The word ‘margin’ has several meanings, both in the world of business and finance, as well as other situations. It can refer to the difference between the cost of a product and how much you sell it for. It can also mean the amount by which revenue from total sales exceeds costs in a business.

In non-business/finance English, it may refer to the blank space around the text on a page, the amount allowed beyond what is necessary, as in “We need to allow for a margin of error,” or a border/edge. In the phrase “The margin of sanity,” it means a limit in capacity, beyond which something deteriorates or ceases to exist.

The verb ‘to margin’ means: 1. To provide an edge or border, usually around a text. 2. To deposit money with a broker as security. 3. To annotate or summarize a text in the margins.

If it costs you $10 to produce or buy a pair of shoes, and you sell them for $20, then your margin is $10.

Margin is many meanings

Below are some business and finance meanings of margin:

– Banking: 1. The difference between the value of an asset used as collateral and the amount lent against it. 2. The percentage interest added to the market rate, or subtracted from a market rate of deposit – thus providing the bank with a profit.

– Commerce: the difference between the cost of buying a product and its selling price. If I buy shoes for $10 per pair and sell them at $20 per pair, my margin is $10 (twenty minus ten) or 50%, while my ‘mark up’ is 100% (double $10).

It also means the ratio between a business’ revenues and expenses.

Currency Trading: the difference between a currency’s spot price and forward price.

With a forex margin account, the investor takes a short-term loan – from the broker – that is equal to the amount of leverage he or she is taking on. Before placing a trade, the investor first has to deposit money into the account.

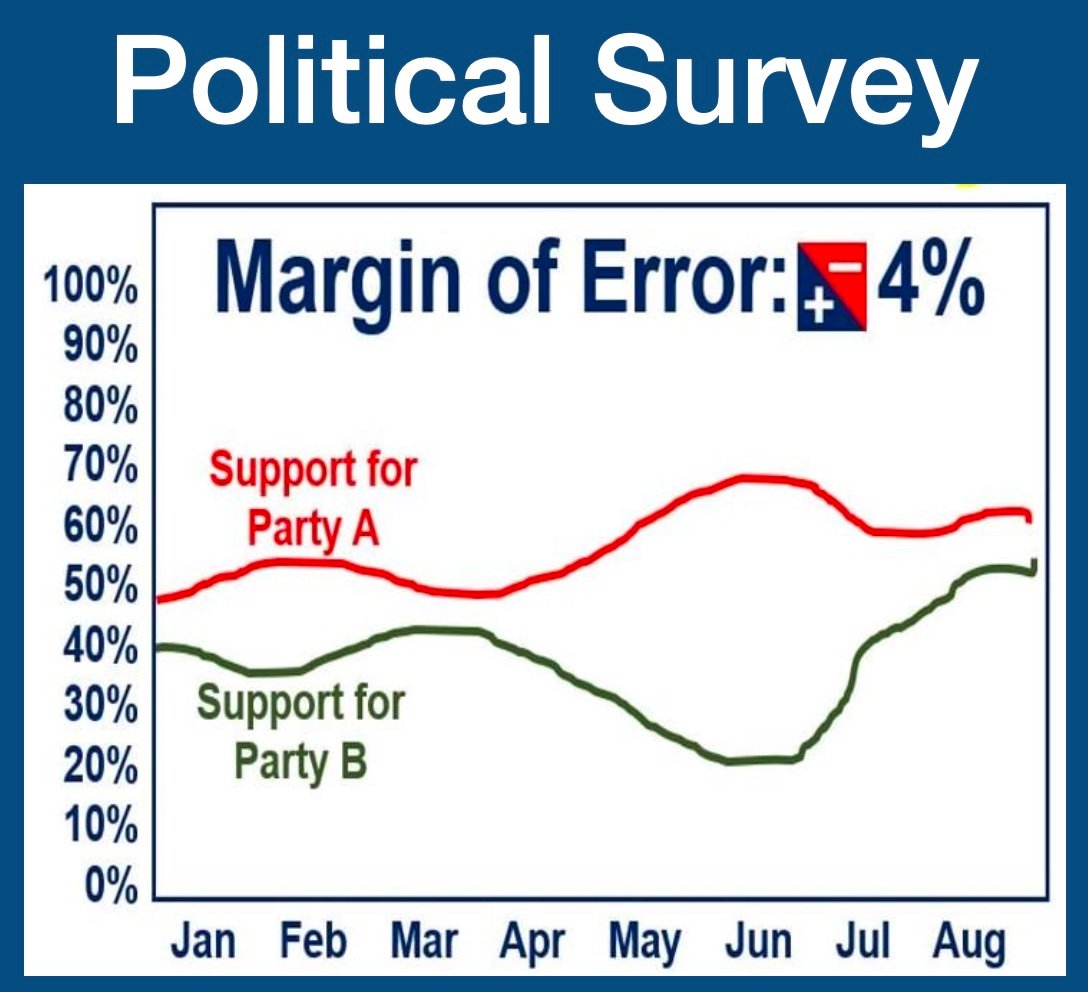

A margin of error in surveys relates to how accurate it usually is. Relating to the image above, the survey authors could say: ‘These are our findings, give or take 4%.’

Commodity Trading: the difference between the spot and forward price quoted for a commodity.

Securities Trading: the difference between the amount of money a stockbroker lends a speculator and the current value of the securities deposited by him or her as collateral.

In the world of securities investing, a margin account is one offered by brokerages that allows the investor to borrow money to purchase securities. With this facility, the investor might put down half the value of a purchase and borrow the other half from the broker. He or she will have to pay the broker interest for the right to borrow the money, and will use the securities as collateral.

Futures Trading: the minimum amount of capital that must be available in a person’s account for him or her to trade futures contracts. Think of this margin as collateral that allows the investor to participate in futures markets.

The ‘initial margin’ is the minimum amount of capital the investor needs in his or her account to trade futures contracts, while the ‘maintenance margin’ is the subsequent capital amount he or she must contribute to the account to maintain the minimum margin requirements.

Nasdaq’s Glossary of Terms explains the meaning of margin as follows (it has many money meanings than this):

“Allows investors to buy securities by borrowing money from a broker. The margin is the difference between the market value of a stock and the loan a broker makes. Related: Security deposit (initial). In the context of hedging and futures contracts, the cash collateral deposited with a trader or exchanged as insurance against default.”

Marginal: in economics, the term ‘marginal’ means the same as ‘by adding one more’ or ‘additional’. For example, marginal price is the price of buying one more, marginal labor output is how much an additional worker would produce, marginal propensity to save/spend refers to what percentage of a person’s additional income is saved/spent.