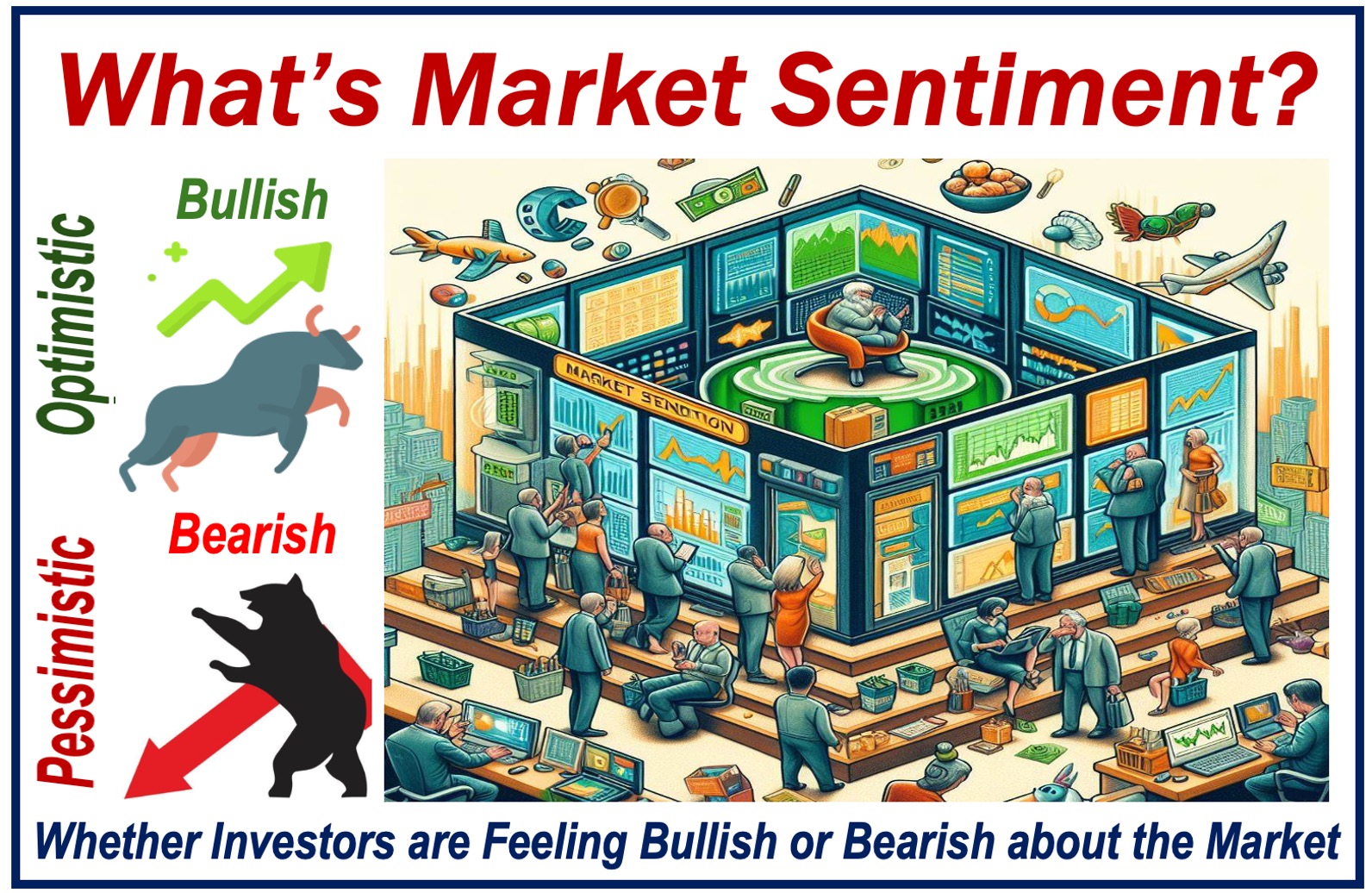

Market Sentiment refers to how investors are feeling at the moment about the economy, a specific sector, the financial markets, or a company.

In this context, the term “the markets” means the collective arenas where shares (stock market), securities, commodities, derivatives, and other financial instruments are traded.

In the world of finance, understanding market sentiment is crucial. It reflects the prevailing mood or tone, influencing the market’s movement and trend.

There is more to the markets than just numbers and charts, feelings and perceptions are also important.

Market sentiment – a collective emotion

Market sentiment is often seen as a collective emotion that is driven by news, events, the general economic outlook, and even rumors. An optimistic or pessimistic rumor, if it comes from a reputable or moderately reputable source, can influence market sentiment significantly.

In history, some rumors have cause disastrous bank runs. A bank run occurs when a significant number of depositors (bank customers) start withdrawing their money because they are scared of the bank’s financial health, the banking system, or the overall economy.

The Panic of 1907

A key event in the Panic of 1907, which occurred in New York City, was the bank run on the Knickerbocker Trust Company, triggered by rumors about its solvency after a failed attempt to corner the market on United Copper Company shares. This led to widespread panic and its eventual suspension on October 22, 1907.

Bullish sentiment

When investors are feeling optimistic about the economy, the market, or a specific company, we say that sentiment is “bullish.” Investors believe that prices will rise, therefore, now is a good time to buy.

- A bull market

We also have the term “a bull market,” which refers to a market in which prices are expected to rise.

Bearish sentiment

When sentiment is “bearish,” on the other hand, it means that investors are expecting prices to fall. They will say that now is a good time to sell.

- A bear market

The term “a bear market” is one in which we expect prices to go down.

This tug-of-war between optimism and pessimism, that is, market sentiment, shapes the market’s direction.

Gauging Market Sentiment

To understand how investors feel about the market, analysts use various indicators to effectively gauge market sentiment. These indicators offer insights into the collective mood and can help predict future market movements. Below are some key tools and methods that professionals use:

Market Surveys

These surveys directly inquire about investors’ sentiments towards the market, capturing their current feelings and expectations.

Volume of Trades

Investors typically view a high volume on days when the market is up as a sign of bullish sentiment, while they interpret high volume on days with declining market values as indicating bearish sentiment.

Technical Analysis Tools

Instruments like moving averages and sentiment indexes are crucial for understanding market sentiment. These tools analyze past market data to identify trends and predict future market behavior.