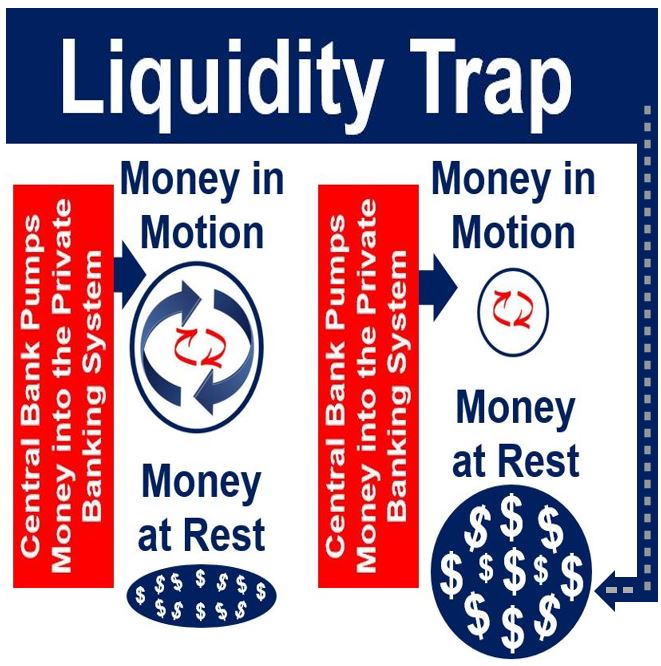

In a Liquidity Trap, the central bank has added money to the market hoping to simulate the economy by lowering interest rates, but spending does not increase. It is when monetary policy becomes impotent. People hold on to cash because they expect deflation, insufficient aggregate demand, or even war. A liquidity trap is most likely to occur when interest rates are very near zero and money supply fluctuations fail to lead to changes in price levels.

Monetary policy becomes ineffective

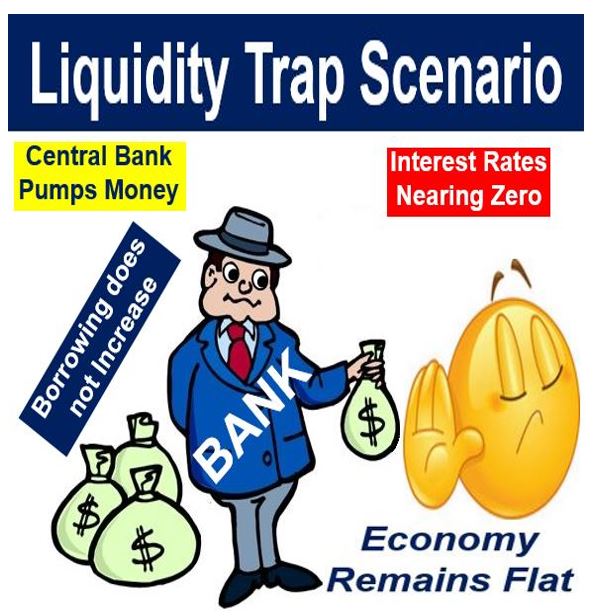

When an economy is in recession, it can be faced with the problem of short-term interest rates reaching almost zero. In such cases, monetary policy becomes ineffective, and an external catalyst is introduced to trigger economic activity.

The central bank does this by buying financial assets of longer maturity from commercial banks – it injects money into the private banking system – the aim being to lower long-term interest rates. When these measures fail to reduce long-term interest rates, a liquidity trap occurs.

Economy trapped in a recession

Companies, banks and individual citizens may become so risk averse that they prefer the liquidity of cash to offering or using credit. In such a situation, the economy is trapped in a recession, despite all the measures taken by monetary policymakers.

According to an article published by the Federal Reserve Bank of Richmond and written by Renee Haltom, a liquidity trap is:

“A situation in which people have a virtually endless demand to hold cash – an endless demand for liquidity – relative to other assets. In that situation, the central bank’s increases to the money supply fail to translate into increased consumption or investment to get the economy churning because the private sector simply holds on to the cash.”

“The impotence of monetary policy in a liquidity trap is often asserted to justify alternative policies like fiscal stimulus.”

A liquidity trap is the modern central bank policymaker’s ultimate nightmare. If adding injections of capital to boost preferences for goods over cash, thus stoking inflation and kick-starting the economy does not work, what then?

Maynard Keynes

British economist Maynard Keynes (1883-1946) introduced the concept of a liquidity trap. The following quote comes from his book General Theory of Employment, Money, and Interest:

“There is the possibility … that, after the rate of interest has fallen to a certain level, liquidity-preference may become virtually absolute in the sense that almost everyone prefers cash to holding a debt which yields so low a rate of interest. In this event the monetary authority would have lost effective control over the rate of interest. But whilst this limiting case might become practically important in future, I know of no example of it hitherto.”

The liquidity trap controversy

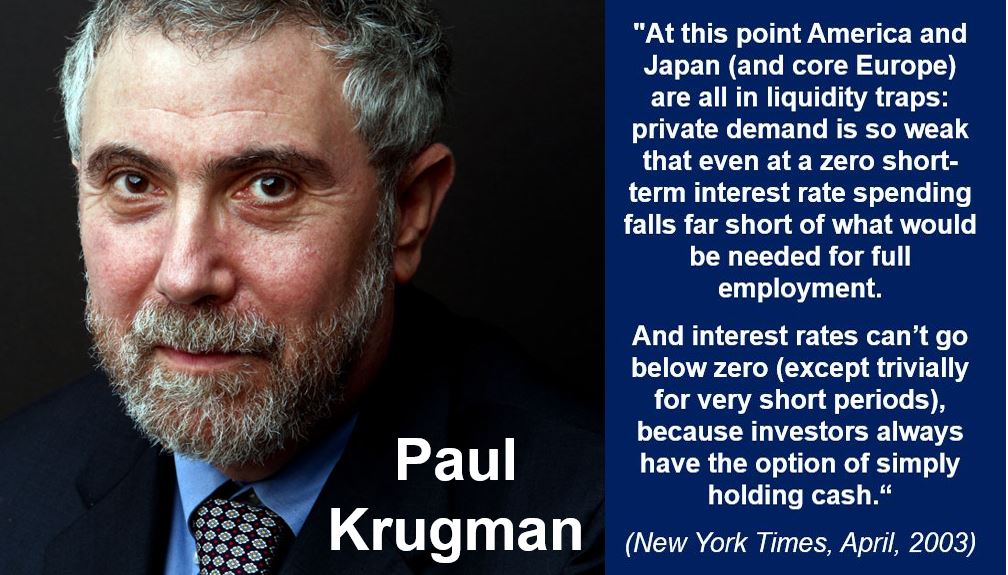

Followers of Keynesian Economics believe that in the 1930s – during the Great Depression – the economies of the United Kingdom, United States and several other countries were caught in a liquidity trap. The Japanese economy suffered a similar scenario in the late 1990s.

Monetarists disagree with Keynesian Economists. Monetarism has no place for liquidity traps, they say. They blame the Great Depression of the 1930s and Japan’s more recent problems on other factors, and believe that ways can be found to make monetary policy effective.

According to Neoclassical economists, expansive monetary policy – even in a liquidity trap – may still stimulate the economy through the direct effects of greater money stocks on aggregate demand.

This was essentially what the Bank of Japan hoped for in 2001, when it introduced quantitative easing. It was also the hope of central banks in Europe and North America in 2008-2009, with their foray into quantitative easing.

Their policy initiative attempted to stimulate the economy through methods other than the reduction of short-term interest rates.

Liquidity trap – warning signs

One glaring sign is extremely low interest rates. Bondholder behavior can be affected by low interest rates, together with other worries about the current financial and political state of the economy, resulting in bond-selling in a way that damages the economy.

Adding further to the money supply, fails to bring about changes in price levels, because consumers shift toward saving funds into lower-risk and highly liquid instruments – cash.

If interest rates do not change, consumers have nothing to motivate them to invest in other options.

When the interest rate reaches zero, consumers do not want to hold any type of bonds, because money – which also pays 0% interest and is usable in transactions – is a better option.

In a liquidity trap, lenders find it hard to attract qualified borrowers. With interest rates nearing zero, there is little elbow room for additional incentives to attract highly-qualified candidates.

This shortage of borrowers is most evident with fewer consumers buying cars, homes and other higher-priced items on credit.

Liquidity trap vs. credit crunch

The difference between a liquidity trap and a credit crunch is that in a liquidity trap consumers have ample access to cheap credit, but choose not to borrow.

In a credit crunch, people are not borrowing money, either because it is not possible or they find it too expensive.

As far as the availability of credit is concerned, a liquidity trap is the opposite of a credit crunch – in the former there is lots of it and it is extremely cheap, while in the latter there is either none of it or it is very expensive.

The term ‘liquidity’ refers to how fast one can turn an asset into cash, how promptly a company can pay its bills, and the level of activity in a market.

Video – What is a Liquidity Trap?

This interesting video, from our YouTube partner channel – Marketing Business Network, explains what a ‘Liquidity Trap’ is using simple and easy-to-understand language and examples.