What is propensity? Definition and meaning

Propensity exists in dozens of different forms in the world of economics – to invest, spend, save, import, export, etc. In layman’s English, propensity is a natural tendency to behave or do things in a certain way. For example, cats have a tendency to hunt birds, while humans are inclined to acquire material possessions.

Understanding these propensities provides valuable insights into consumer behavior and economic forecasting, aiding policymakers and businesses in strategic planning.

Average and marginal propensities

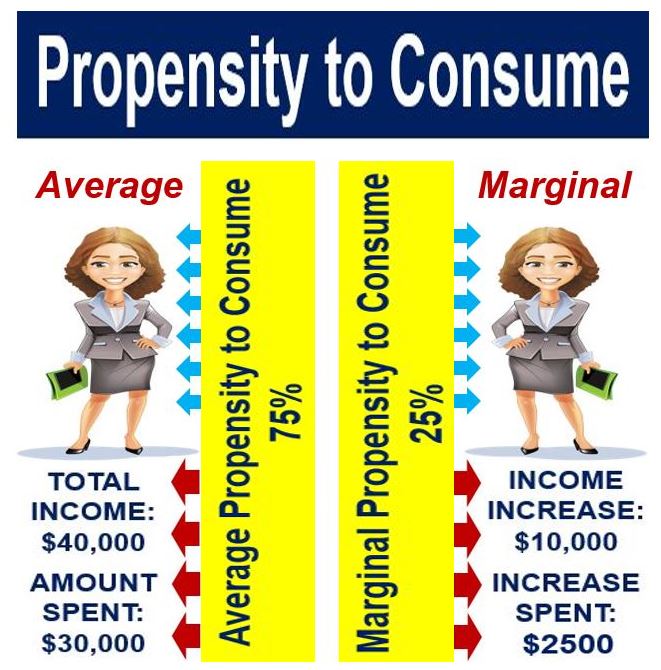

In every case, it is important to know the difference between average and marginal propensities.

-

The average propensity to consume

This is total consumption divided by total income. It expresses the percentage of income that is used for consumption, i.e. what proportion of your income you spend.

-

The marginal propensity to consume

This refers to how much of each extra dollar, pound, or euro of income is used for consumption (as opposed to savings).

Working out the average is much easier than trying to calculate or predict the marginal propensity.

MyAccountingCourse.com says that the average propensity to consume:

“Expresses the percentage of income consumed at any given level of income. In other words, it’s the amount of income the average consumer spends on goods and services.”

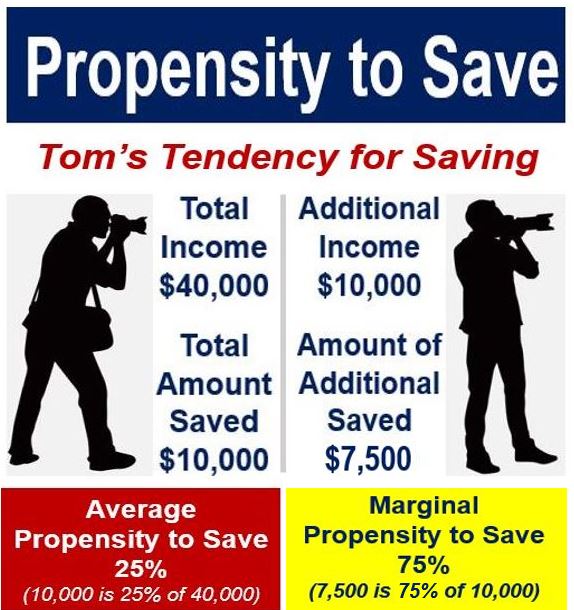

Propensity to save

In economics, this refers to the percentage of total income or of an increase in income that people save instead of spending on products and services.

-

The Average Propensity to Save

Also known as the savings ratio, is the ratio of total savings to total income. It is usually expressed as household savings as a fraction or percentage of total household disposable income.

-

The Marginal Propensity to Save

This is the ratio of a change in savings to a change in income.

The propensities to save and consume, when added together, should always equal one or 100%.

According to the Oxford Reference Dictionary:

“The proportion of disposable income which individuals do not desire to spend on consumption. The average propensity to save gives total desired saving as a proportion of total disposable income; the marginal propensity to save is the proportion of additional income an individual desires to save.”

Our inclination to buy imported goods

When individuals and companies buy things, a percentage of those goods and services were created at home, and a percentage were made abroad.

-

The Average Propensity to Import

This is the amount of money a consumer spends on imports as a percentage of his or her total income. For example, if you earn $60,000 and spend $15,000 of that income on imported goods, your average propensity to import is 25% (15,000 is 15% of 60,000).

-

The Marginal Propensity to Import

This refers to the percentage change in import expenditure that occurs when your disposable income (spare cash) goes up or down.

For example, if you earn an extra $10 dollars of disposable income, and your marginal propensity to import is 0.2, you will spend $2 of those $10 on imported goods and services.

In countries where consumers buy lots of imported goods and services, such as the USA and UK, an effective way of controlling the current account on the balance of payments (decrease imports) is to reduce their disposable income – raise the income tax rate.

Propensity Score Matching

Propensity score matching (PSM) is a statistical matching technique that estimates the effect of a treatment, policy or other intervention by accounting for the variables that predict receiving the treatment.

This method is particularly useful in observational studies where random assignment is not possible, allowing researchers to approximate the conditions of a randomized controlled trial.

By using this approach, analysts can more accurately measure the impact of specific actions on diverse populations, enhancing the reliability of causal inferences in non-experimental data.

Video – What is Propensity?

In this visual guide presented by our affiliate channel, Marketing Business Network on YouTube, we explain what “Propensity” means using straightforward language and easy-to-understand examples.