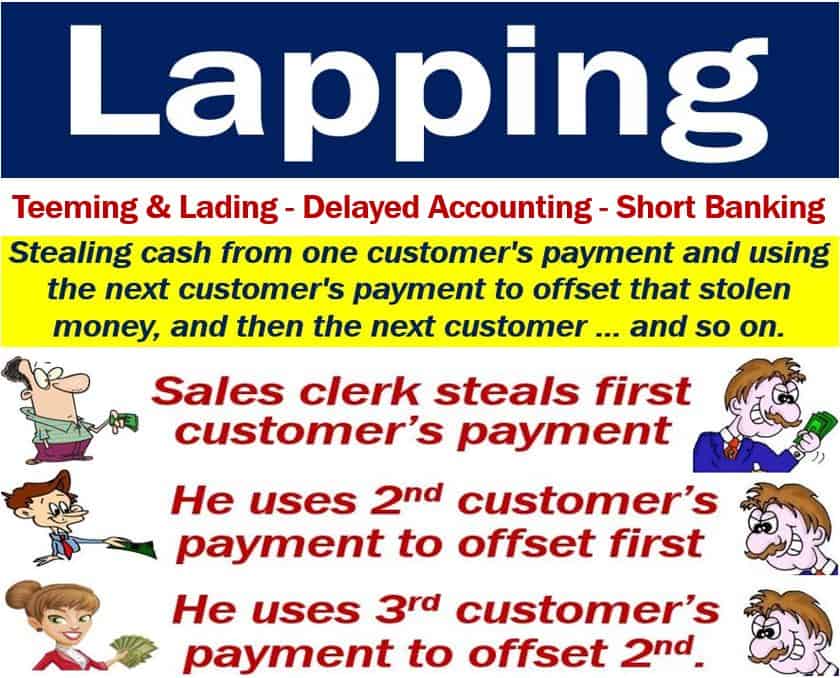

Lapping is the illegal practice of allocating one customer’s payment to another customer’s account. Fraudsters do this to make the books balance, usually to hide a theft or shortfall. A clerk or cashier may steal cash from one customer’s payment. They cover it up by stealing money from the next customer’s payment, and then the next … and so on. When the same person handles and records the cash, this type of fraud is easier to carry out successfully.

Companies mitigate the risk of lapping by enforcing strict internal controls, including separation of duties and regular account reconciliations.

Lapping – a white-collar crime

Lapping is a white-collar crime. In this context, white collar refers to office work, rather than manual work. White-collar crimes involve fraud, embezzlement, bribery, Ponzi schemes, and other office-based practices.

InvestingAnswers.com has the following definition of the term:

“A lapping scheme is a fraudulent accounting practice that hides stolen cash by overlapping successive receivables.”

Teeming and lading, delayed accounting, and short banking mean the same as lapping.

Lapping – an example

Barry, who works as a clerk, stole money that a sale had generated. He offset the missing money by using cash from the next sale.

To offset the missing money from the second sale, he took money from the third sale … and so on.

Let’s suppose Barry’s first sale was for $100. He put the one hundred dollars in his pocket. In other words, he stole that money

His next customer bought something for $200. Rather than use the second customer’s payment toward the corresponding $200 receivable, Barry used $100 to satisfy the $100 open receivable from his first customer.

He then used the remaining $100 to partially offset the missing receivable from the second customer.

Barry continued allocating money from subsequent sales. He could continue perpetrating this type of fraud for a long time. He could because he is using payments continually to pay for older debts, i.e., money that he stole.

Regarding this type of fraudulent activity, AccountingTools.com says:

“This type of fraud can be conducted in perpetuity, since newer payments are continually being used to pay for older debts, so that no receivable involved in the fraud ever appears to be that old.”

Without stringent checks, lapping schemes can go undetected for months or even years, often unraveling only when a fraudulent transaction fails to align with a legitimate customer payment.

Other meanings

Here are some other meanings of the term ‘Lapping’:

-

Machining

A process to smooth or flatten surfaces with an abrasive.

-

Waves

The sound or action of water hitting the shore.

-

Fabrication

Making a part’s surface flat or smooth.

-

Compound

An abrasive paste used in smoothing operations.

-

Networks

Overloading a network device beyond its processing capacity.

-

Lapping water

The dog is using its tongue to drink.

-

Lapping in athletics race

John has overtaken Peter by a full track lap.

Video – What is Lapping?

This interesting video presentation, from our sister channel in YouTube – Marketing Business Network, explains what ‘Lapping’ is, using simple and easy-to-understand language and examples.